Every few months, you face the spotlight, unveiling your financial report to the public. Your finances are laid bare, revealing your wins, losses, and savings. Sounds nerve-wracking, doesn’t it? Well, that’s essentially what earnings season is like.

For market participants, this period is a whirlwind, with companies shedding light on their behind-the-scenes actions. And amidst the chaos, the importance of this season cannot be overstated. Let’s delve into three key reasons why earnings season holds such weight.

Earnings Season Delivers Crucial Business Insights

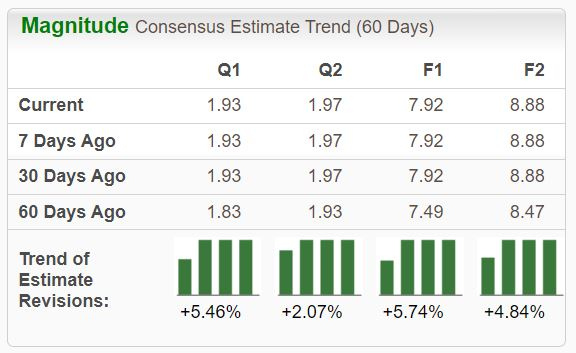

Through earnings reports, investors gain a wealth of data, from revenues and expenses to profits. This information offers a deeper understanding of a company, allowing investors to spot any warning signs. Take Arista Networks’ recent revenue growth guidance boost, lifting shares post-earnings. With a Zacks Rank #1 (Strong Buy), Arista Networks showcases escalating earnings expectations.

Image Source: Zacks Investment Research

Quarterly Reports Drive Stock Movement

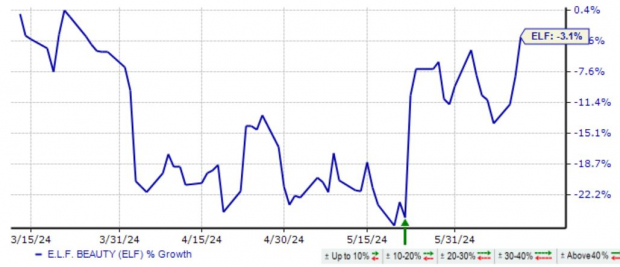

A company’s quarterly earnings often spark fluctuations in its stock price, a trend not lost on market players. Positive surprises or raised guidance commonly fuel bullish momentum post-earnings. e.l.f. Beauty witnessed a surge in its shares following a recent earnings release, with a 15% earnings rise and a 71% sales spike. Protecting investments with stop-loss orders during volatile post-earnings phases can safeguard capital.

Image Source: Zacks Investment Research

Earnings Season Unveils Current Market Trends

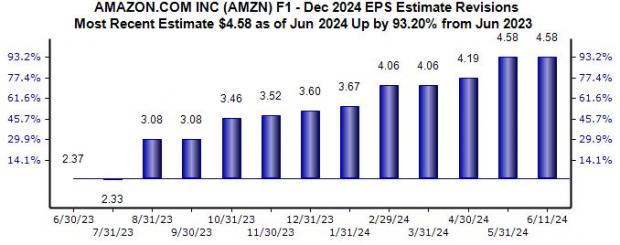

Besides individual insights, earnings season offers a bird’s eye view of economic and industry trends. Robust quarterly results from multiple companies hint at a thriving economy, potentially benefiting the stock market. Conversely, a slew of disappointing earnings may signal economic deceleration, impacting stocks negatively. Trends within industries are also revealed, aiding investors in strategic positioning. Case in point, Amazon’s strong AWS results signal increased cloud computing demand amidst an AI surge. Analysts are markedly optimistic on Amazon’s fiscal year outlook, with a 93% rise in Zacks Consensus EPS estimate over the past year.

Image Source: Zacks Investment Research

The Crux of the Matter

Earnings season may be chaotic, but it’s a necessary evil in the world of investments. Understanding its importance lies in the updated financial insights provided, the market rollercoaster post-earnings, and the overarching market and industry trends brought to light.