Assessing the S&P Emini Pre-Open Market Conditions

- After surpassing the significant 5,400 milestone, the S&P Emini is beginning to exhibit sideways movement, hinting at a potential stall in its upward trajectory. This shift warns of a probable transition into a trading range following a bullish leg.

- Bears are content with the advancing push towards 5,400 as long as the market encounters resistance near this round number and ultimately retraces its steps downwards.

- The bears are eyeing a downturn towards the May 31st low – the base of the most recent higher low – as their target.

- Conversely, the bulls aim to shield the market from descending below the May 31st higher low. Their argument hinges on the sustenance of higher lows on the daily chart, signaling a prevailing bullish trend.

- Anticipated in the following weeks, the daily chart is poised for a pullback. The bears’ strategy relies on intensifying selling pressures to convince traders that the rise from the May 31st low signifies an exhaustive buying climax.

- Over the upcoming days, traders will scrutinize the bears’ ability to instigate selling pressure and potentially dictate market dynamics.

Projected Market Behavior for Today

- With a 24-point dip in the overnight Globex session, the Emini encountered a sell-off during the night but discovered buyers around the 5,400 benchmark.

- Traders should brace for a volatile market open characterized by substantial price fluctuations. An 80% likelihood of a trading range start is contrasted with only a 20% chance of a discernible trend setting in.

- This sets the scene for a probable formation of a double top/bottom or a wedge top/bottom during the initial trading hours.

- Considering the typical failure of breakout attempts on market openings, most traders are advised to exercise caution in the initial 6-12 bars unless swift decision-making skills are at play.

- Optimally, traders should direct their attention towards capturing the opening swing, usually initiated before the expiration of the second hour.

- Friday’s trading significance underscores the importance of the weekly chart, with bulls vying to conclude the week above 5,400, ideally exceeding the midpoint at 5394.25, while bears anticipate otherwise.

- A potential late-day breakout might materialize as traders gauge the weekly chart’s closure.

- Throughout the day, traders are advised to monitor the 5,400 benchmark, expected to retain a magnetic effect on market movements.

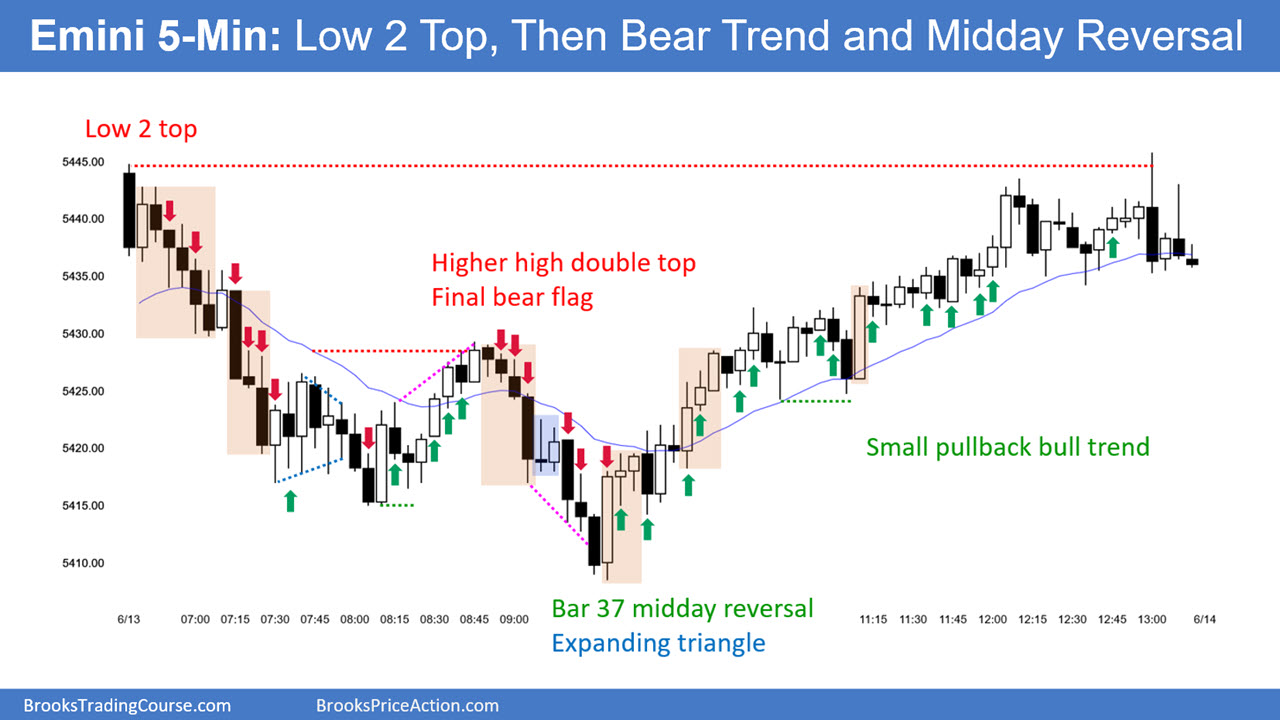

Analysis of Previous Day’s Emini Setups

Yesterday’s stop-entry setups offer valuable insights, outlining buy and sell opportunities through distinctive arrows. Subscribers to the Brooks Trading Course and Encyclopedia of Chart Patterns have exclusive access to an extensive library of detailed swing trade setup explanations, including Online Course/BTC Daily Setups. In addition, Encyclopedia members receive daily chart updates.

Emphasizing the concept of being Always In, these setups present logical entry points for traders seeking to maintain a continuous or near-constant market presence. However, it’s crucial to acknowledge that while many swing setups emerge, not all lead to actual trades due to trader expectations. Early exits are common, often driven by a desire to secure modest profits (scalping) or limit losses.

Traders concerned about account risk are advised to await lower-risk trades or explore alternative markets like the Micro Emini.