Investors often look to Wall Street analysts for guidance when considering their investment decisions. The impact of brokerage recommendations on stock prices is well-documented, but are these recommendations truly reliable indicators?

Before delving into the credibility of brokerage opinions and ways to leverage them effectively, let’s explore what the financial gurus on Wall Street think about PDD Holdings Inc. Sponsored ADR (PDD).

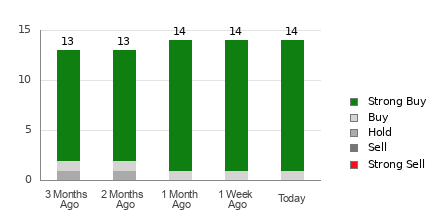

PDD Holdings Inc. Sponsored ADR currently boasts an average brokerage recommendation (ABR) of 1.04, falling between Strong Buy and Buy on a scale ranging from 1 to 5. This ABR is derived from the inputs of 14 brokerage firms, with 92.9% suggesting Strong Buy and 7.1% advocating Buy.

Exploring Brokerage Recommendation Trends for PDD

While the ABR leans towards buying PDD Holdings Inc. Sponsored ADR, it’s crucial not to base investment decisions solely on this metric. Research indicates that brokerage recommendations often come with a hidden bias, skewed by the firms’ vested interests in the stocks they cover.

Brokerage firms have been found to exhibit a strong positive bias towards stocks they cover, leading to an abundance of “Strong Buy” ratings compared to “Strong Sell.” This dissonance can mislead investors rather than provide genuine insight into a stock’s potential trajectory.

Contrastingly, the Zacks Rank presents a reliable yardstick for stock performance assessment, categorizing stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Aligning the Zacks Rank with ABR findings can greatly aid investors in making informed decisions.

Clarifying the Distinction Between ABR and Zacks Rank

The ABR, dependent solely on brokerage inputs, is often displayed with decimal points and ranges from 1 to 5. In contrast, the Zacks Rank is a quantitative model rooted in earnings estimate revisions, offering a comprehensive view of a stock’s potential.

Analysts under brokerage employ are known to be overly optimistic in their recommendations, influenced by their firms’ interests. On the other hand, the Zacks Rank hinges on earnings estimate revisions, a metric strongly correlated with short-term stock price movements based on empirical data.

Differentiating further, the Zacks Rank uniformly applies its gradings across all stocks with earnings estimates, ensuring an equitable distribution. Moreover, the Zacks Rank remains timely in reflecting evolving stock trends by swiftly incorporating analysts’ revised earnings estimates.

Assessing the Investment Appeal of PDD

The Zacks Consensus Estimate for PDD Holdings Inc. Sponsored ADR has witnessed a notable 42.6% surge over the past month, now standing at $12.18 for the current year. Analysts’ unified optimism in revising EPS estimates upwards signals potential for significant stock appreciation.

Given the substantial consensus estimate adjustment and other pertinent factors, PDD Holdings Inc. Sponsored ADR carries a Zacks Rank #1 (Strong Buy). This endorsement of the stock’s prospects underscores a compelling investment opportunity in the near future.

Hence, the ABR equivalent recommending a Buy for PDD Holdings Inc. Sponsored ADR could act as a valuable compass for discerning investors.