Brokerage recommendations are akin to a well-worn compass that investors often turn to when steering through the turbulent waters of the stock market. However, much like a compass, these recommendations may not always point investors in the right direction when it comes to deciding on stocks. Let’s delve into the intriguing world of investment advice and what the high priests of Wall Street have to say about Netflix (NFLX).

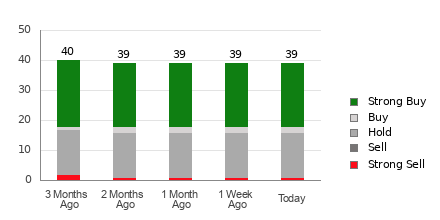

Presently, Netflix boasts an Average Brokerage Recommendation (ABR) of 1.91, perched ambiguously between Strong Buy and Buy on a scale of 1 to 5. The calculation derives from the collective wisdom of 39 brokerage firms, with 21 shouting Strong Buy and a meager two chanting the lesser Buy. In the grand symphony of recommendations, Strong Buy trumpets at 53.9%, while Buy hums at a mere 5.1%. Shall we dance or wait out this melody of advice?

The Tale of Recommending Trends for NFLX

While the siren call suggests buying Netflix, be wary of steering your ship based solely on this echo. Historical evidence suggests that brokerage recommendations might fall short of navigating investors to the shores of handsome returns.

The mirage of these recommendations often stems from the vested interests of the brokerage firms, with analysts often painting rosier pictures due to loyalty to their employer’s stocks. For every whisper of “Strong Sell”, five “Strong Buy” recommendations are uttered, painting a portrait of bias that may cloud true market potential.

So, what’s an investor to do amidst this cacophony of counsel? Perhaps, harmonizing brokerage recommendations with a more melodious tune like the Zacks Rank, a venerable stock rating tool that sings about a stock’s forthcoming performance with proven reliability.

Decoding ABR vs. Zacks Rank

Contrasting ABR with Zacks Rank is akin to comparing apples with oranges, sweet yet entirely distinct. While ABR frolics in decimal realms of brokerage whims, Zacks Rank waltzes to the quantitative melody of earnings estimates revisions in whole numbers.

Analysts’ sunny-side-up views are often cast over ABR, whereas the Zacks Rank dances to a more grounded beat of earnings estimate revisions. This divergence in approach can lead investors to either the rainbow’s end or down a rabbit hole of misjudgment.

Moreover, the dynamic freshness of the Zacks Rank offers investors a bouquet of recent market insights, unlike the static tones of ABR. As brokerage analysts nimbly adjust their sails to changing business winds, the Zacks Rank unfurls new banners of potential future price movements.

The Netflix Conundrum: To Invest or Not?

In the Netflix narrative, the Zacks Consensus Estimate for the current year stands firm at $18.31, an anchor amidst the shifting tides of opinion. This steadfast outlook could tether Netflix to the broader market’s trajectory in the days ahead.

The recent alignment of the consensus estimate, alongside other earnings-related factors, has hastily painted a Zacks Rank #3 (Hold) on Netflix’s canvas. This moderate stance urges caution when sailing in the seas of Buy-equivalent ABR for Netflix.

As the sun sets on the horizon of stock recommendations, investors are advised to don their critical lenses, cross-referencing various indicators like the Zacks Rank, rather than blindly following the broker beacon into uncharted waters.