Netflix NFLX shares have surged +34% this year, hinting at a continuing rally with the streaming giant anticipated to unveil substantial growth in its Q2 results set for Thursday, July 18.

Maintaining its throne as the streaming king over Disney DIS, we explore the opportune moment to invest in Netflix stock.

Image Source: Zacks Investment Research

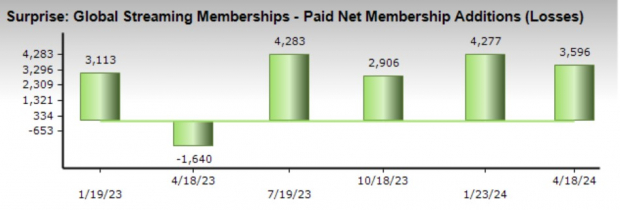

Impressive Subscriber Growth

Netflix boasts over 270 million paid subscribers, significantly ahead of Disney’s approximately 150 million customers across Disney+, ESPN+, Hotstar, and Hulu.

Forecasts suggest Netflix added 5.41 million subscribers in Q2, slightly lower than the 5.89 million in the same period last year. However, the standout is Netflix’s stellar Q1 performance with a massive 9.32 million subscriber additions, surpassing expectations by 3.59 million and showing a substantial increment from Q1 2023’s 1.75 million additions.

Image Source: Zacks Investment Research

Q2 Financial Outlook

Leveraging its subscriber growth, Netflix is projected to witness a 16% increase in Q2 sales, climbing to $9.53 billion. Moreover, earnings are expected to soar by 43% to $4.70 per share compared to $3.29 per share in Q2 2023.

Intriguingly, Netflix has surpassed earnings projections in three of the last four quarterly reports, boasting an average earnings surprise of 9.26%.

Image Source: Zacks Investment Research

Assessing Netflix’s P/E Valuation

Correlating with its expansion, Netflix’s shares now trade at 35.8X forward earnings, a significant drop from its five-year peak of 108.3X, while still offering a slight discount to the median of 40.6X.

Image Source: Zacks Investment Research

The Bottom Line

With a more reasonable P/E valuation, now presents itself as a propitious moment to tap into Netflix’s colossal growth potential. Furthermore, Netflix typically experiences a surge when surpassing earnings estimations, making it a compelling buy-the-dip candidate during any declines, rendering it an intriguing investment for the future.