Analyzing the S&P E-Mini Pre-Open Market

- Touching the moving average and the crucial 5,600 round number, the market found itself at pivotal support levels in yesterday’s trading session.

- After staying distant from the moving average for approximately 30 bars, a climactic situation emerged.

- Despite the commendable efforts of the bears to push the market down to the moving average, the odds lean towards a trading range rather than a robust bearish trend.

- The bears are treading cautiously, selling at yesterday’s close risk, intruding support levels, and navigating through a substantial pullback.

- The recent breakout showcases enough strength for a potential second leg down.

- Pessimistic bears foresee the recent selloff as the initial phase of a downward reversal towards the June low, predicting this year’s high has peaked.

- The market is less likely to plunge straight to the June low, implying that bears may have to establish a sequence of lower highs within a tight trading range before a clear downward breakout.

- Overall, the bears have made progress reaching the moving average; however, the next hurdle is achieving firm closings beneath it to signal increased momentum.

Anticipated Market Behavior Today

- The Globex market initially dropped to yesterday’s lower range but has since stabilized and slightly trended upwards on the 15-minute chart.

- The bulls eye a double bottom scenario with yesterday’s low and today’s Globex session bottom. Their aim is to break above the neckline (from yesterday’s 1:30 PM EST) and initiate an upward measured move from the double bottom.

- Given the daily chart’s support level, the bulls are rooting for an upward breakout and a robust reversal upwards throughout the day.

- Traders should brace themselves for a sideways trading range at the market open, which is typical behavior.

- Usually, there’s an 80% chance of a trading range formation post-market open, with only a 20% likelihood of a bullish trend. Hence, traders are advised to exercise patience before entering a trade.

- Most traders would benefit from waiting for 6–12 bars before engaging in any trade activities.

- With it being Friday, the weekly chart carries significance, suggesting a potential unexpected breakout late in the day as traders finalize decisions based on the weekly chart closure.

- Overall, the market is likely to see a bounce today due to the critical support level on the daily chart.

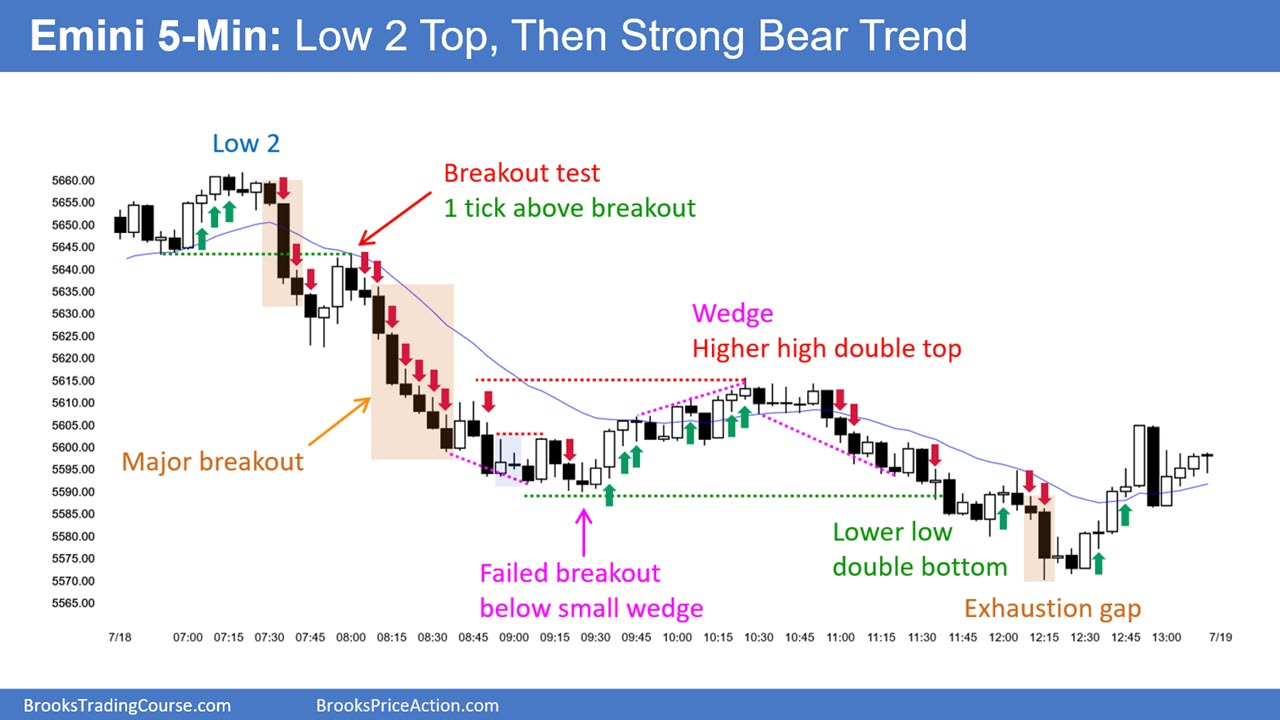

Yesterday’s E-Mini Trading Setups

Offering stop-entry setups from yesterday, each buy and sell entry bar is visually highlighted. For more detailed explanations of swing trade setups, individuals with access to the Brooks Trading Course and Encyclopedia of Chart Patterns can explore a near 4-year library. Encyclopedia members receive updated daily charts alongside the Encyclopedia resources.

Emphasizing an ‘always-in’ perspective, these swing setups may not always translate into actual trades. Traders often exit if expectations are not met, aiming for modest gains or cutting losses early.

If the risk posed by a trade seems excessive for one’s account, it is advisable to await lower-risk opportunities or consider alternative markets such as the Micro E-Mini.