Opportunity knocks with oversold stocks in the communication services sector, offering a chance to invest in undervalued gems.

RSI, a momentum indicator, reveals a stock’s strength on both rising and falling price days, guiding traders on short-term performance. When RSI falls below 30, a stock is typically deemed oversold.

Here’s a breakdown of three standout players offering potential wins:

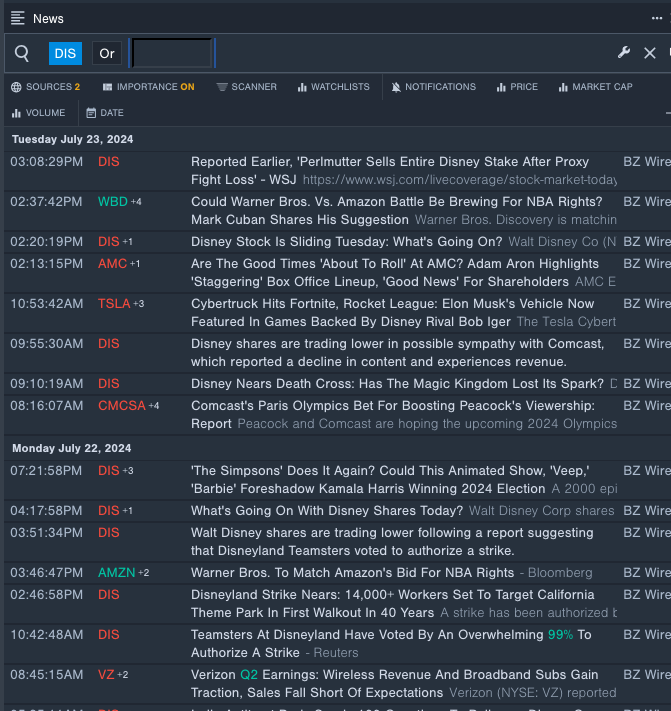

1. Disney: Weathering Storms and Making Waves

- India’s antitrust concerns over Disney’s $8.5 billion merger with Reliance Industries caused Disney’s stock to tumble by 11% in the last month, hitting a 52-week low of $78.73.

- RSI Value: 20.76

- Price Action: Disney shares closed down by 3.4% at $90.94 on Tuesday.

- Benzinga Pro’s real-time newsfeed kept investors on top of the latest Disney developments.

2. IQIYI Inc – ADR: Navigating Rough Waters

- Analyst Charlene Liu’s downgrade from Hold to Reduce and a lowered price target for iQIYI sent the stock down by 15% over the past five days, hitting a 52-week low of $3.06.

- RSI Value: 26.29

- Price Action: iQIYI shares closed down by 6.5% at $3.16 on Tuesday.

- Benzinga Pro’s charting tool signaled red flags in iQIYI’s stock behavior.

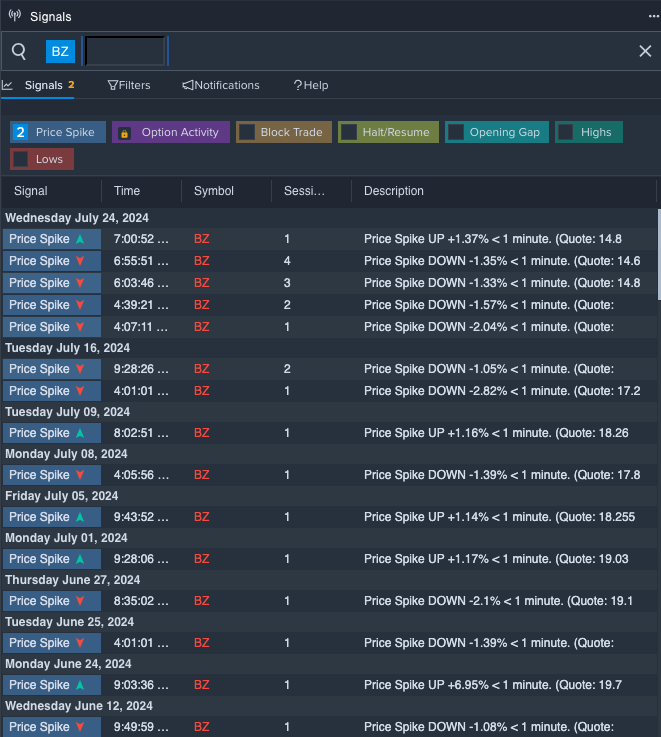

3. Kanzhun Ltd: Navigating Challenges and Building Futures

- Kanzhun’s impressive quarterly results buoyed by Chairman Zhao’s positive remarks saw a 22% dip in the past month, reaching a 52-week low of $12.57.

- RSI Value: 24.19

- Price Action: Kanzhun shares ended the day with a 0.8% drop at $15.93 on Tuesday.

- Benzinga Pro’s signals hinted at a potential uptick in Kanzhun’s shares.

Read Next: