The financial world is akin to a stormy sea, where hidden treasures lie within the depths awaiting those who dare to venture. Investing in the most battered stocks in the financial sector presents a chance to uncover diamonds in the rough.

One such tool in a trader’s arsenal is the Relative Strength Index (RSI), a compass that guides them through the stock market waters. When the RSI dips below 30, it signals that a stock may be oversold—like a discounted artifact waiting to be unearthed.

Let us navigate through the turbulent waters of the financial world and uncover three stocks presenting an opportunity for savvy investors.

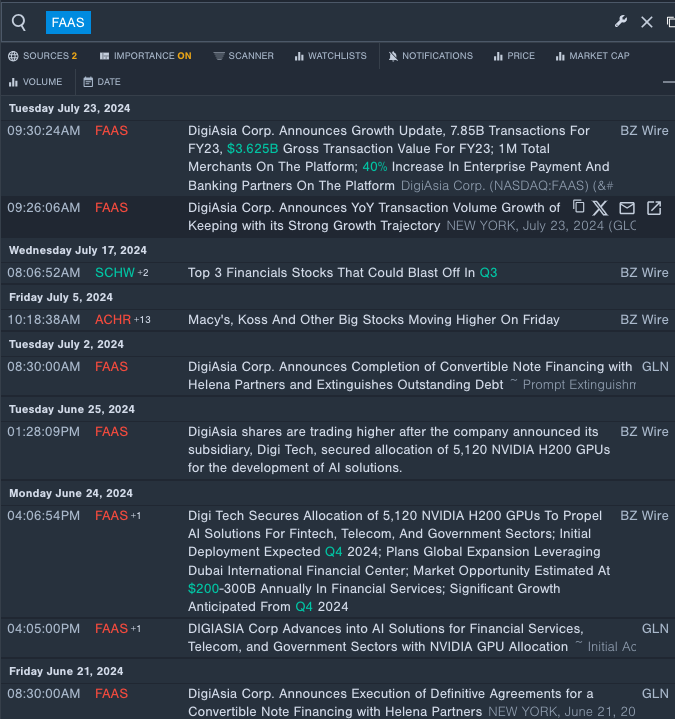

DigiAsia Corp (NASDAQ: FAAS)

- A story of high tides and low tides, DigiAsia Corp recently reported a surge in transactions, a flag emblazoned with 7.85 billion transactions for the full year 2023, compared to a paltry 4.5 billion in 2022. However, this wave of success was followed by a squall, with a stock plunge of nearly 47% in the past month, hitting a 52-week low of $2.71.

- RSI Value: 23.36

- FAAS Price Action: DigiAsia’s stock dipped by 1.6%, closing at $2.83 on a recent trading day.

- Like a lighthouse guiding ships to safety, Benzinga Pro’s real-time newsfeed illuminated the latest on DigiAsia.

Jiayin Group Inc – ADR (NASDAQ: JFIN)

- In the financial ocean, Jiayin Group Inc – ADR experienced a turbulent storm, recording a decline in first-quarter EPS. Yet, amidst the tempest, CEO Yan Dinggui hailed their achievements, with a loan facilitation volume surge and a net revenue growth spurt. Despite the recent 12% stock dip, hitting $4.45, the horizon seems hopeful.

- RSI Value: 24.99

- JFIN Price Action: Jiayin Group’s stock saw a 1.7% rise, closing at $5.47, hinting at a potential silver lining.

- Like a lookout in a crow’s nest, Benzinga Pro’s charting tool helped identify the trends in Jiayin Group’s stock.

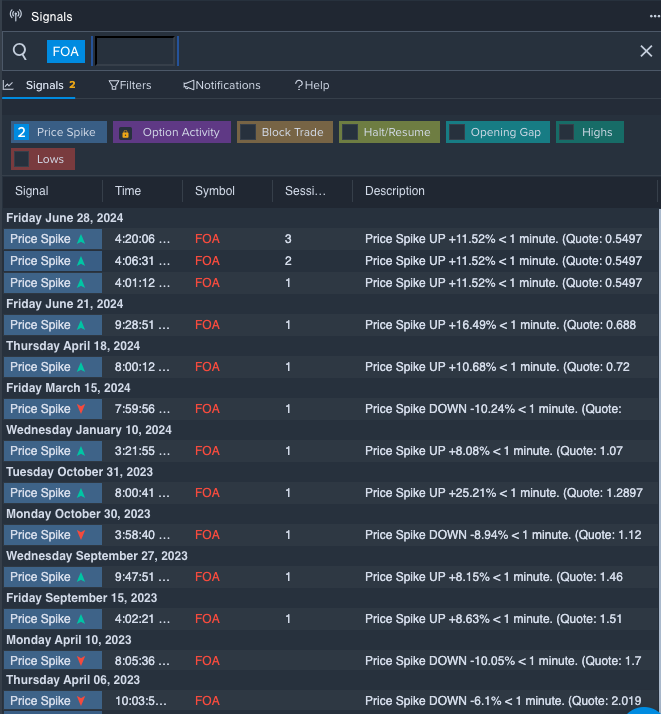

Finance of America Companies Inc (NYSE: FOA)

- Amidst the financial maelstrom, Finance of America Companies Inc sets sail to release second quarter results on a fateful day. Despite a tumultuous past with a 16% stock slide, hitting $4.10, hope lingers on the horizon.

- RSI Value: 21.38

- FOA Price Action: Finance of America’s stock experienced a 1.1% descent, closing at $7.53, all while Benzinga Pro’s signals hinted at a potential breakthrough in their shares.

Explore further depths of financial insight and market trends for promising stocks and opportunities.