Expanding Partnerships and Lower Interest Rates Drive Affirm’s Growth

Recently, Affirm Holdings Inc (NASDAQ: AFRM) has witnessed a surge in its stock value after B of A Securities analyst Jason Kupferberg upgraded the stock from Neutral to Buy. With a target price set at $36, Kupferberg’s assessment hints at the company’s impending GAAP profitability, possibly sooner than anticipated by the market.

Surpassing Expectations and Forecasting Stability

Kupferberg highlighted the upcoming fourth-quarter results as a potential boost for Affirm, indicating the achievability of fiscal 2025 forecasts. Notably, the analyst expressed optimism regarding revenue generation, pointing to the impact of lower interest rates on the company’s Revenue Less Transaction Costs (RLTC) metric.

Strategic Partnerships and Risk Management

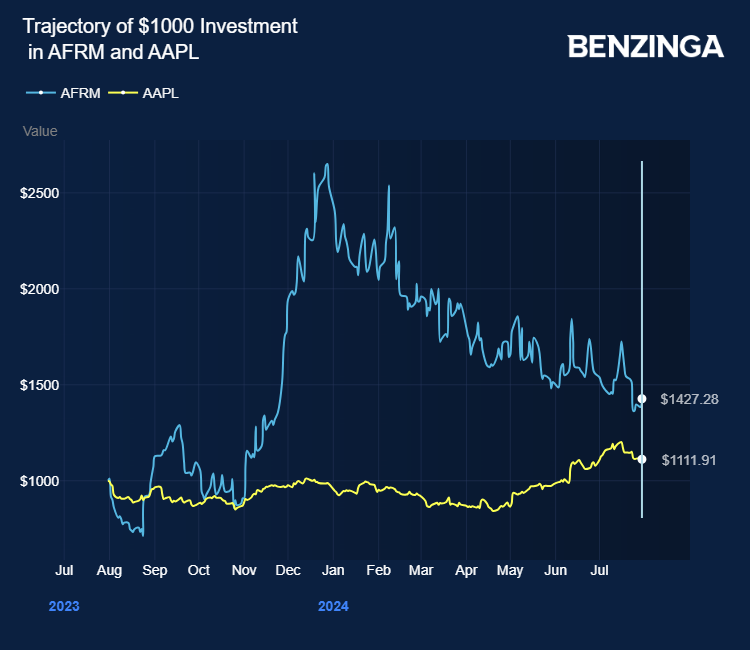

Furthermore, Kupferberg emphasized the importance of new collaborations and expanded partnerships, particularly with tech giants like Apple Inc (NASDAQ: AAPL). He also commended Affirm’s credit risk management, noting a well-structured control system in place.

Paving the Way for Long-Term Profitability

During a recent investor forum in November 2023, Affirm Holdings outlined a profitability framework that Kupferberg deems realistic, especially supported by prudent expense management. In light of this framework, the analyst identified potential inaccuracies in street estimates concerning warrant and stock-based compensation expenses.

Harnessing Economic Trends for Financial Advantage

Kupferberg pointed out the market’s expectation of several interest rate cuts in the upcoming years, foreseeing a positive impact on Affirm Holdings’ cost of funding and financial gains. The company’s strategic decision to adjust its merchants to a higher APR on loans is poised to drive up yields and Gross Merchandise Value (GMV) growth.

Despite recent fluctuations in share prices, Kupferberg anticipates a positive turn following the fourth-quarter results, expecting a stronger stance on profitability and robust guidelines for fiscal years ahead.

Future Prospects and Revenue Estimates

Affirm Holdings’ future seems promising, with potential enhancements in Apple relationships, expansion of the Affirm Card program, and geographical scaling with industry giants like Amazon.Com Inc (NASDAQ: AMZN) and Shopify Inc (NYSE: SHOP). Kupferberg forecasts considerable growth in sales, estimating $2.27 billion for fiscal 2024, $2.75 billion for fiscal 2025, and $3.24 billion for fiscal 2026.

Stock Performance

Notably, AFRM shares closed trading 2.31% higher at $27.46 on Tuesday, reflecting the investor community’s positive reception to the company’s recent developments.