Earnings season surges ahead, with a myriad of companies set to reveal their financial performance this week. Noteworthy among them are the parallel entities of Lyft (LYFT) and Uber Technologies (UBER).

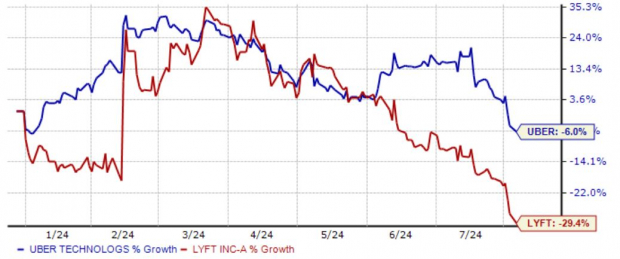

Over time, these companies have soared in popularity, outshining traditional taxi services with their innovative platforms. In terms of recent market performance, Lyft shares have faced more significant challenges in 2024 compared to Uber, painting an interesting picture for investors.

Image Source: Zacks Investment Research

But will this trend persist? Let’s delve deeper into the upcoming earnings releases to gauge the trajectory of these ridesharing giants.

Analyst Sentiment: Charging Ahead?

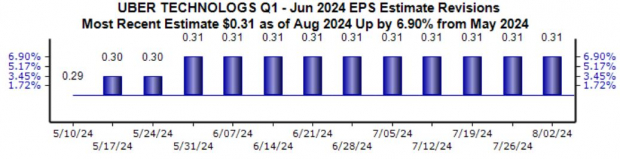

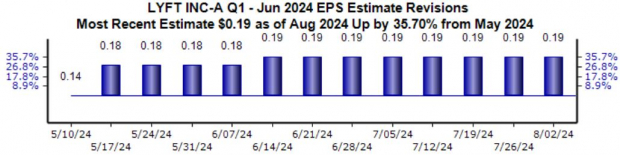

Both Uber and Lyft have witnessed positive revisions in their earnings forecasts for the upcoming releases, with Lyft experiencing more pronounced adjustments. Expectations are high, with Uber’s earnings anticipated to surge by 70% and Lyft projected to see a 27% rise.

Uber Revisions –

Image Source: Zacks Investment Research

Lyft Revisions –

Image Source: Zacks Investment Research

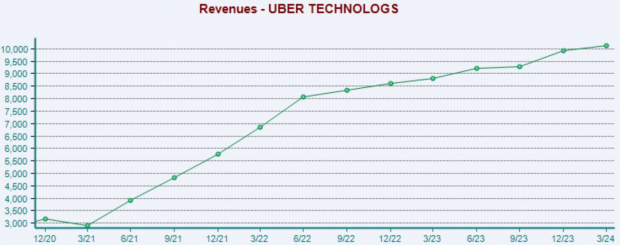

Furthermore, while Uber’s sales expectations have remained steady, Lyft has witnessed favorable revisions in its revenue forecasts. Boasting robust sales growth over the years, both companies exhibit impressive financial performance.

Uber’s Quarterly Revenue –

Image Source: Zacks Investment Research

Lyft’s Quarterly Revenue –

Image Source: Zacks Investment Research

Key Performance Indicators: Monitoring the Progress

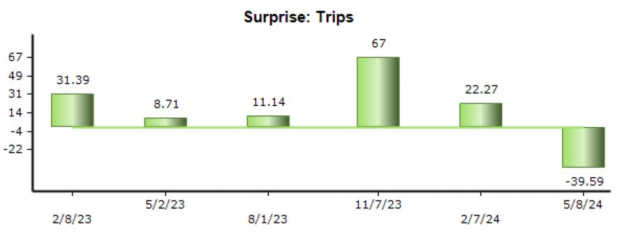

Uber’s key metric, Trips, plays a significant role in its quarterly reports. The company has consistently exceeded expectations in this area, with a slight shortfall in the most recent release.

Despite this setback, the year-over-year growth in Trips signals a robust momentum. For the upcoming quarter, market consensus estimates reveal an anticipated Trips count of 2.7 billion, up from 2.3 billion in the same period last year.

Image Source: Zacks Investment Research

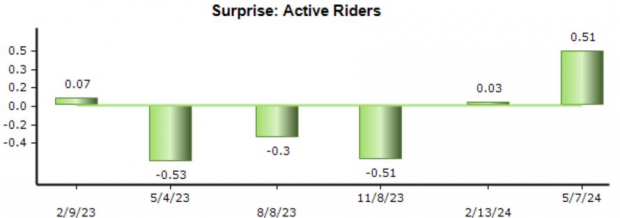

On the other hand, Lyft reports several key metrics, with Active Riders being a notable one. The latest quarter marked a turnaround in the company’s performance, with Active Riders reaching 21.9 million, reflecting a 12% year-over-year growth.

The consensus estimate for Active Riders in the upcoming period is 23.8 million, indicating a slight increase from the previous year’s figure of 21.5 million.

Image Source: Zacks Investment Research

Final Thoughts: Navigating the Road Ahead

Despite experiencing recent price declines of 21% for Uber and 19% for Lyft, both companies are set to unveil their Q2 results soon.

Given the prevailing market pessimism, positive revelations regarding rider growth in the upcoming reports could reignite investor enthusiasm. Analyst sentiment has also been optimistic in recent months.

Profitability and cash flow figures will be closely scrutinized, with both companies showing upward trends in these essential financial metrics.

Stay tuned as the ride-hailing giants gear up to showcase their financial prowess in the face of challenging market conditions.