Comparing E-Commerce Powerhouses from the East

When it comes to the world of Chinese e-commerce, two juggernauts stand tall – Alibaba and PDD Holdings. In the epic clash of titans, the question arises: which stock emerges as the superior investment option? Let’s delve into the numbers to uncover the victor.

Distinct Strategies in a Shared Arena

Alibaba, a behemoth in the e-commerce landscape, boasts a broad focus on both domestic and global marketplaces. Its platforms, including Tmall and Taobao, resonate strongly with a vast consumer base. On the other end, PDD excels in the discount e-commerce realm, notably through its Pinduoduo platform and the international venture, Temu. Additionally, Alibaba stretches its reach into cloud computing and technology investments.

Market Performance and Valuations

Recent market performance paints a diverging picture for the two rivals. Alibaba, despite a 5% uptick year-to-date, faces an 18% decline over the past year. In contrast, PDD shares are down 12% for the year but exhibit a robust 43% surge over a year. Surprisingly, their valuations do not veer far apart, sparking curiosity.

While most players in China’s e-commerce arena struggle with profitability, Alibaba and PDD carve a niche for themselves, making industry-wide comparisons challenging. Notably, the Chinese e-commerce industry’s price-to-sales (P/S) ratio stands at 1.2x, marginally below the three-year average of 1.4x.

Alibaba: The Dragon of Valuation

Alibaba’s allure lies in its attractive valuation metrics. With a price-to-earnings (P/E) ratio of 18.4x and a P/S ratio of 1.3x, Alibaba presents itself as a compelling opportunity, especially considering the anticipated earnings growth reflected in its forward P/E of 8.8x. Echoes of Amazon’s journey resonate in Alibaba’s evolution, transitioning from a growth stock to a mature player.

The company’s strategic focus on cloud revenue growth, coupled with enhancements to its Tmall and Taobao platforms, projects a promising future. Although recent revenue growth has slowed, Alibaba’s valuation appears enticing, trading near the lower band of its historical P/E range.

Despite the inherent risks linked with Alibaba’s forward-looking valuation, the stark comparison to Amazon’s multiples and the robust sales prospects in China introduce a compelling narrative in the investment landscape.

The Quest for BABA Stock’s Price Target

Alibaba’s Strong Buy consensus rating, supported by 13 Buy and three Hold ratings, underscores the positive sentiment surrounding the stock. An average price target of $104.06 hints at a tantalizing upside potential of 33.5%, showcasing investor confidence in Alibaba’s trajectory.

PDD Holdings: The Challenger’s Dilemma

PDD embraces a valuation landscape akin to Alibaba, boasting a P/E ratio of 17x. However, its P/S ratio of 4.4x raises apprehensions of potential overvaluation. Despite this, PDD’s stellar revenue growth – a whopping 90% in 2023 – positions it as a growth-oriented contender in the sector.

Trading at the lower end of its P/E spectrum, PDD exhibits a forward P/E of 10.5x, signaling an attractive proposition marred by regulatory uncertainties. Scrutiny surrounding PDD’s Temu marketplace and its TikTok account exacerbates investor worries, highlighting the nuanced challenges faced by the challenger.

The lack of transparency surrounding Temu’s financials adds an additional layer of complexity to PDD’s narrative, necessitating a cautious approach in the investment realm.

In conclusion, the rivalry between Alibaba and PDD not only epitomizes the vibrancy of China’s e-commerce landscape but also unravels the intricate web of opportunities and risks that investors must navigate in this dynamic marketplace.

Bullish Outlook for PDD Holdings and Alibaba Amidst Market Volatility

As the global economy exhibits erratic behavior, investments within the Chinese e-commerce sector have become an oasis in the desert of uncertainty. Within this landscape, PDD Holdings and Alibaba emerge as leading contenders, each capturing the attention of investors seeking refuge from the storm of market instability.

Unlocking the Potential: PDD Holdings’ Price Target Analysis

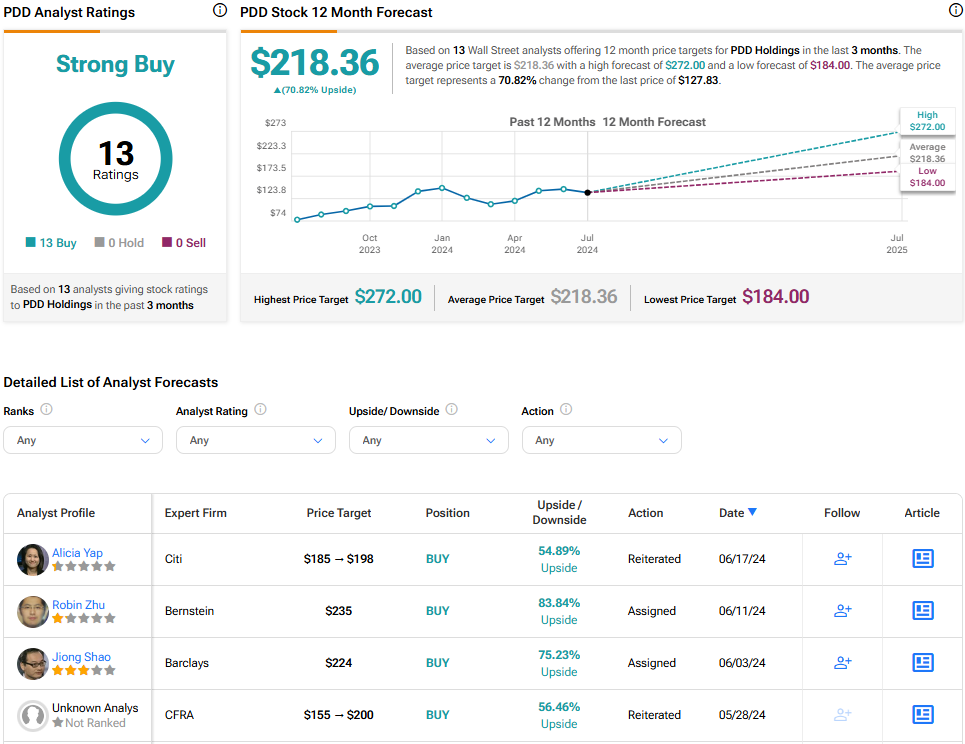

With a resounding chorus of 13 Strong Buy ratings echoing through the financial realm, PDD Holdings peers confidently toward a horizon of advancement. Bathed in the glow of optimism, the stock’s target price of $218.36 unveils a tantalizing 70.8% potential upside, serving as a beacon for investors navigating turbulent waters.

Explore further PDD Analyst Ratings to deepen your understanding of the stock’s trajectory.

Embracing Resilience: The Bullish Sentiment for Alibaba and PDD Holdings

Alibaba and PDD Holdings stand as pillars of strength in the realm of e-commerce, weathering the ebb and flow of market sentiment with unwavering resolve. While both entities bask in the glow of potential prosperity, Alibaba emerges as the golden apple of opportunity, shining brighter in the constellation of investment choices.

Amidst concerns of consumer spending hesitancy in China casting shadows over both stocks, the dawn of realization breaks — these clouds are transient, fleeting wisps that belie the true potential of these giants. A momentary dip in the market begs the discerning investor to seize the opportunity presented by such undervaluation.

The caveat of investing in Chinese stocks teeters menacingly on the precipice of delisting, wielding the sword of uncertainty over Alibaba and PDD. However, PDD, draped in the cloak of heightened risk due to potential legislative action threatening its stability, finds itself at a crossroads of destiny. As the symphony of market dynamics plays out, Alibaba emerges as the steady ship navigating tumultuous seas, offering solace to investors questing for stability amidst the tempest.

As investors brace themselves against the headwinds of change, embracing the evolution of market forces, the landscape of Chinese e-commerce beckons as a bastion of opportunity. Within this realm, PDD Holdings and Alibaba weave a tale of resilience, painting a portrait of optimism amidst the canvas of volatility.