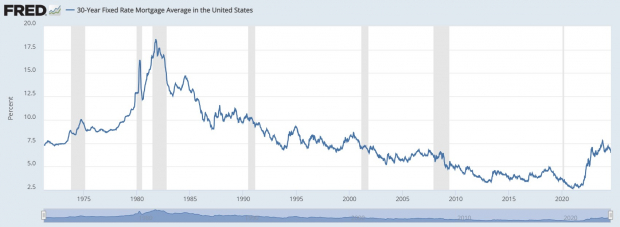

As the curtain rises on another earnings season, all eyes are on Home Depot (HD) as they prepare to unveil their Q2 results on Tuesday, August 13. The home improvement giant stands under the spotlight, poised to meet investor expectations amidst a backdrop of tantalizingly low mortgage rates.

Image Source: Federal Reserve Economic Data

Anticipated Q2 Performance

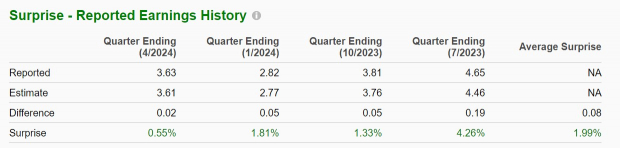

According to Zacks estimates, Home Depot’s Q2 sales are projected to witness a slight contraction of -1% to $42.62 billion compared to the previous quarter. Earnings per share are also expected to see a modest decline of -2%, settling at $4.55 from the prior year’s $4.65.

Image Source: Zacks Investment Research

Recent Market Performance

Despite Home Depot’s stellar track record, concerns loom over inflationary pressures stemming from higher mortgage rates that could potentially curb consumer spending on home improvement products. This has resulted in HD’s stock climbing a lackluster +6% over the past year, trailing behind competitor Lowe’s (LOW) and lagging the S&P 500’s benchmark of +19%.

Image Source: Zacks Investment Research

Valuation Analysis

Currently, Home Depot’s stock is trading at 22.8 times its forward earnings projection. The company is expected to see stagnant growth in fiscal year 2025, with a projected 5% upswing in FY26 to $16.03 per share. Comparatively, Home Depot maintains a slight premium over Lowe’s with a 19.3X earnings multiple, while aligning closely with the S&P 500’s 22.4X multiple.

Image Source: Zacks Investment Research

Final Thoughts

As the earnings day approaches, Home Depot’s stock holds a Zacks Rank #3 (Hold). While the company’s long-term growth prospects continue to shimmer, the key to unlocking further upside lies in exceeding earnings forecasts and capitalizing on the narrative of lower interest rates ahead.