Tesla Inc. TSLA embarks on a tumultuous journey in 2024. The electric behemoth sees a 19% dip year-to-date, yet a recent 3% upswing over the past month offers a faint glimmer of relief.

The spark of hope ignited on July 23 with Tesla’s second-quarter financial statement. The revenue rested at approximately $25.5 billion, a modest 2% uptick from the previous year, surpassing Wall Street’s expectations of $24.73 billion.

However, Tesla’s earnings per share (EPS) unveiled a contrasting narrative, plunging 43% year-over-year to 52 cents, missing the Street’s projected 62 cents. Despite this misstep, a technical savior emerged as a Golden Cross transpired on July 29.

Chart created using Benzinga Pro

A Golden Cross, wherein the 50-day moving average eclipses the 200-day moving average, signals a potential bullish trajectory. Investors behold this pattern with optimism, hinting at a probable Tesla revival.

While Tesla revels in the radiance of its Golden Cross, the panorama for the broader clean energy domain appears bleak.

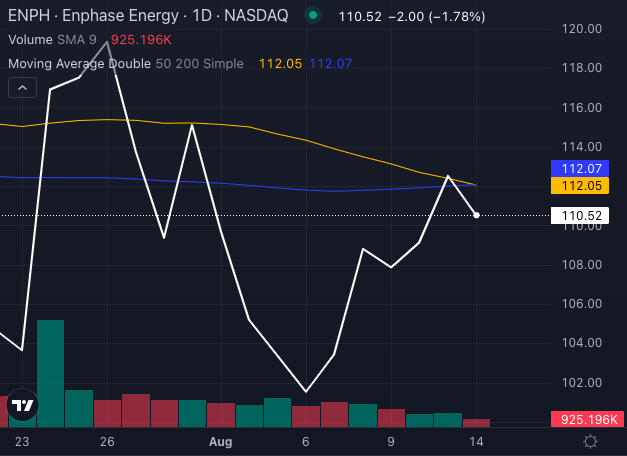

Enphase Energy Inc. ENPH, a frontrunner in energy management tech, grapples with a 15.69% year-to-date descent, straddling the precipice of a Death Cross.

Chart created using Benzinga Pro

This foreboding omen, where the 50-day moving average descends below the 200-day moving average, forewarns of potential further downturns.

Blink Charging Co. BLNK, a pivotal player in the EV arena, faces its own trials.

Chart created using Benzinga Pro

With a 35.49% year-to-date slump, Blink hurtles towards a Death Cross, shrouding its near-term prospects in uncertainty.

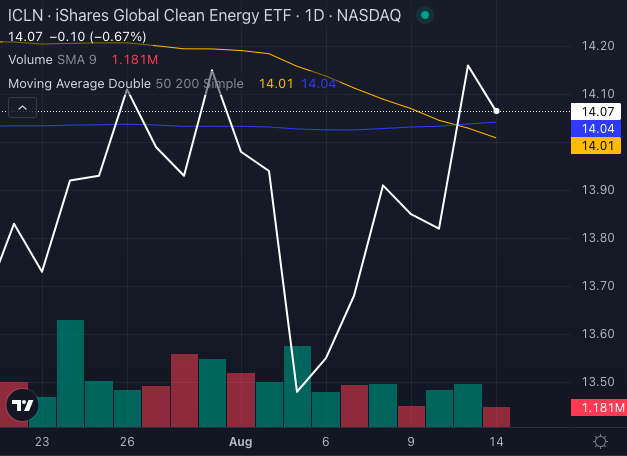

The iShares Global Clean Energy ETF ICLN, tracing the trajectory of clean energy entities globally, has already surrendered to a Death Cross, echoing the sector’s overarching tribulations.

Chart created using Benzinga Pro

The ETF faces an 8.54% year-to-date slump, illustrating the uphill battle confronting clean energy stocks despite Tesla’s technical resurgence.

As Tesla thrives with its Golden Cross, clean energy stocks grapple with a Death Cross predicament, exemplifying the divergent paths within the sector.