Unveiling Market Forecasts with the Elliott Wave Principle

Delving into the depths of market prediction, the Elliott Wave Principle (EWP) stands as our guiding light through the tumultuous waters of the financial realm, particularly when assessing the performance of the NASDAQ 100 (NDX). By discerning recognizable patterns within the market’s ebbs and flows, the EWP equips us with a roadmap to anticipate potential trajectories, rooted firmly in a foundation of price-based guidelines. While the future remains veiled in uncertainty, the EWP offers a lens through which we may glimpse the most probable path forward, reminding us that all forecasts necessitate an adaptable mindset of vigilance and adjustment.

From Peaks to Valleys: Tracing the Index’s Journey

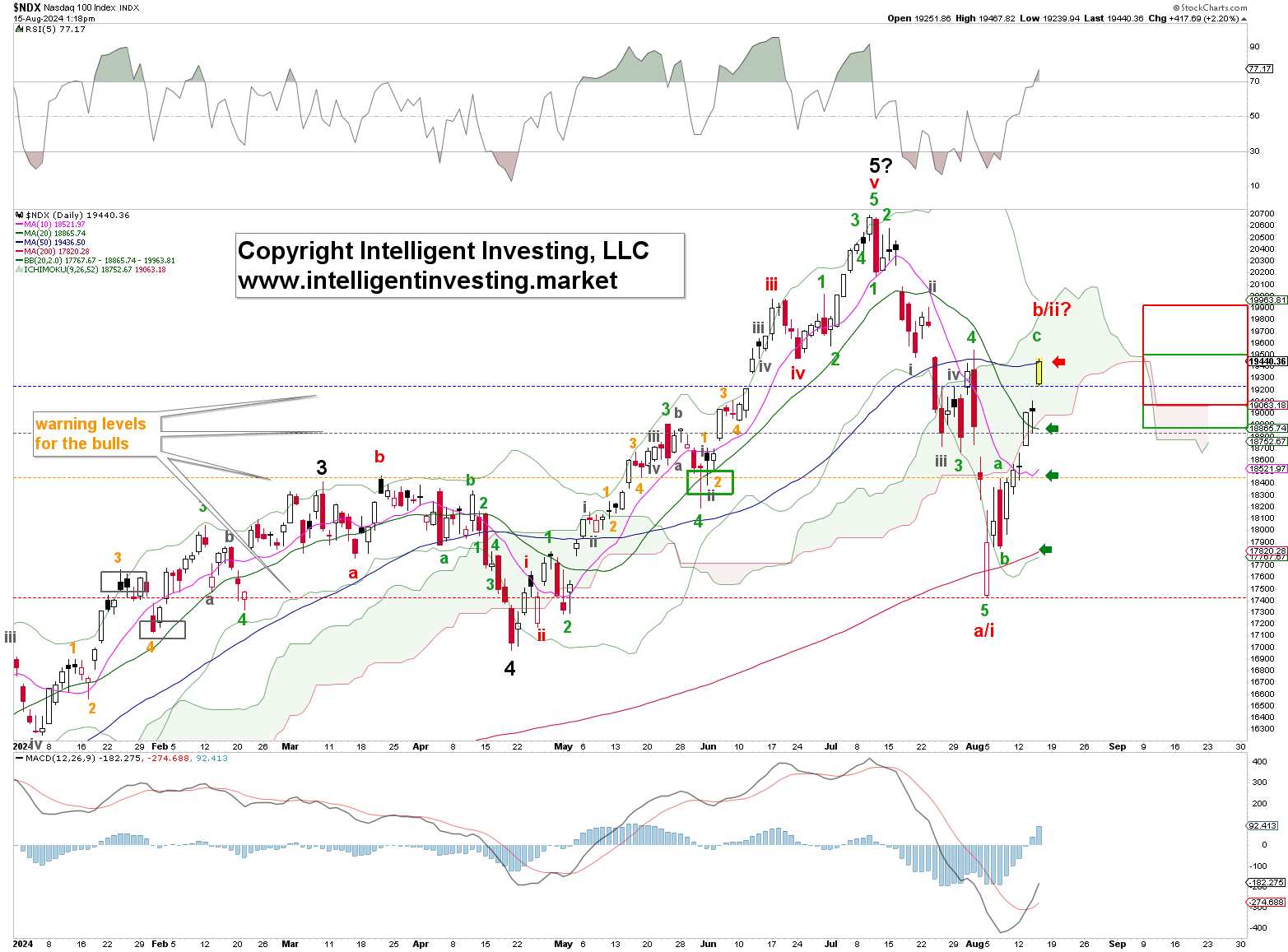

In a recent analysis, our projections indicated that the index would find its zenith around the 200.0% extension mark near $20665, give or take $50. True to form, the NDX reached its crescendo at $20690 on July 10, only to commence a descent of over 15% by the subsequent Monday’s opening bell. Referring back to our August 1 insights, we envisioned a path forward:

“A breach beneath Monday’s low will confirm the initiation of green W-5 within the broader red W-a/I structure, aiming towards the support band between $18200-400. A subsequent retracement—red W-b/ii—could prospectively target the 50-76.4% range of the preceding upswing, hovering in the vicinity of $19300-800.”

Echoing our forecast, on the fateful Monday of August 5, the index hit a nadir at $17435, slightly undershooting the anticipated range. Despite this discrepancy in magnitude, the index embarked on a restorative rally in alignment with our prognostication, now treading in the $19420s. Our recent track record reflects a commendable 2.5 out of 3 marks over the past six weeks, prompting the pertinent inquiry: What lies ahead in the market’s unfolding narrative?

Auguring Market Movements: Current Landscape and Future Trajectories

The red W-b/ii counter-wave rally has successfully navigated the $19300-800 target zone, encapsulating the 50-76.4% retracement spectrum of the prior red W-a/i surge. Moreover, the green W-c phase is on the cusp of caressing the 1.618x W-a extension milestone at $19500, emanating from the nadir of green W-b. Although $19500 beckons, the realm beyond that threshold remains ripe for exploration, potentially extending its horizons into the $19800 domain.

Raising the proverbial Bulls’ colored flags of caution, we designate threshold levels guiding us towards the diminishing prospects of further upside. Moreover, the intricacies of the red W-b/ii might unfurl into a more intricate tapestry, elongating the current rally merely into the initial strides of W-a within the W-b/ii schema. However, this speculative discourse shall reside in the realms of possibility for another day, offering a narrative thread worth pondering but not yet dwelling upon.

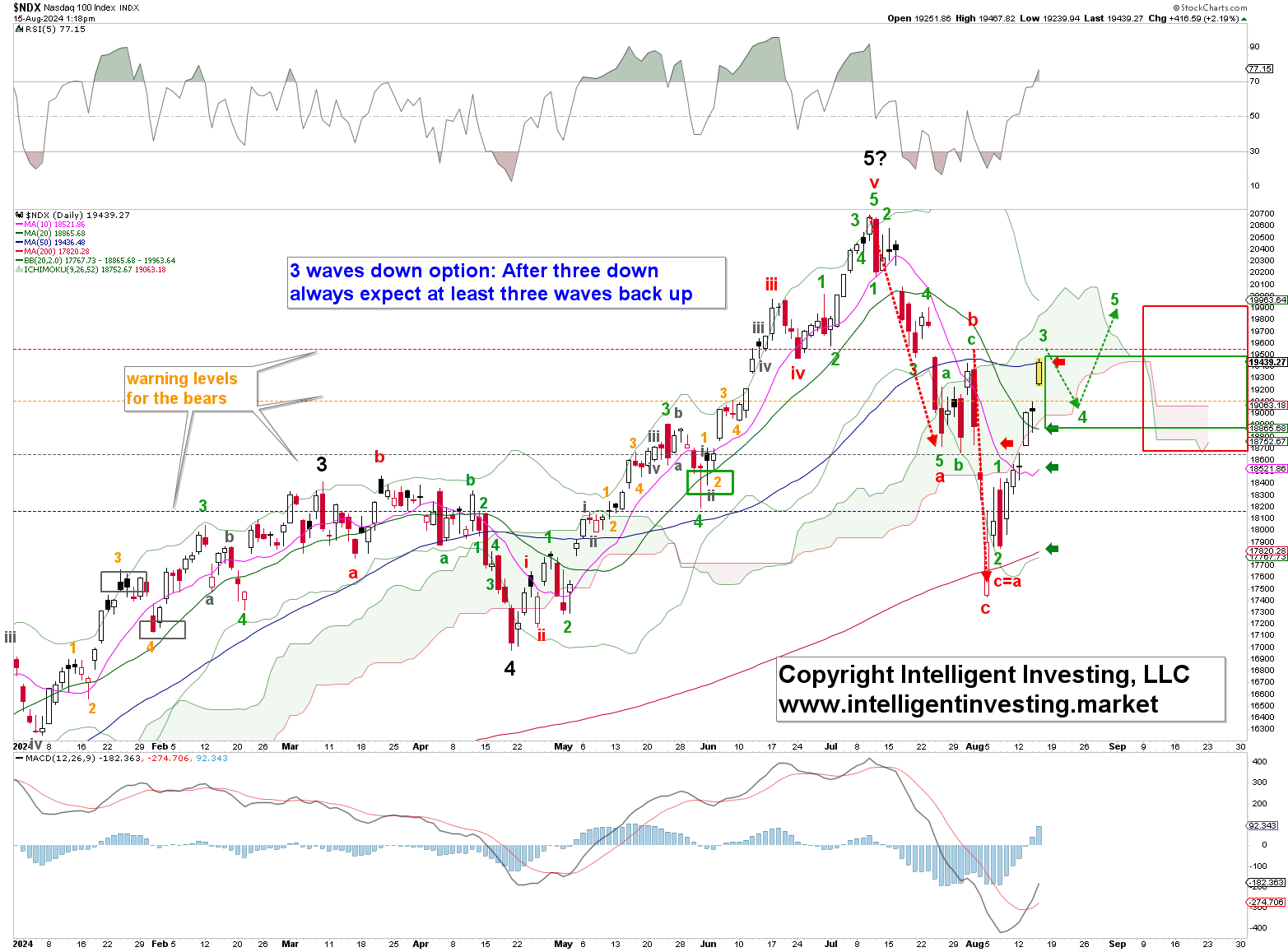

Given the more profound downturn witnessed last week—an unexpected downturn in its depth—a novel scenario emerges, challenging our traditional viewpoints through the prism of a three-wave decline. Observing the delineation of red W-a, b, and c in Figure 2 below, the market manifests the hallmark characteristics of corrective price kinetics, potentially setting the stage for a renewed upward impetus. A fresh narrative may unfurl through the verdant paths of green waves 1-2-3-4-5, steering the index towards the aspiration of fresh historical pinnacles.

Critical to this prospective journey, the impending arrival of green W-3 stands herald as the precursor to the ensuing green W-4 and 5. Ideally, the former shall stand sentinel above the $18700 threshold, fortifying the grounds for the latter to venture boldly towards the $19950 +/- 50 echelon. Yet, as we retrospectively trace the path of five expansive waves from the crucial nadir of October 2022 to the zenith of July, as we shall elucidate in our forthcoming update, this speculative tableau shall, for the present, adorn the mantle of our alternative scenario.