Jeff Clark’s bright red warning flag… the reversal of bond yields’ multi-decade direction… three major consequences… on a bear market’s doorstep?… how to trade volatility

Sir John Templeton once said:

The four most dangerous words in investing are: “This time it’s different.”

Perhaps.

But master trader Jeff Clark offered a visual of why today is “different” compared to the last 40 years – and the takeaway suggests that investors should be careful.

Here’s Jeff:

Most folks under 50 years old have no idea what’s coming next. They’ve never experienced a rising interest rate environment.

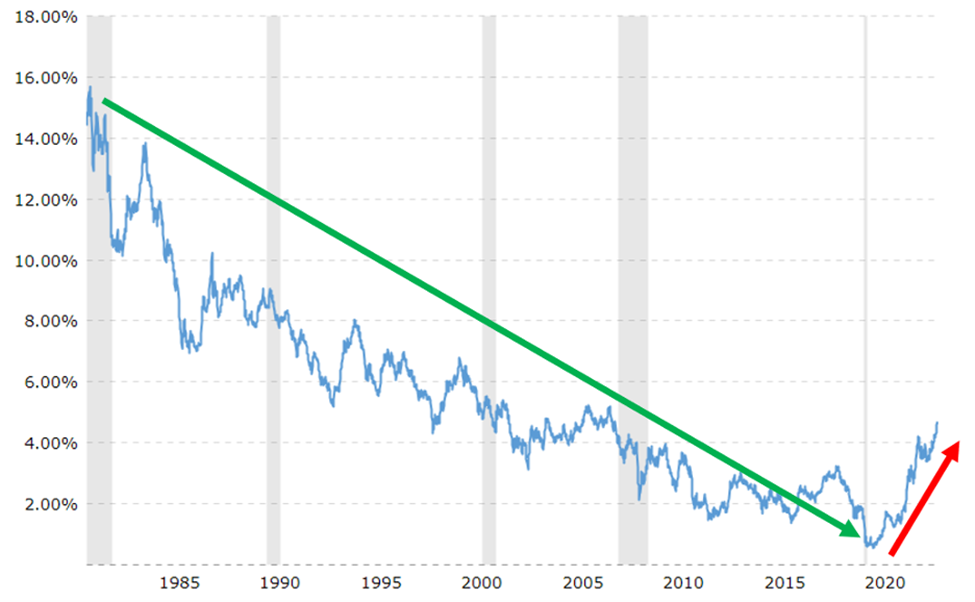

Look at this chart of 30-year interest rates…

Source: StockCharts.com

Long-term interest rates peaked in 1982, with the 30-year Treasury Bond yielding 14%.

Rates then declined for the next 40 years – hitting as low as 0.4% during the COVID crisis in 2020.

But look at what has happened in the last three years. The 30-year Treasury yield broke out above a 40-year declining resistance line.

This is a tectonic shift in the market

This reversal in the direction of treasury yields has three primary consequences:

- Tighter economic conditions for Main Street

- Tougher investment conditions for Wall Street

- Heavier debt burdens on Uncle Sam

Beginning with “Main Street,” Jeff notes that Interest rates are up 60% since 2022 – and 1,100% higher than their 2020 lows. Borrowing money now costs 11 times more than it did five years ago.

Here’s Jeff with the significance:

Most folks manage their debt by taking out new loans to pay off older debt as it matures. And, for the past 40 years we’ve been able to do this at perpetually lower interest rates. This allowed us to borrow even more money without incurring larger debt payments…

There were no consequences to borrowing money. Deficits didn’t matter.

Now though, with long-term interest rates recently hitting the highest level in 20 years, it costs more to borrow money. Any maturing debt must be refinanced at higher rates.

Nobody is refinancing their mortgage anymore and taking out a pile of cash to spend on their lavish lifestyles.

Now, you might recall that in yesterday’s Digest, we profiled the recent resilience of the U.S. consumer. But that resilience doesn’t mean that there aren’t risks today.

To explain, let’s jump to our hypergrowth expert Luke Lango. In his Innovation Investor Daily Notes from last week, he dove into the “pretty ugly” second revision of U.S. Q1 GDP, then turned to the consumer:

The more-important personal consumption number was revised significantly lower from +1.8% to +1.2%. That’s a really low growth number for personal consumption.

Going back to 1995, the average personal consumption growth rate has hovered around 3%. We are at 1/3 of that today.

The U.S. economy is not in a great position right now.

Tougher investment conditions for Wall Street

Back in 2023, I wrote a Digest that suggested the economic and investment conditions that helped Baby Boomers and Generation X generate wealth were fading.

Yes, those generations faced bear market and recessions, but overall, “buy the dip” was a winning strategy. I suggested one primary reason for their good fortune…

The slow, steady decline of the 10-year Treasury yield.

It created a perfect environment for stock investors.

I wasn’t the only one who had arrived at this conclusion. Here was the “Bond King” Bill Gross, co-founder of PIMCO, from back in 2013:

All of us, even the old guys like [Warren] Buffett, [George] Soros, [Dan] Fuss, yeah – me too, have cut our teeth during perhaps a most advantageous period of time, the most attractive epoch, that an investor could experience.

Since the early 1970s when the dollar was released from gold and credit began its incredible, liquefying, total return journey to the present day, an investor that took marginal risk, levered it wisely and was conveniently sheltered from periodic bouts of deleveraging or asset withdrawals could, and in some cases, was rewarded with the crown of “greatness.”

Perhaps, however, it was the epoch that made the man as opposed to the man that made the epoch…

We’re no longer in that epoch.

To illustrate, in our 2023 Digest, we showed a very similar chart to the one Jeff highlighted above, except we chose the 10-year Treasury, not the 30-year.

Source: MacroTrends.net

Our bottom-line mirrored Jeff’s…

This time is different…at least in the bond market.

To be clear, this doesn’t mean life-changing stock returns aren’t possible (we’re looking at you, AI/robotics/humanoids). But it does suggest that if this bond direction continues, it will be a headwind to stock returns that we haven’t faced in about 45 years.

Heavier debt burdens on Uncle Sam

Let’s return to Jeff:

The U.S. government – with $9 trillion of its $36 trillion national debt due to mature in 2025 – for lack of a better word… is screwed.

All of that debt will be refinanced at higher interest rates.

Stepping back for context, our government is already paying through the teeth on interest expense.

The U.S. Treasury’s annual interest expense passed $1.117 trillion last year, making it the second-largest government expense on record.

Source: Bloomberg / Joe Consorti

But the spending that’s on the way dwarfs this…

Here’s the Peter G. Peterson Foundation, a non-partisan thinktank:

Over the next decade, the U.S. government’s interest payments on the national debt are now projected to total $13.8 trillion — the highest dollar amount for interest in any historical 10-year period and nearly double the total spent over the past two decades after adjusting for inflation.

The government has two options to finance this hefty price tag: raise taxes or issue more debt.

We’re not raising taxes. As we’ve profiled in the Digest, the Trump Administration’s “big, beautiful bill” (which Elon Musk calls “a disgusting abomination”) has passed the House and is now in the Senate.

It aims to make the tax cuts from the “2017 Tax Cuts and Jobs Act” (TCJA) permanent, including provisions like the higher standard deduction and lower tax brackets.

It also includes new tax relief measures, such as no taxes on tips, a deduction for auto loan interest, and tax relief for seniors.

So, that leaves “issuing more debt” – which is what we’ve been doing for the last handful of years.

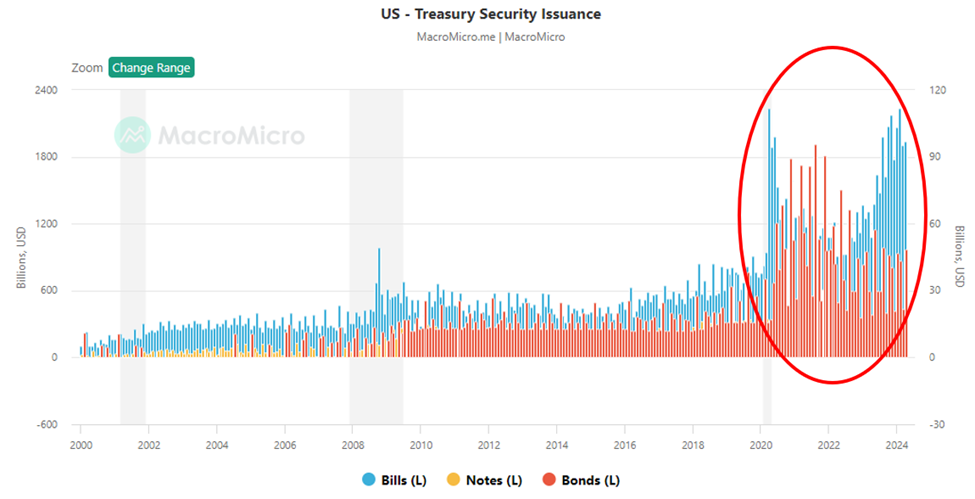

As you can see below, we’ve had an explosion of treasury issuance since 2020.

Source: MacroMicro

When new treasury issuance floods the market, the oversupply results in lower prices to entice buyers. And since bond prices and yields are inversely correlated, this means bond yields rise.

That’s not good for stocks or for the federal government’s debt service (and eventually, the value of your savings in dollars).

Back to Jeff:

Some of us wrinkled, gray-haired, old folks remember what it was like living in the 1970s.

We’ve seen how financial assets perform in a rising interest rate environment.

So, what do we do?

First, while we won’t dive into it today, we’ve been pounding the table for months: We invest in AI, robotics, and humanoids.

These stocks may face volatility and go through significant drawdowns, but the long-term upside is massive given the seismic tech shifts ahead.

Second, prepare for volatility. As we’ve covered in the Digest, Jeff believes a bear market is at our doorstep, with a potential bottom around 4,150 on the S&P this fall.

Most importantly, we seek out opportunity regardless of the market environment.

Even in bear markets, Jeff has shown how explosive rallies can deliver double- or triple-digit gains in days. And of course, there are also big profits in betting on downside moves.

Bottom line: double- and even triple digit returns – as the market moves up or down – are in play over very short timeframes. But let me show you.

Here are five of Jeff’s most recent trades in his service Delta Report, both long and short. Notice how quickly Jeff is in and out of these trades, as well as their returns:

- OSCR long trade on 05/06/2025, closed on 05/07/2025 for a profit of 97.10%

- WGMI long trade on 04/15/2025, closed on 04/24/2025 for a profit of 81.13%

- DELL short trade on 04/09/2025, closed on 04/11/2025 for a profit of 89.79%

- C short trade on 04/04/2025, closed on 04/09/2025 for a profit of 76.39%

- MRVL short trade on 04/04/2025, closed on 04/09/2025 for a profit of 90.72%

Now more than ever, you should consider adding this type of shorter-term, bi-directional trading to your toolkit. If you’d like to learn more about how, mark your calendar for next week, Wednesday, June 11 at 10 am ET for Jeff’s Countdown to Chaos event.

Jeff will dive into the details of how he trades. In short, it’s a “reversion-to-the-mean” trading strategy. Basically, when he sees that a stock or an index gets stretched too far in one direction or the other, he bets on the proverbial rubber-band snapping back.

Here’s Jeff:

We look to buy stocks that are deeply oversold, and we look to sell/short stocks that have pushed too far into overbought territory.

Next Wednesday, I’ll walk you through more details, as well as exactly what’s coming next… and how you can position yourself not just to survive but to profit in spades.

I’ll reveal 10 compelling opportunities flashing right now, as well as the powerful new tool I’ve built with TradeSmith to find them daily.

If you’ve ever wanted to turn volatility into your biggest advantage, join us for the Countdown to Chaos.

Stepping back, “this time it’s different” can be a dangerous assumption…unless it really is different

So, it is different today?

Back to Jeff to answer and take us out:

“Deficits don’t matter,” the younger folks shout at us older traders. “The national debt has grown from less than $1 trillion in 1982 to almost $37 trillion today, and nothing bad has happened.”

They ask, “What’s different this time?”

Take another look at the chart above…

This time, you’ll see the difference.

Have a good evening,

Jeff Remsburg