Revolutionizing Personalized Health Screening

A not-so-distant future reveals a groundbreaking innovation – the advent of the “smart toilet.” This cutting-edge device, fueled by artificial intelligence, offers real-time analysis of bodily indicators for any initial signs of illness or disease. According to Sanjay Mehrotra of Micron Technology, regular physician visits may become obsolete, as abnormalities can be swiftly identified through urine and stool analysis.

The Era of AI-Enabled Personalized Healthcare

Should any irregularity be detected, AI steps in without delay. By leveraging your unique genetic makeup and the specific health issue identified, a customized medication is promptly formulated. This marks the onset of an era characterized by AI-driven personalized healthcare, as elucidated by Forbes.

The Consensus: AI & Healthcare Integration

Expert analysts unanimously recognize the paramount significance of merging AI and healthcare. This convergence is anticipated to wield a transformative influence not only on individual well-being and longevity but also on the financial status of industry players, as highlighted in a recent Digest article.

AI’s Dual Role in Healthcare Transformation

AI is poised to revolutionize healthcare on two pivotal fronts – enhancing wellness care for individuals and lowering operational costs for healthcare providers. Take, for instance, the progress in nursing, where AI innovations could soon see autonomous digital nurses like Florence assuming certain responsibilities.

Expanding Horizons: AI in Medical Device Innovation

Projections from Grand View Research predict a substantial growth in AI’s influence on medical device advancements. From diagnostics to patient management, AI is set to drive progress, with an estimated market expansion to over $200 billion by 2030.

Big Tech’s Strategic Moves in Healthcare

Industry giants like Amazon, Apple, Alphabet, and Microsoft are swiftly capitalizing on AI to reshape healthcare dynamics. From pharmacy services to interoperability solutions, these tech behemoths are pioneering innovative initiatives that promise to revolutionize the healthcare landscape.

Investing in the AI Healthcare Boom

Contrary to popular belief, the transformative potential of AI in healthcare is not a distant prospect; significant returns are already materializing today. With triple-digit returns becoming a reality in the present, the trajectory of AI-powered healthcare investments is showing promising signs of growth.

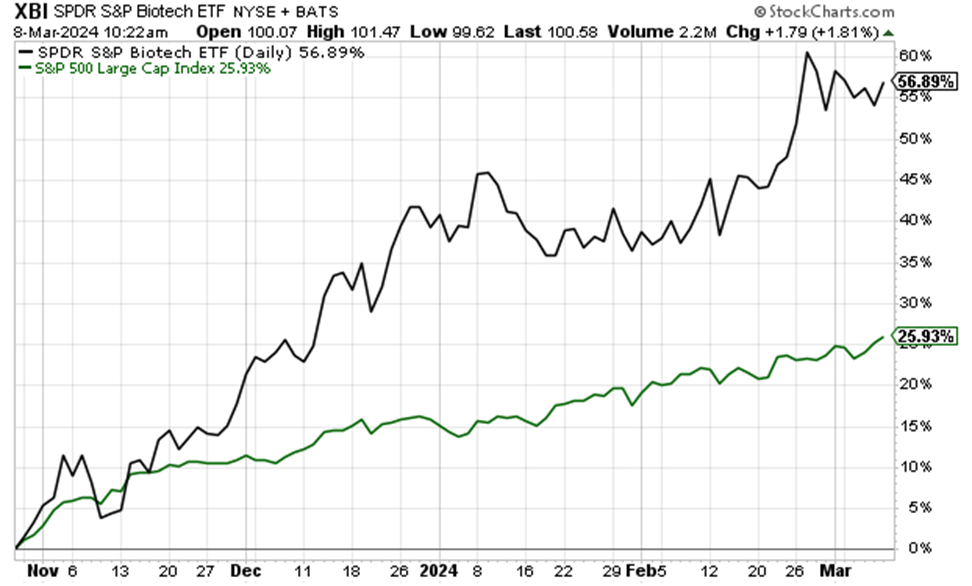

The AI Revolution Unleashes a Biotech Boom

Source: StockCharts.com

But that’s just the tip of the iceberg when it comes to individual biotech stocks’ performance.

Year-to-date, Elevation Oncology (ELEV) is skyrocketing by over 800%, Skye Bioscience (SKYE) is surging more than 500%, and Corbus Pharmaceuticals (CRBP) is climbing about 500%.

So, what’s causing this biotech bonanza?

The answer partly lies in the realm of AI.

The integration of AI in biology is poised to unlock substantial economic value, primarily due to the vast ocean of data available.

The Momentum of the Biotech Sector

This surge is not a fluke. Significant growth is happening in real-time for everyday investors.

Consider Luke’s High Velocity Stocks trading service. In this service, Luke employs a trading strategy known as “stage analysis” in the biotech sector.

A glance at the portfolio reveals impressive figures:

- A 160% gainer, entered on January 9th…

- A 141% winner, from January 23rd…

- A 135% winner, initiated on August 8th…

- A 51% winner, established on November 14th…

The average return of the entire portfolio stands at around 56%, with no position older than last August. Six out of the ten positions were opened within the last three months.

Exploring Diverse Investment Avenues

However, if trading small biotechs isn’t your cup of tea to capitalize on this trend, fret not.

Many mega-cap healthcare firms are currently on an acquisition spree, acquiring small-cap biotech companies to tap into their valuable intellectual property, patents, and pipelines.

These acquisitions are likened to “call options,” with any one of them potentially turning into a game-changer for the acquiring mega-cap company overnight.

Therefore, investing in stable mega-cap biotech/healthcare companies offers a diluted yet exposure to game-changing possibilities.

Consider stocks like Merck, Amgen, or Gilead. While they may lack the volatility of microcap biotechs, their acquisitions could yield significant returns.

Additionally, while awaiting the fruits of these “call options,” investors can enjoy dividend yields of 2.5% from Merck, 3.3% from Amgen, and 4.1% from Gilead.

The Promise of a Healthcare Revolution

As we stand at the cusp of an era that promises vast wealth accumulation, let’s not lose sight of the bigger picture.

The true value doesn’t solely reside in monetary gains but in the profound enhancement of well-being for individuals and their families.

As we look to the future, experts predict a scenario where advancements in medical science and technologies lead to a drastic reduction in disease-related fears.

Life-extending strategies to combat ailments like Alzheimer’s, heart disease, and diabetes while preserving quality of life are anticipated to become commonplace.

This shift, enabled by technology and advanced research techniques like AI, underscores the critical importance of investing in AI within the healthcare realm to safeguard our most precious asset – life itself.

So, as we navigate this transformative landscape, remember, the greatest gains may not always be measured in dollars but in the priceless gift of health and longevity.

Wishing you a fulfilling journey,

Jeff Remsburg