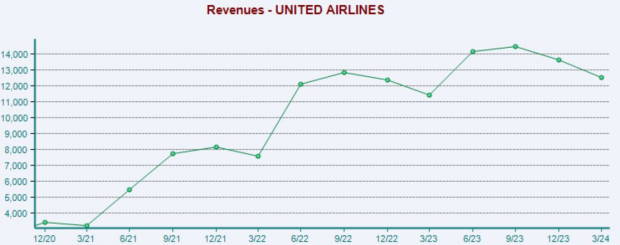

United Airlines: Soaring Above Expectations

The 2024 Q1 earnings season is in full swing, and United Airlines (UAL) has set a high bar. Despite a $200 million hit from the Boeing 737 MAX 9 grounding, UAL outperformed with a 71% beat on EPS estimates.

Consumer interest in travel remains robust, driving UAL’s positive performance. With a 9.1% increase in capacity and lower fuel prices compared to the previous quarter, the airline is charting a profitable course, as illustrated below:

Image Source: Zacks Investment Research

United Airlines has reaffirmed its full-year guidance, anticipating adjusted EPS in the range of $9 – $11. The market’s favorable response to UAL’s results reflects confidence in the company’s outlook.

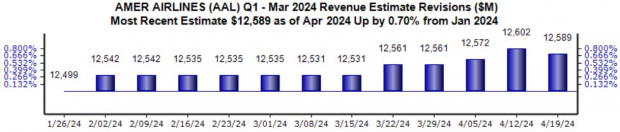

American Airlines: Navigating Positive Momentum

Analysts are eyeing American Airlines (AAL), noting a positive trend in earnings estimates. With a current Zacks Consensus EPS estimate of -$0.28 (an improvement from -$0.32 in March), AAL is poised for a steady financial performance.

Image Source: Zacks Investment Research

AAL has consistently outperformed expectations, exceeding the consensus EPS estimate by an average of 120% in its last four earnings reports.

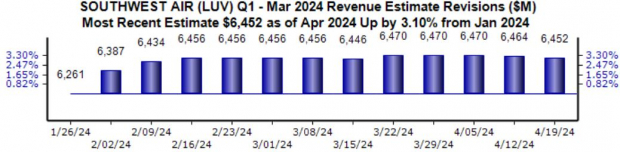

Southwest Airlines: Navigating Headwinds

Southwest Airlines (LUV) faces some challenges in its earnings outlook. With a Zacks Consensus EPS estimate of -$0.31 (down from -$0.19 in March), LUV is working to overcome these hurdles.

Image Source: Zacks Investment Research

Despite the EPS estimate headwinds, Southwest Airlines has a track record of beating consensus expectations, with an average of 52% in its last four earnings releases.

The Verdict: Looking Ahead in the Skies

As American Airlines and Southwest Airlines gear up to report their earnings, the industry landscape painted by United Airlines offers valuable insights. While UAL’s success story showcases growing consumer demand and favorable fuel prices, it’s crucial to remember that factors affecting UAL, like the Boeing 737 MAX grounding, do not directly impact AAL or LUV.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The market has a storied history of resilience in presidential election years, regardless of the political party in power. The energetic voter base tends to buoy the market, offering opportunities for both Democrats and Republicans. In times of uncertainty, the market often surprises to the upside, charting its course amidst political shifts.