Alibaba’s trading shares embarked on an upward trajectory as the Chinese e-commerce titan successfully concluded a three-year regulatory “rectification” process. This marked the finale of a tumultuous period for the corporation following the antitrust penalty levied against it in 2021 for monopolistic behaviors.

The State Administration for Market Regulation (SAMR), China’s regulator, affirmed its close monitoring of Alibaba in recent years to ensure compliance with antitrust statutes. The regulator lauded the fulfillment of the rectification process, deeming it a success.

Unfair Strengthening of Market Dominance by the “Choose One” Policy

In 2021, SAMR imposed a hefty RMB18.23 billion ($2.6 billion) fine upon Alibaba following an inquiry that unearthed anti-competitive actions. These included coercing merchants to opt for a single e-commerce platform, effectively barring them from collaborating with both. The regulator highlighted that the “choose one” stratagem unjustly bolstered Alibaba’s market predominance.

Subsequent to the penalty imposition, SAMR monitored Alibaba’s adherence to the mandated regulations. Confirming Alibaba’s full compliance, SAMR disclosed that the “choose one of two” approach had ceased. Furthermore, the regulator pledged to assist Alibaba in enhancing its compliance, operational efficiency, and innovative initiatives.

Positive Implications of Regulatory Overhaul for BABA

The resolution of this regulatory inquiry bodes well for Alibaba, marking the conclusion of one of its most momentous skirmishes with Beijing, a conflict that had severely impacted the company’s market performance. Indeed, BABA shares had plummeted over 70% from their peak in 2020. Nonetheless, Alibaba remains confronted with challenges, including tepid growth amidst escalating competition in China’s e-commerce sphere and cautious consumer spending patterns.

Is Alibaba a Promising Investment Right Now?

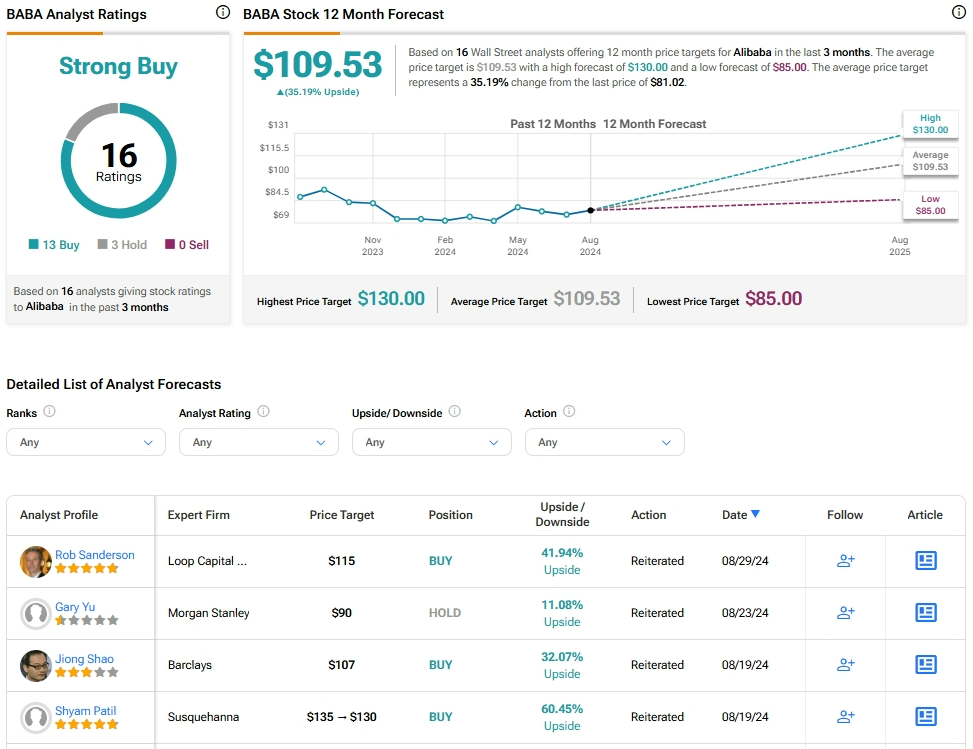

Market analysts maintain a bullish stance on Alibaba stock, reflected in a Strong Buy consensus rating based on 13 Buy recommendations and three Holds. Over the past year, BABA has witnessed a decline of over 10%, while the average price target of $109.53 suggests a potential upside of 35.2% from current levels.

Explore more analyst ratings on Alibaba here