Advanced Micro Devices AMD shares lost 17.1% in the past month underperforming the Zacks Computer & Technology sector’s return of 0.9%.

AMD shares have also lagged chip peers – NVIDIA NVDA and Intel – in the past month. Shares of NVIDIA and Intel returned 9.5% and 4.2%, respectively, in the same time frame.

AMD shares have been affected by a sluggish fourth-quarter 2024 view.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The company expects fourth-quarter 2024 revenues of $7.5 billion (+/-$300 million). At the mid-point of the revenue range, this represents year-over-year growth of approximately 22% and sequential growth of approximately 10%.

Sequentially, AMD expects strong growth in the Data Center, Client and Gaming segments. Year over year, the company expects Data Center and Client segment revenues to increase significantly, driven by its strong product portfolio. The Embedded and the Gaming segment revenues are expected to decline.

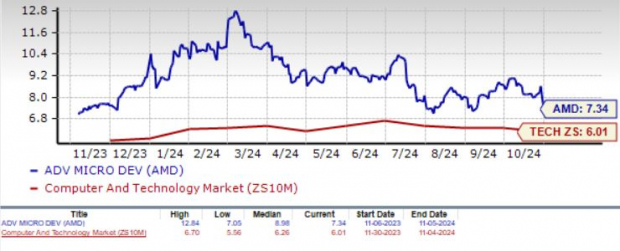

One Month Performance

Image Source: Zacks Investment Research

AMD’s Estimate Revision Shows Downward Trend

The Zacks Consensus Estimate for AMD’s fourth-quarter 2024 earnings is currently pegged at $1.06 per share, down 2.8% over the past 30 days. The figure suggests 37.66% year-over-year growth.

The consensus mark for fourth-quarter 2024 revenues is pegged at $7.51 billion, indicating 21.82% growth year over year.

Advanced Micro Devices, Inc. Price and Consensus

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

The Zacks Consensus Estimate for AMD’s 2024 earnings is currently pegged at $3.30 per share, down 1.8% over the past 30 days. The figure suggests 24.53% growth from the figure reported in 2023.

The consensus mark for 2024 revenues is pegged at $25.66 billion, indicating 13.16% growth from the figure reported in 2023.

Strong Semiconductor Demand to Aid AMD’s Prospects

AMD has been benefiting from strong sales of its data center chips that support hyperscalers and power AI and Generative AI (Gen AI) applications. Strong demand for these chips drove global semiconductor sales in the third quarter of 2024. The Semiconductor Industry Association reported 23.2% year-over-year growth in global semiconductor sales, which hit $166 billion.

Exiting third-quarter 2024, AMD’s public cloud instances increased 20% year over year to more than 950, with Microsoft MSFT, AWS, Uber, and Netflix deploying it at scale.

Meta Platforms META alone employed more than 1.5 million EPYC CPUs globally to power its social media platforms. EPYC instance adoption by enterprise customers also expanded, with notable wins from Adobe, Boeing, and Tata, among others.

The World Semiconductor Trade Statistics (“WSTS”) projects global sales to reach $611.2 billion, indicating a 16% increase from 2023. This indicates an uptick from the previous guidance of 13.1%. This bodes well for AMD.

IDC’s expectations for 2024 semiconductor sales are more optimistic. It expects more than 20% year-over-year growth, primarily fueled by heightened demand for AI chips and recovery in smartphone demand. For 2025, WSTS expects global sales to grow 12.5%, ultimately reaching $687.4 billion.

Rich Partner Base, Acquisitions Aid AMD’s Prospects

Enterprise and Cloud AI customer pipeline remains robust. AMD and its partners, including Microsoft, Oracle, DELL, HPE, Lenovo, and Supermicro, have instinct platforms in production.

AMD’s acquisitiveness primarily aims to reduce the technological gap with NVIDIA in the ongoing race for AI dominance. It has been on an acquisition spree to strengthen its AI ecosystem.

The company recently closed the acquisition of Helsinki, Finland-based Silo AI. AMD is strengthening its data center AI footprint with the announced acquisition of ZT Systems for roughly $4.9 billion in cash and stock.

AMD’s initiatives to expand its portfolio are making it well-positioned to challenge NVDA not only in the data center market but also in the growing AI-enabled consumer PC market.

In the third quarter of 2024, AMD expanded its footprint among energy, technology, and automotive companies, including Airbus, FedEx, HSBC, Walgreens and others.

New offerings like the Instinct MI325X accelerator are helping to expand AMD’s footprint in the data center market. AMD has launched the Ryzen AI 300 Series, the third generation of AMD AI-enabled mobile processors, and Ryzen 9000 Series processors for laptop and desktop PCs.

AMD Shares – Is it the Right Time to Buy?

AMD’s expanding portfolio, thanks to acquisitions of Silo AI and ZT Systems, is expected to boost its top-line growth. Investors who already own the stock may expect the company’s growth prospects to be rewarding over the long term.

However, AMD’s near-term prospects are dull, given the weakness in the Embedded segment amid stiff competition from NVIDIA. AMD has a Growth Score of D, which makes the stock unattractive for growth-oriented investors.

AMD stock is also overvalued, as the Value Style Score of D suggests a stretched valuation at this moment.

The stock is trading at a premium with a forward 12-month Price/Sales of 7.34X compared with the Zacks Computer and Technology sector’s 6.01X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

AMD currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report