Advanced Micro Devices Inc AMD reportedly plans to enter the mobile device market with new accelerated processing unit (APU) chips designed for smartphones.

The chips will leverage Taiwan Semiconductor Manufacturing Co’s TSM 3nm process, extending Taiwan Semiconductor’s order visibility for 3nm production into late 2026, UDN.com reports.

The new APU chips are rumored to target flagship smartphones, potentially being used in models from Samsung Electronics SSNLF.

Also Read: Nvidia and Intel Competition Threaten AMD’s Growth, Analyst Says

AMD previously collaborated with Samsung on the Exynos 2200 processor, which featured a GPU based on AMD’s RDNA 2 architecture. However, this earlier partnership focused on graphic enhancements rather than central processor development.

AMD’s current MI300 series processors, known for their application in AI servers, could lay the groundwork for these upcoming mobile APUs. Industry insiders suggest that Samsung integrate these APUs into its premium devices, which rely heavily on Taiwan Semiconductor-manufactured components, such as Qualcomm Inc processors in the Galaxy S series.

According to Taiwan Semiconductor, its 3nm technology, including N3, N3E, and N3P nodes, has drawn significant interest from major clients like AMD, Apple Inc, and MediaTek. The demand for these advanced chips is so high that Taiwan Semiconductor has tripled its production capacity compared to last year. However, it still needs to work on meeting the overwhelming number of orders.

Taiwan Semiconductor’s ongoing development of its 3nm family will further address emerging needs in AI, mobile devices, and automotive computing.

AMD posted third-quarter revenue of $6.8 billion, surpassing analyst expectations of $6.71 billion. Revenue grew 18%, driven by a 122% increase in Data Center revenue, which reached $3.5 billion. Client segment revenue rose 29% to $1.9 billion. However, Gaming revenue dropped 69% to $462 million, while Embedded revenue decreased 25% to $927 million.

For the fourth quarter, AMD projects revenue of $7.5 billion, plus or minus $300 million, reflecting 22% growth at the midpoint.

Goldman Sachs analyst Toshiya Hari credited AMD’s growth to increasing capital investment in AI infrastructure, driven by enterprises in an “AI arms race.” AMD’s robust product pipeline, including competitive GPUs and the integration of ZT Systems, positions the company for accelerated growth.

Rebounding demand for server CPUs and market share gains in enterprise-targeted SKUs will likely boost revenue and margins.

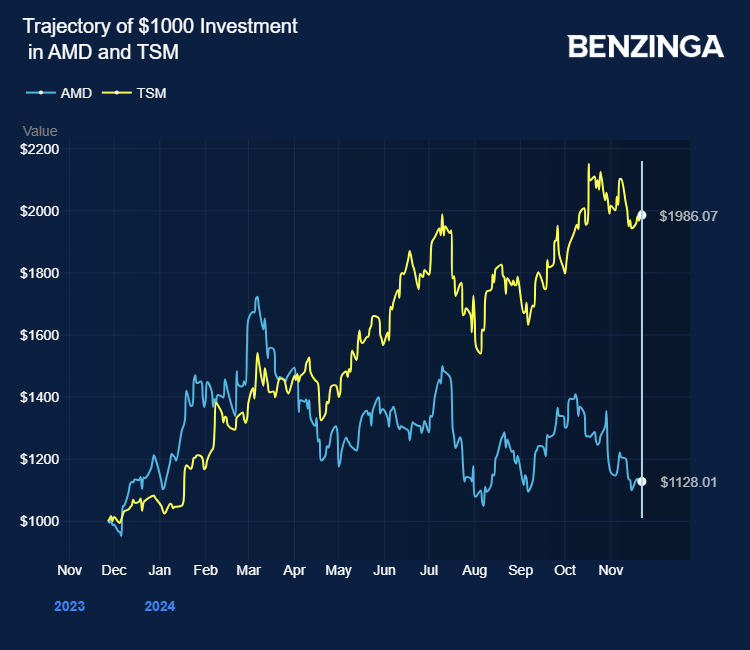

Price Actions: AMD stock is up 2.4% at $141.75 at the last check on Monday. TSM is down 2.6%.

Also Read:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs