China’s Cavalry: 5 Signs of a Market Rebirth

Yesterday, I delved into the turbulent waters of U.S. equities, foreseeing choppy months ahead. But, remember, as they say on Wall Street, “There’s always a bull market somewhere.” Indeed, the eye of the storm may lie beyond our shores, particularly in the realm of Chinese stocks, which have languished for years, plagued by stifling government policies, COVID restrictions, and a debilitating real estate crisis.

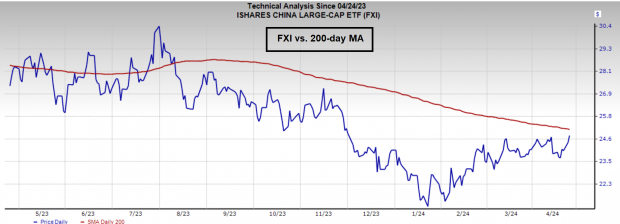

The iShares China Large-Cap ETF (FXI) has weathered a brutal storm, plummeting over 40% in the past three years, marooned as investors flocked to U.S. equities and other global markets, leaving Chinese stocks adrift.

Rejuvenation Signals

Image Source: Zacks Investment Research

Nonetheless, five compelling indicators suggest that Chinese equities have hit rock bottom and are on the cusp of a renaissance:

The Winds of Change

The iron grip of China’s government policies has kept the markets in a bearish stranglehold, but recent outlook revisions by UBS Group (UBS) and Goldman Sachs (GS) signal a shift. China’s efforts to bolster its $10 trillion equity market and implement business-friendly reforms are poised to lure back wary foreign investors

Diamonds in the Rough

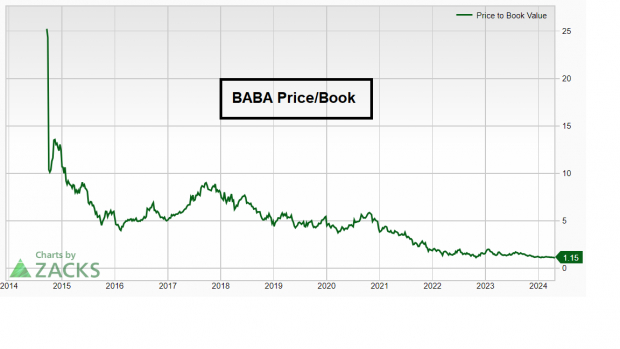

While Chinese stocks like Alibaba Group (BABA) have long masqueraded as value traps, their valuations have now hit rock bottom. For instance, Alibaba sports a historically low price-to-book ratio of 1.15, making it an irresistible bargain in the current market.

Image Source: Zacks Investment Research

Storm Before the Calm

The tempestuous real estate market, symbolized by Evergrande’s fall from grace, has cast a long shadow over China’s economy. Yet, as markets often do, they signal a possible turnaround when the outlook seems bleakest. Recall Bitcoin’s bounce after FTX’s calamity.

Riding the Bull

Tech behemoths Alibaba, Tencent Holdings (TCEHY), and JD.com (JD) have announced substantial buyback programs, a move that buoys investor morale and curbs dilution. These buybacks are a shot in the arm for the Krane CSI Internet ETF (KWEB), the pulse of Chinese internet stocks.

Signs in the Stars

Chinese equities have begun to outshine their U.S. counterparts, showing robust relative strength indicators. As FXI and other proxies edge closer to breaching the 200-day moving average, a significant shift in the long-term trend seems imminent.

Image Source: Zacks Investment Research

The Verdict

A sea change in governmental policies and other auspicious omens suggest that Chinese equities are poised for a resurgence.

The Bitcoin Boom: Unrivaled Returns in the Financial Landscape

Bitcoin stands unrivaled in financial circles, boasting unparalleled returns. Despite its rollercoaster ride, Bitcoin has outperformed all other forms of decentralized, global money.

Though the future remains uncertain, historical data paints a rosy picture for Bitcoin enthusiasts. In the past three presidential election years, Bitcoin recorded meteoric returns: +272.4% in 2012, +161.1% in 2016, and +302.8% in 2020. Zacks’ crystal ball predicts another bullish upswing in the coming months.

Insightful Analysis on Recent Investment Recommendations

Exploring Recent Trends in Investment

The world of investment is akin to a thrilling rollercoaster ride, with investors constantly seeking the next big opportunity. Recent recommendations from Zacks Investment Research have set the market abuzz with excitement. These recommendations offer a tantalizing glimpse into the potential future of the financial landscape.

Unveiling the Gems Amongst the Investments

In a sea of options, some stocks shine brighter than others. The Free Stock Analysis Reports for companies like The Goldman Sachs Group, Inc., UBS Group AG, Tencent Holding Ltd., JD.com, Inc., and Alibaba Group Holding Limited reveal insights that are more precious than a hidden treasure waiting to be discovered.

ETFs: A Potential Goldmine

Exchange-Traded Funds (ETFs) have become a favorite hunting ground for investors, offering a diversified basket of stocks. The iShares China Large-Cap ETF and KraneShares CSI China Internet ETF, both highlighted in recent reports, represent opportunities that are as alluring as a pot of gold at the end of a rainbow.

Analyzing Market Dynamics

Understanding the ebb and flow of the market is akin to deciphering a complex puzzle. The comprehensive analysis provided by Zacks Investment Research sheds light on the recent trends in Chinese equities, offering investors a roadmap to navigate through choppy waters and emerge victorious.

Embracing the Future with Informed Decisions

Investing is not merely about taking risks; it is about making informed decisions that stand the test of time. By delving into the insights presented by Zacks Investment Research, investors can equip themselves with the knowledge and foresight needed to steer their financial ship through turbulent seas towards the promised land of returns.