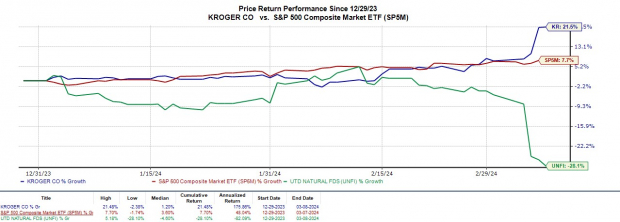

You wouldn’t expect a duel between a behemoth and an underdog to end in a tie, yet here we are – Kroger KR and United Natural Foods UNFI both acing their quarterly earnings. Kroger, the grocery giant, struts at 52-week highs around $55, while UNFI scrapes the bottom at $11 a share. The climax? Intriguingly promising business prospects and rational valuations anchoring this tug-of-war.

Image Source: Zacks Investment Research

Earnings Triumphs

Kroger jolted investors on Thursday with a 10% surge post Q4 results – $1.34 per share, up a mighty 35% YoY, twisted low-cost chains in its favor. Stellar sales of $37.06 billion, a 6% rise, skipped slightly below par despite pulverizing estimates by 18%. For 17 consecutive quarters from March 2020 onwards, Kroger has been a gladiator in surpassing earnings projections. Meanwhile, United Natural Foods, unraveling its fiscal Q2 show, boastfully delivered $0.07 a share – a clear stomp over the $0.01 forecasted. Still, a year-on-year dip from $0.78, haunted by transaction hiccups, damaged margin, and inflatory bloating, deprived the glory somewhat. Sales of $7.77 billion undershot by -2%, slipping down gently from $7.81 billion in the preceding year’s quarter. UNFI managed to dodge earnings jinx in three out of its last four quarterly dips.

Delving Into Kroger’s Worth

Marking its territory post a recent sprint, Kroger’s lovely shares frolic at a delicious 12.7X forward earnings multiple, cozying up to the Zacks Retail-Supermarkets’ clique. The S&P 500’s 21.6X stands eclipsed in comparison, evoking a sense of superiority. Sweetening the pot, a 2.09% yearly dividend caresses the shareholders, but the tantalizing whisper of acquiring competitor Albertsons ACI turns heads significantly. Yet, the Albertsons affair hangs in a regulatory limbo, its fate at the whims of the Federal Trade Commission’s scrutiny. Picture-perfect symmetry in chaos.

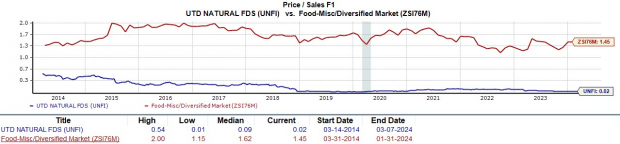

The Value Paradox of United Natural Foods

United Natural Foods, showcasing resplendent prospects of affluence, parades as a steal; UNFI shares lounge at a modest 0.02X forward sales mark. This riveting discount shames its peers, especially as the crystal ball predicts a 2% uptick in total sales this year to a majestic $31 billion. A stark contrast to the Zacks Food-Miscellaneous troupe at 1.4X sales and the S&P 500 lurks at 3.6X – UNFI is the elusive, mischievous charmer of the town, casting its enchanting spell.

Parting Thoughts

The horizon glimmers gold as EPS whispers hint at an upward tango, dressing both Kroger and United Natural Foods in a Zacks Rank #2 (Buy). The symphony of their valuations – Kroger’s euphoria potentially soaring higher and UNFI sashaying towards a revival – all paint a portrait of budding optimism amidst the unpredictable chaos of the stocks jungle.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>