Investors take note – the consumer discretionary sector offers a rare chance to plunge into undervalued firms amidst concerns about overpricing. These oversold stocks might just be the beacon in the storm for those seeking out opportunities in a turbulent market.

One key indicator, the Relative Strength Index (RSI), stands out as a vital metric to gauge the market sentiment. When the RSI dips below the 30 mark, it usually signals that the said stock is oversold.

Per historical trends, let’s delve into the top three consumer stocks that are potentially poised to skyrocket:

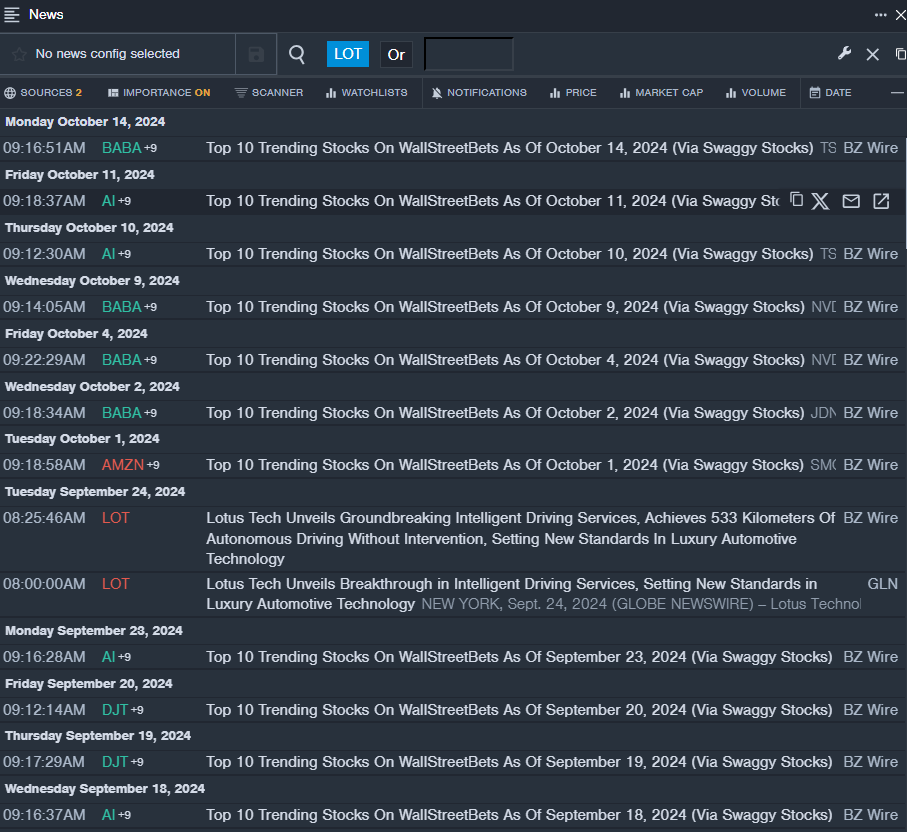

Lotus Technology Inc – ADR LOT

- Innovation is the lifeline of Lotus Technology Inc, evident in their latest unveiling of intelligent driving services that set a new benchmark in luxury automotive tech. Despite this, their stock witnessed a 14% decline in the past month, hitting a 52-week low of $4.27.

- RSI Value: 27.96

- LOT Price Action: Priced at $4.32 on Wednesday, Lotus Technology shares incurred a marginal dip of 0.8%.

- Staying alert pays off – thanks to Benzinga Pro’s real-time news updates on LOT.

The Undervalued Gem: Stride Inc LRN

- Stride Inc has been the underdog, with margins possibly hidden beneath the disruptive Covid era. The company’s stock plunged by 20% in the recent month, hitting a low of $43.77 in the past year.

- RSI Value: 17.43

- LRN Price Action: Despite recent setbacks, Stride’s shares traded at $65.94 on Wednesday after a minor 6.6% fall.

- Tracking trends is key – kudos to Benzinga Pro’s insightful charting tool for shedding light on LRN’s trajectory.

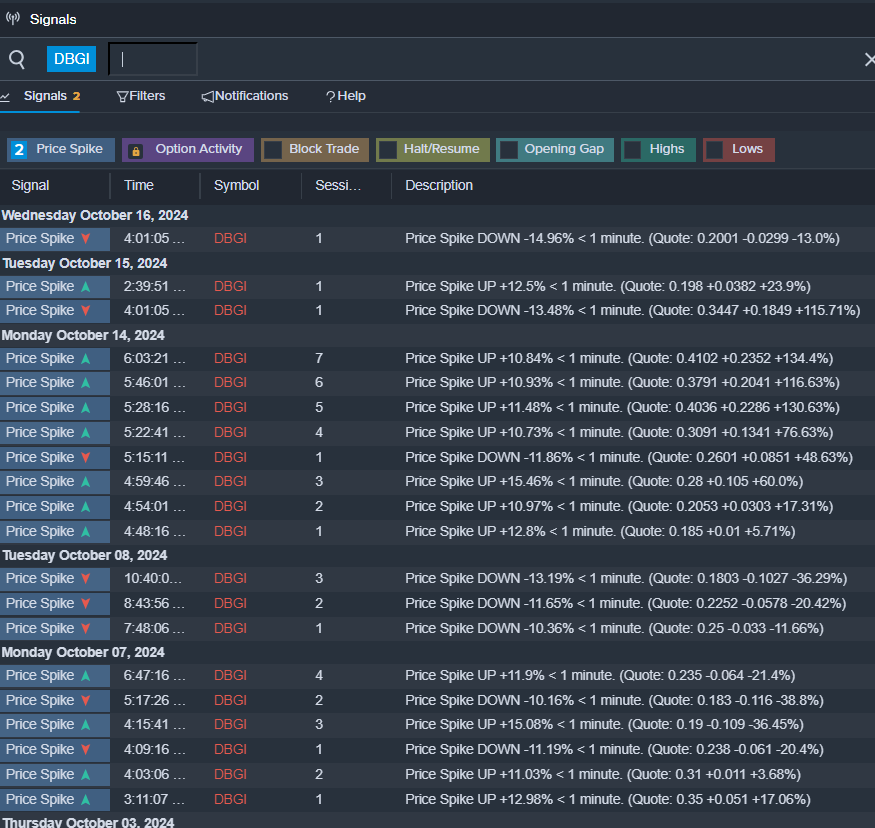

Digital Brands Group Inc Facing a Downturn: DBGI

- Unfortunately, Digital Brands Group has been hit by the storm, encountering a delisting notice from the Nasdaq due to non-compliance with listing standards. Their shares tumbled by a staggering 59% in the past month, with a grim 52-week low of $0.14.

- RSI Value: 28.93

- DBGI Price Action: Priced at $0.20 after a 10.9% decline on Wednesday, Digital Brands faced a tough market day.

- Staying vigilant is essential – a shoutout to Benzinga Pro’s signals for uncovering potential movements in DBGI shares.

Food for thought: With the right insights and analysis, these volatile times can be turned into opportunities. Stay informed. Stay alert. Dive into the untapped potential while the wave is just about to crest.

Market News and Data brought to you by Benzinga APIs