The Impact of President Biden’s Budget Proposal

President Biden’s recently unveiled $7.3 trillion budget proposal is not as innocuous as it may appear at first glance. Laden with implications for taxpayers, the document, more of a messaging tool than a concrete plan, hints at a shift towards “Big Government” on steroids.

The Wall Street Journal aptly characterizes it as a “largely symbolic document.” However, the fiscal priorities laid out within could permeate future policy decisions, potentially altering the financial landscape significantly.

For high earners, the ramifications are clear—a heavier tax burden. The proposal includes a jarring proposal to double the capital gains tax on affluent individuals from 20% to 39.6%. This move signifies a departure from previous incentives that encouraged savings and investment, posing a direct threat to traditional wealth-building strategies.

Furthermore, even individuals outside the high-income bracket are not exempt from the budget’s influence on their portfolios. Targeting corporate taxes and stock repurchase excise levies, the proposal has the potential to impact stock prices and overall investment sentiment.

Long-Term Ramifications of Government Spending

The relentless increase in government debt, currently ballooning at a rate of $1 trillion every 100 days, spells trouble for the stability of the economy. By examining a chart tracing national debt growth over the past few decades, it becomes evident that our fiscal trajectory has veered into dangerous territory.

The exponential rise in our national debt presents a stark reality—runaway expenses are becoming increasingly difficult to rein in. Compounded by soaring interest costs estimated to reach a staggering $1.1 trillion over the next decade, the burden of debt service threatens to eclipse even defense spending.

Forecasts suggest that interest costs will soon rival the expenditures on major entitlement programs such as Social Security and Medicare, underscoring the severity of the fiscal conundrum at hand.

Navigating Economic Uncertainties

As we cautiously celebrate apparent decreases in inflation rates, it’s imperative to remain vigilant regarding financial pitfalls that may lie ahead. Amidst the volatile economic landscape, adapting investment strategies and financial planning to navigate the evolving paradigm becomes paramount.

For individuals across all income brackets, the current fiscal environment demands a proactive approach towards wealth accumulation and preservation. With the specter of tax hikes and diminishing purchasing power looming large, the prudent management of personal finances emerges as a critical imperative in safeguarding one’s financial well-being.

The Real Story Behind Inflation, Prices, and Your Wealth

Let’s delve into the latest inflation report that shook the markets today, stirring unease among investors. The Producer Price Index (PPI) surged a substantial 0.6% in a single month, defying expectations and registering a notable 1.6% increase year-over-year, the most significant leap since September. Yet, before we fall into the trap of assuming falling inflation heralds good news, let’s dissect the distinction between inflation and prices – and the implications for your financial well-being.

The Ferrari’s Lesson: Absolute Speed vs. Speed Inflation

Picture a Ferrari hurtling down a track, starting at 100 miles per hour. If its speed inflation decreases from 10% to 0%, what happens to its actual speed? While the rate of inflation may drop, the absolute speed soars. Similarly, as CPI inflation falls from 9% to around 3% today, the stark reality of escalating prices hits home. As a recent CNBC headline grimly declares, “Homebuyers need an 80% bump in earnings since 2020 to afford a house in today’s market.” The dichotomy between rising costs and stagnant wages paints a concerning picture for everyday consumers.

Gold’s Silent Surge: A Beacon Amidst Economic Turmoil

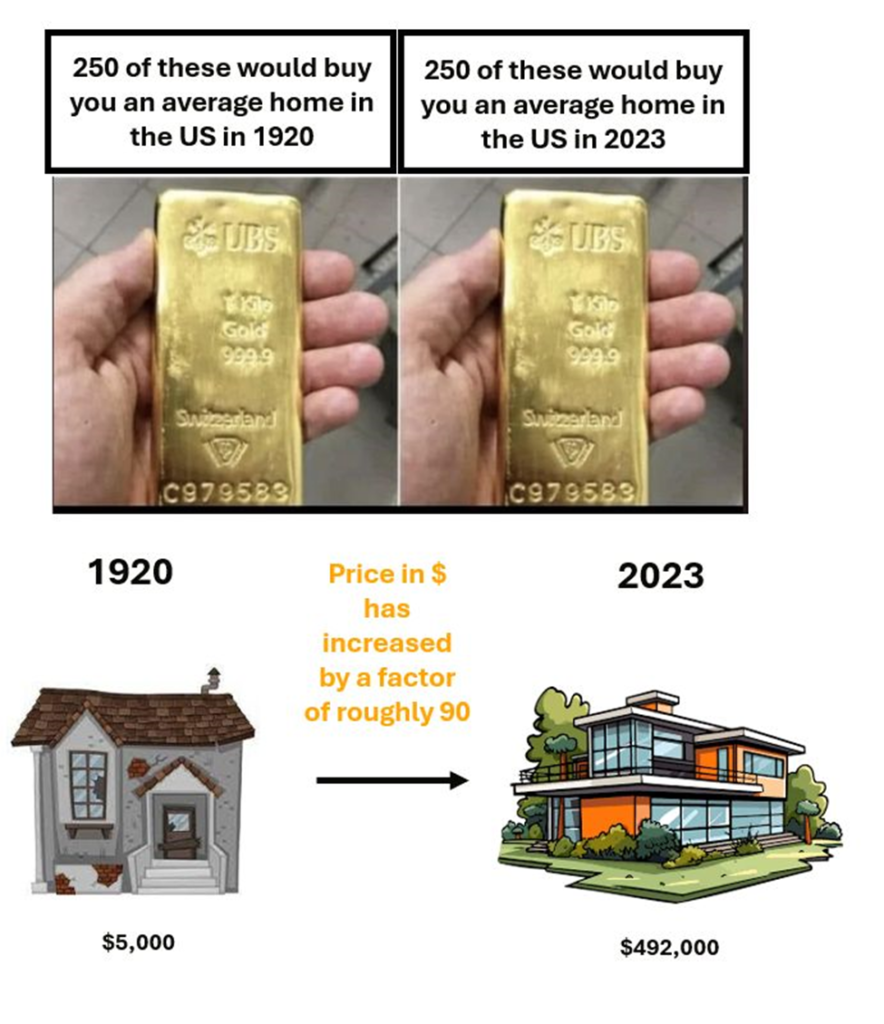

Shift your gaze to gold, a perennial contender in the wealth preservation arena. Unveiling facts from yesteryears, Chief Investment Officer Charles-Henry Monchau reveals gold’s meteoric rise – from a $20.68 valuation per ounce in 1920 to a staggering $2,100 in the present day. A stark juxtaposition emerges with real estate, where house prices surged from $5,000-$6,000 in 1920 to $492,000 in 2023, mirroring an 80x-100x increase.

As the minutiae unravels, contemplate this: How many dollars in today’s landscape equate to a mere $100 from 1920? A jaw-dropping $1,551.63. Let that sink in the next time someone contends that gold is obsolete amid modern financial landscapes.

Navigating the Financial Landscape: Where to Channel Your Endeavors

With prices escalating and wages struggling to keep pace, the investment realm beckons as a haven for financial growth. Embracing the current bull market, acclaimed investor Louis Navellier prophesies an influx of $8.8 trillion in cash poised to inundate the market. He advocates delving into specific stocks identified by his quantitative model as potential high-flyers in the impending cash deluge. Louis’ recent live event, the Emergency Cash Bubble Briefing, sheds light on this paradigm shift, urging a departure from cash-heavy portfolios towards small-cap stocks for accelerated wealth accumulation.

In this frenzied market environment, where myriad wealth-stealers prowl, it’s prudent to grasp opportunities for substantial gains. With our financial fates hanging in the balance, embracing market dynamics offers a chance to navigate turbulent waters and secure our financial footing. As we embark on this journey towards financial well-being, seize the moment to equip yourself with insights that could pave the way to a prosperous future.