A Glimpse into Q1 Earnings

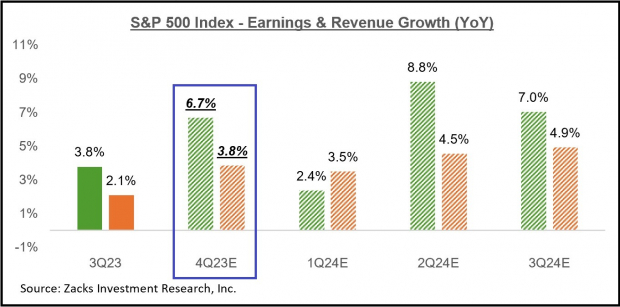

The first quarter of 2024 holds promises of a 2.4% surge in S&P 500 earnings in comparison to the same period in the previous year, riding on the coattails of a 3.5% boost in revenues. This positive momentum follows a previous quarter where earnings skyrocketed by 6.7% on a 3.8% revenue upswing in 2023 Q4.

Tech Sector Continues to Drive Growth

Once again, the Tech sector emerges as a prime driver of growth in the 2024 Q1 landscape. Its robust earnings growth plays a pivotal role, preventing the rest of the index from sagging into negative figures.

Reflecting on Q4 Earnings Season

The earnings season of 2023 Q4 is yet to officially conclude, with a total of 7 S&P 500 companies still pending their quarterly reports. Out of the 493 members that have already disclosed their Q4 results, earnings have surged by 6.9% from the preceding year, coupled with a 3.8% increase in revenues. Impressively, 75.3% have surpassed EPS estimates, while 64.1% have exceeded revenue forecasts.

Meet the ‘Magnificent 7’

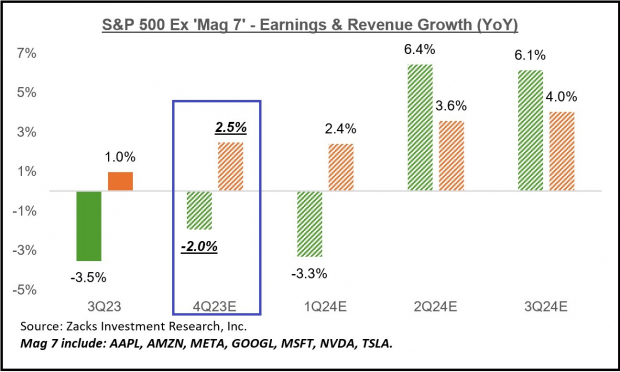

Come 2024 Q1, the ‘Magnificent 7’ are anticipated to experience a remarkable 33.2% spike in earnings, alongside a 13.4% rise in revenues. Excluding the contribution of these ‘Magnificent 7,’ the rest of the index would witness a downturn of 3.3% from the corresponding period last year.

Significance of Tech Sector & ‘Mag 7’ Stocks

The Tech sector played a crucial role in the growth narrative of Q4, with substantial contributions from the ‘Magnificent 7’ stocks like Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia, and Tesla. Noteworthy is the fact that Amazon and Tesla are part of sectors other than Tech.

Now, let’s delve into the earnings and revenue growth pattern for the S&P 500 index:

Image Source: Zacks Investment Research

Similarly, here’s an overview of the growth scenario for the S&P 500, excluding the ‘Magnificent 7’ stocks:

Image Source: Zacks Investment Research

Shifting focus to an annual basis, here’s the big picture of earnings:

Image Source: Zacks Investment Research

Assessing the Future Landscape

With expectations of a moderation in the U.S. economy’s growth trajectory due to the cumulative impacts of Fed tightening, adjustments in estimates might be inevitable. Nevertheless, the anticipation of a 4.9% revenue growth does not seem extravagant, especially considering the nominal GDP growth rate exceeding 6% recorded last year.

Looking ahead, the predicted 2024 earnings growth hinges significantly on margin expansion, foreseeing a rise to 12.4% net margins from the previous year’s 11.7%. Embedded in this outlook is the belief that the inflationary phase has reached its conclusion, thereby enabling net margins to revert to 2022 levels.

Such projections of margins and revenues do not appear far-fetched given the prevailing economic conditions.