The Contrarian’s Delight: Undervalued Industrials

Seeking potential rockets amidst the ruins? The industrials sector may hold the key. Oversold stocks offer a glimpse into undervalued companies waiting to take flight.

The Relative Strength Index (RSI), a key momentum indicator, measures a stock’s strength on up days versus down days. A stock is in oversold territory when its RSI dips below 30, signaling a potential upswing in the short term.

Let’s explore the top contenders teetering on the edge of opportunity.

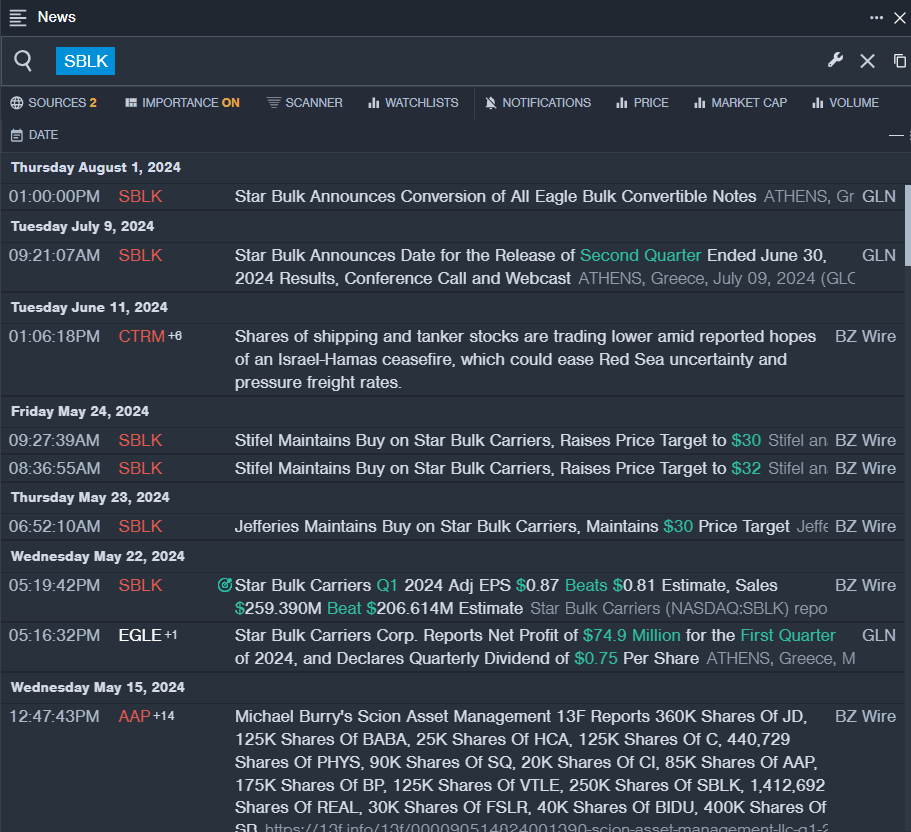

Star Bulk Carriers Corp (SBLK)

- Star Bulk Carriers is poised to unveil its second-quarter results post-market on August 7. The stock has endured a tumultuous period, marking a 12% slide in the last month with a 52-week low of $16.86.

- RSI Value: 27.28

- SBLK Price Action: The stock closed at $21.74 on Thursday, down 3.6%.

Symbotic Inc (SYM)

- Symbotic faced adversity with worse-than-expected third-quarter earnings and a disappointing fourth-quarter revenue outlook. The stock nosedived by 37% over the last five days, hitting a 52-week low of $24.21.

- RSI Value: 26.59

- SYM Price Action: Closing at $24.61 on Thursday, SYM tumbled by 8.2%.

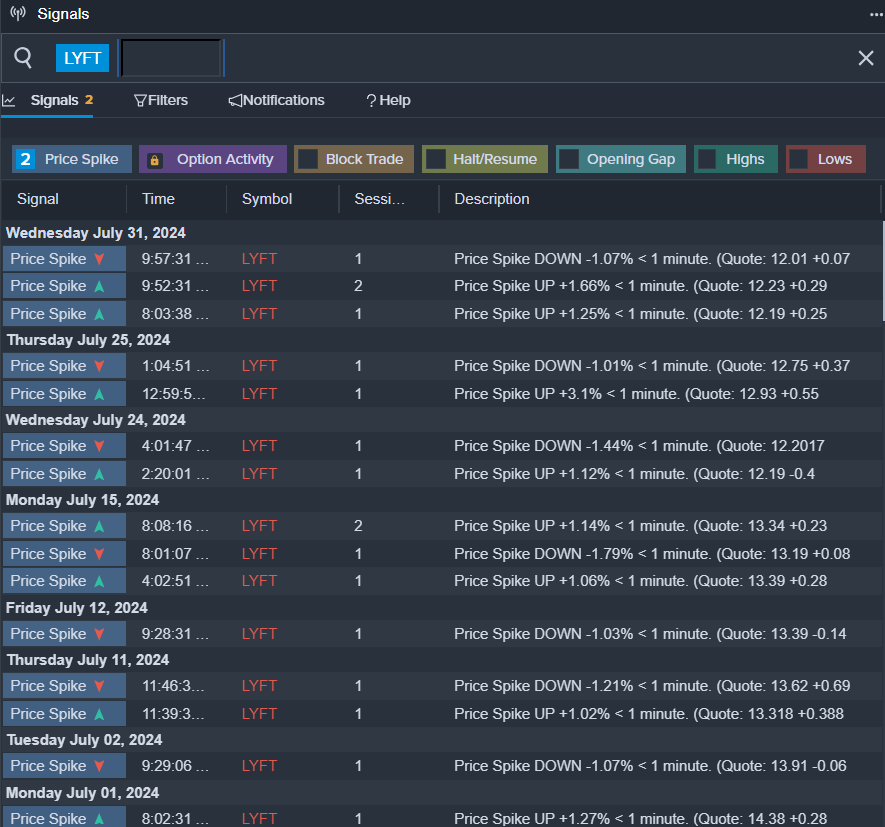

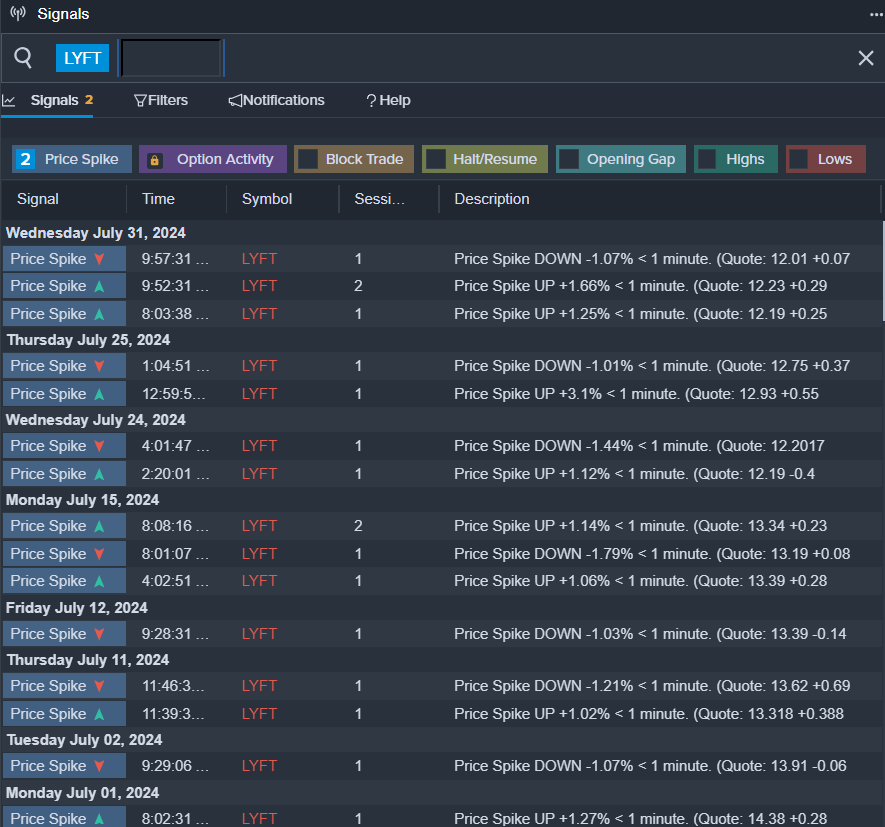

LYFT Inc (LYFT)

- Lyft faced internal turbulence as President Kristin Sverchek announced her departure, sending the stock plunging by 15% in the past month and hitting a 52-week low of $8.85.

- RSI Value: 25.99

- LYFT Price Action: The stock closed at $11.42 on Thursday, down by 5.2%.