Despite the strong fiscal third-quarter results released by Disney (DIS), the company’s stock has experienced a 5% decline since the report and is now positioned 30% below its 52-week highs. Market volatility post-earnings may be contributing to this downturn, although Disney showcased promising signs, notably turning a profit in its streaming unit.

Image Source: Zacks Investment Research

Disney’s Q3 Results

Disney reported a robust performance in Q3, driven by its Entertainment segment both in box office revenue and direct-to-consumer (DTC) initiatives. Earnings per share came in at $1.39, marking a 35% increase from the previous year’s $1.03 EPS and surpassing analyst expectations of $1.20 per share.

The company posted sales of $23.15 billion, reflecting a 3% year-over-year growth that exceeded estimates by 1%, reaching $22.91 billion.

Image Source: Zacks Investment Research

Streaming Profitability & Subscribers

Disney announced that it achieved profitability across its streaming services, including Disney Plus, Hulu, and ESPN+, ahead of its initial schedule. Disney+ Core subscribers saw a 1% increase in Q3, reaching 118 million, positioning Disney as the second-largest streaming service, following Netflix on the leaderboard.

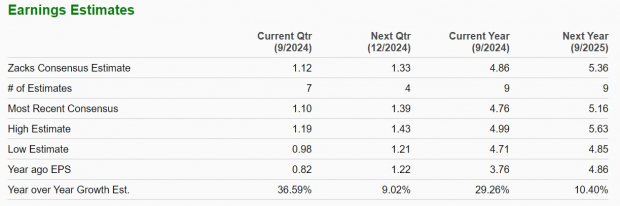

Moreover, Disney raised its full-year EPS guidance, now projecting a 30% earnings growth in fiscal 2024 compared to its previous guidance of 25%, slightly exceeding the Zacks Consensus expectations of $4.86 per share or 29% growth.

Image Source: Zacks Investment Research

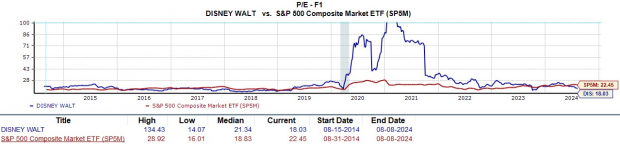

Monitoring Disney’s Valuation

At its current price of $85, Disney’s stock trades at 18 times forward earnings, presenting a significant discount compared to the S&P 500’s 22.4X and Netflix’s 33X. Impressively, DIS is notably below its 10-year high of 134.4X forward earnings, trading at a 15% discount to the median of 21.3X.

Image Source: Zacks Investment Research

Takeaway

While the decline presents an attractive opportunity to buy Disney’s stock following the earnings report, it is essential to note that DIS currently holds a Zacks Rank #3 (Hold). The robust Q3 results and appealing valuation may be enticing, however, a recent reduction in FY25 earnings estimates could pose short-term challenges despite an anticipated 10% EPS growth next year.