Home Depot’s stock has proudly surged +3% following its triumphant feat of surpassing Q2 financial projections. The retail juggernaut showcased unwavering strength despite acknowledging the ramifications of escalating interest rates and a shaky macroeconomic landscape on consumer spending for home improvement endeavors.

Diving into the depths of Home Depot’s stellar Q2 performance unveils a narrative of resilience and strategic prowess, shedding light on whether now is the opportune moment for investors to embrace this beacon of success as they eagerly anticipate Lowe’s forthcoming quarterly results.

Home Depot’s Q2 Earnings Triumph

In the realm of sales, Home Depot’s Q2 figures of $43.17 billion outshone the previous quarter’s $42.91 billion, comfortably exceeding the estimated $42.57 billion by a notable 1%. On the earnings front, the $4.67 EPS soared incrementally from the preceding year, surpassing forecasts of $4.54 per share by an impressive 3%.

The streak of outperforming earnings anticipations is no mere fluke for Home Depot, boasting a streak that spans 17 quarters where it has consistently surprised the market, averaging a 1.64% EPS beat across its last four earnings reports.

Image Source: Zacks Investment Research

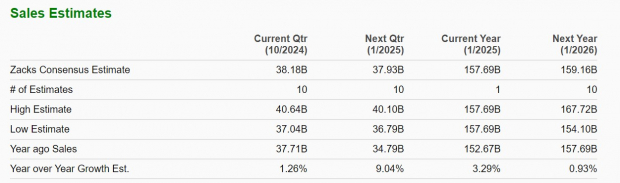

Revenue Projections and Growth Trajectory

Looking ahead, Home Depot’s forecast for total sales growth in its current fiscal 2025 stands between 2.5% to 3.5%, aligning harmoniously with Zacks’ projection of $157.69 billion, indicating a robust 3% expansion.

According to Zacks, the trajectory of Home Depot’s revenue is poised for further ascent, with an estimated 1% uptick in FY26, pushing the revenue figure to $159.16 billion.

Image Source: Zacks Investment Research

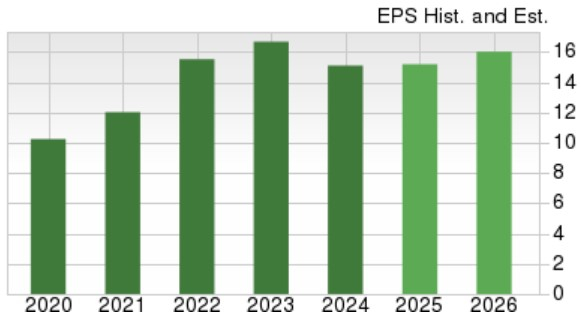

Moreover, although annual earnings are anticipated to remain relatively steady in FY25, a promising 5% surge is envisioned for FY26, propelling the EPS to a commendable $15.96 per share.

Image Source: Zacks Investment Research

The Verdict

Following the Q2 spectacle, Home Depot’s stock now proudly dons a Zacks Rank #3 (Hold). Notwithstanding its triumphant Q2 conquest, the retail titan’s promising guidance and optimistic growth outlook must contend with the turbulent waters of the broader economic climate. Although the horizon spells potential, astute investors may discern even more opportune moments hovering on the horizon.