The Legal Terrain

Crypto giant Kraken, embroiled in a legal tussle with the U.S. Securities and Exchange Commission (SEC), has submitted a motion to dismiss the lawsuit it faces. The crux of Kraken’s defense lies in the absence of accusations of tangible fraud or harm inflicted upon its clientele by the SEC.

Relevance and Implications

This legal saga forms part of a wider narrative gripping the crypto sphere, with lawsuits targeting major industry players such as Coinbase and Binance.US. Another emerging entity, Legit.Exchange, is also angling for a favorable district court ruling. Central to these legal battles is the fundamental question of the SEC’s rightful authority in regulating the crypto arena.

Deconstructing the Arguments

Analysis of Kraken’s motion reveals familiar aspects alongside unique facets. While the SEC’s claim of active digital asset promotion by Kraken is acknowledged, the focus remains on the absence of direct harm to consumers without directly addressing the commingling allegations. Parallel to Kraken, Coinbase and Binance.US have adopted a similar defense strategy in their dismissive motions. Resonating silently in the legal echelons is the possibility of the Supreme Court being drawn into the fray.

Entwined in judicial complexity, each case finds itself spatially dispersed across different districts – Coinbase in Southern District of New York, Binance.US in the District of Washington, and Kraken in the Northern District of California. Adding another wrinkle to the mix, Legit.Exchange has commenced legal proceedings against the SEC in the Northern District of Texas. The convergence of divergent district judgments presents a convoluted path ahead, with the potential for a series of appeals in assorted courts.

Conclusively, while the future trajectory of these cases remains uncertain, it seems inevitable that the deep pockets of the involved parties will drive the legal gameplay towards the brink of successive appeals. The horizon hints at a prolonged legal saga, with a probable climax at the doorstep of the Supreme Court.

Reflecting on this legal labyrinth, one can’t help but wonder about the temporal roadmap unfolding before us. How will the narrative evolve, and what milestones will mark the journey before the potential involvement of SCOTUS? These are queries that echo through the legal corridors surrounding the crypto landscape.

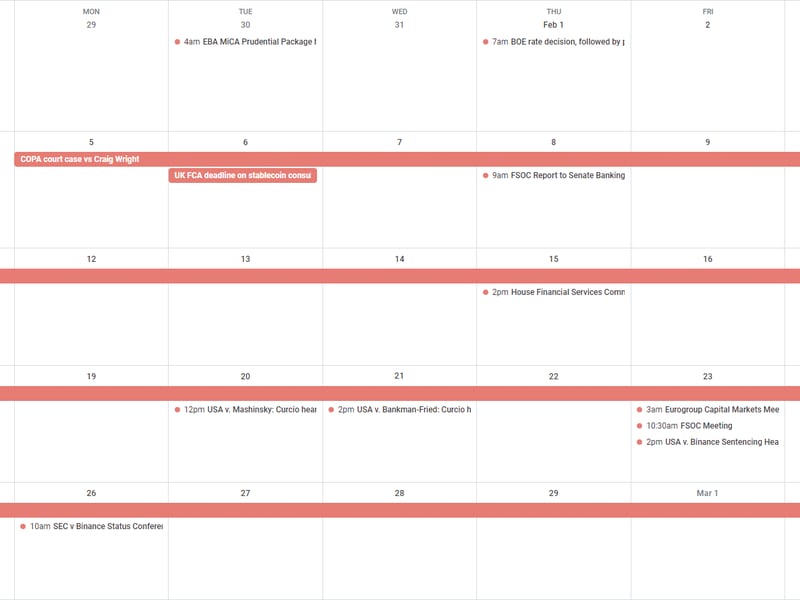

Tuesday

- 17:00 UTC (12:00 p.m. ET) The judge overseeing the U.S. case against Alex Mashinsky held a hearing to confirm he was okay with his attorneys also representing Sam Bankman-Fried.

Wednesday

- 19:00 UTC (2:00 p.m. ET) The judge overseeing the U.S. case against Sam Bankman-Fried held a similar hearing to confirm the same. Bankman-Fried confirmed his trial lawyers would no longer be representing him.

Friday

- 14:30 UTC (10:30 a.m ET) The Financial Stability Oversight Council met in a closed session.

- 19:00 UTC (11:00 a.m. PT) The judge overseeing the U.S. case against Binance signed off on the proposed plea (note: the same judge is overseeing the U.S. case against former Binance CEO Changpeng Zhao, but that sentencing hearing was rescheduled for April).

- (Ars Technica) A Canadian court has ruled that Air Canada must abide by a refund policy its “AI” chatbot made up. Air Canada has taken down the chatbot.

- (Reddit) One intriguing detail in the realm of in-flight Wi-Fi proliferation is passengers’ ability to share photos of aircraft wing imperfections, as showcased during a recent incident on United flight 354. The flight, a 29-year-old Boeing 757, safely diverted to Denver.

- (Bloomberg) A fresh lawsuit alleges that Alameda Research obtained a credit line “worth billions of dollars” from Deltec Bank, subsequently utilized to bolster the growth of Tether (USDT).

If you have reflections or queries for future discourse topics, feel free to drop an email at nik@coindesk.com or connect on Twitter @nikhileshde.

You are also welcome to engage in group conversations on Telegram.

Until we meet again next week!