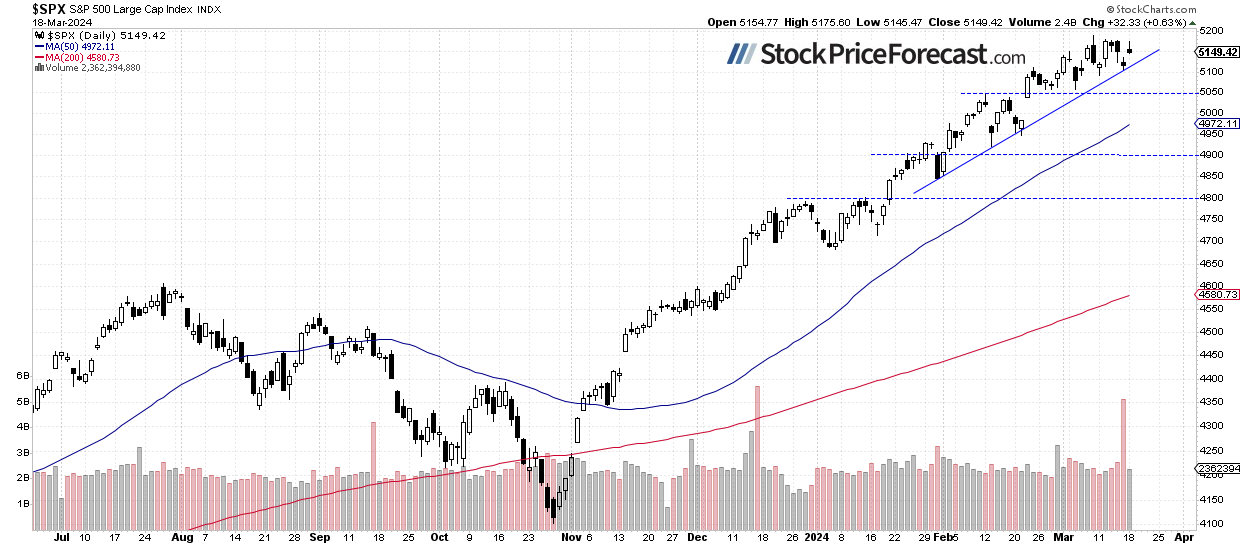

Amidst a market teetering on the edge of new record highs, Friday saw a drop in the S&P, only to inch up marginally on Monday. Hovering in a two-week-long consolidation beneath the recent peak, investors watched nervously as the index danced around the 5,189.26 mark, finding support near 5,100.

As traders brace for the all-important FOMC Rate Decision on the horizon, today’s 0.4% dip in the S&P 500 futures foretells a bearish start for the index. The unresolved question lingers: will the market surge to unprecedented heights?

The recent market surge, allegedly driven by a smattering of tech leaders, is reminiscent of past ebbs and flows. While the indices flirted with new highs, individual stocks remained largely static, hinting at a looming plateau. Could this be a prelude to a substantial market correction or merely a hiccup along the way?

With investor sentiment riding high, the market is treading cautiously. The AAII Investor Sentiment Survey unveiled bullish readings, with 45.9% of investors optimistic and only 21.9% voicing skepticism. Such exuberance often prefigures market complacency, potentially hinting at an imminent shift.

Examining a historical perspective, the S&P 500 continues its upward trajectory, tracing a month-long upward trend on the daily chart.

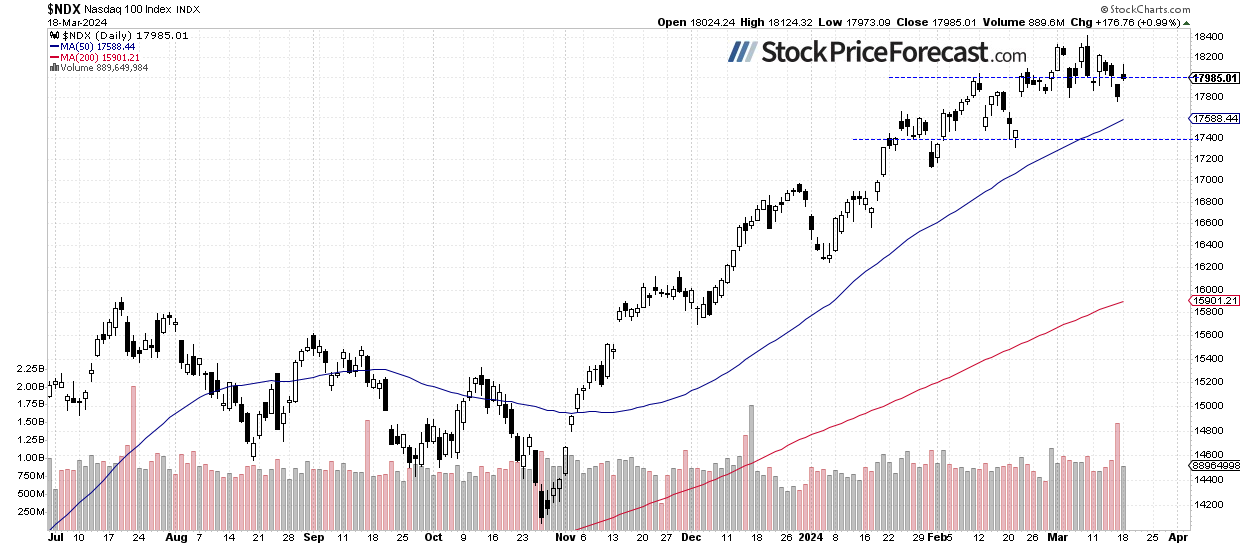

Nasdaq 100 Seeking Stability Near 18,000

On March 8, the Nasdaq 100 index touched a record 18,416.73 before backtracking swiftly, settling into a sideways trajectory ever since. After breaching previous lows last Friday, the index wavered around the 18,000 benchmark yesterday.

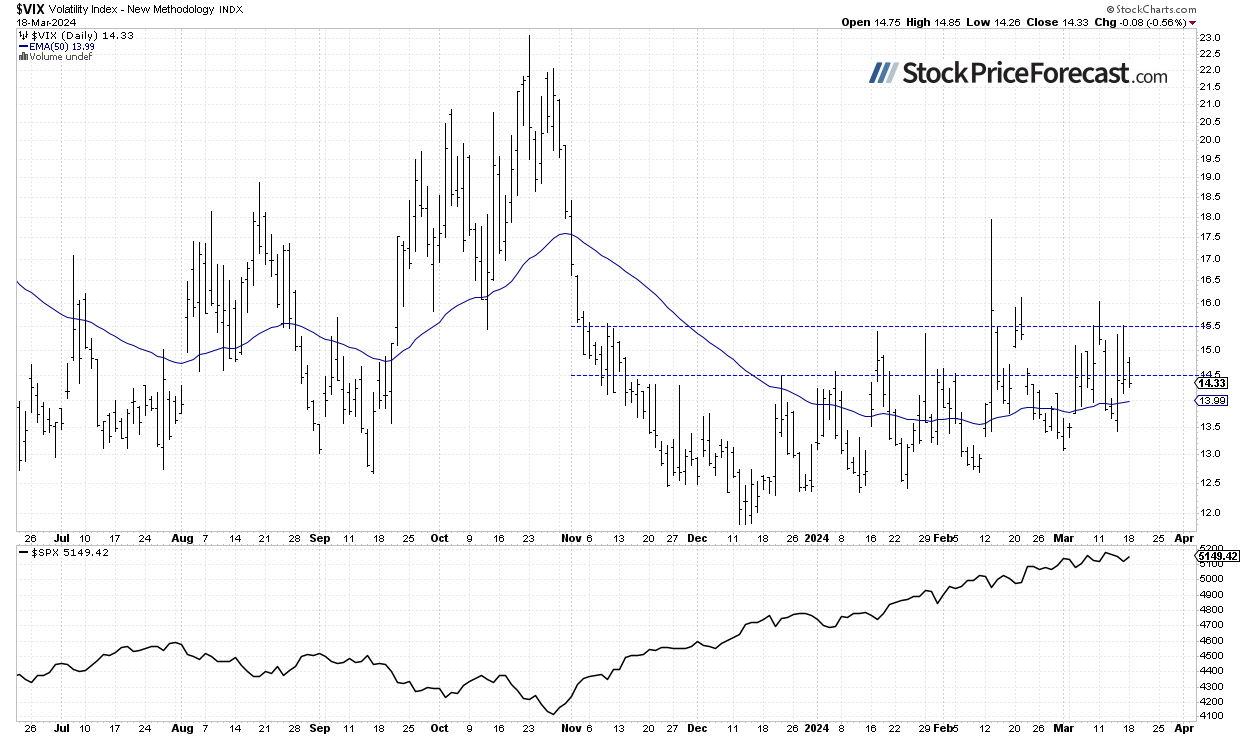

VIX – Fear Gauge Below 15

The VIX, a barometer of market anxiety, hovered around 15.50 on Friday before dipping below 14.50 later in the day, reflecting dwindling trepidation. Yesterday, it remained sub-15, indicating a relatively tranquil market atmosphere.

Historically, a declining VIX mirrors a calmer market environment, while an ascending VIX often heralds a downturn. Yet, as the VIX descends, the likelihood of a market reversal looms in the background.

Futures Contract – Consolidating Near 5,200

Gauging the hourly chart of the S&P 500 contract, Monday saw a climb to 5,240, followed by a slight retreat below 5,200 today. While signs point to a consolidation within an upward trend, caution whispers of a potential market summit.

Final Thoughts

Recent market dynamics have been notably bullish, propelled by select tech champions surging to new pinnacles, the S&P 500 surpassing the 5,100 milestone, and the Nasdaq 100 scaling beyond 18,000.

Anticipating a 0.4% dip on the S&P 500 index today, profit-taking activities may intensify ahead of the pivotal Fed report tomorrow. As market maven aptly puts it, “An extended consolidation phase seems imminent, driven by a patchwork of AI-linked stocks, amidst non-universal participation in the market surge.” Despite recent highs, a cautious mindset persists.

Reflecting on earlier prognostications, the trajectory of the stock market points upwards in the mid to long term, punctuated by occasional record highs. Advisable counsel advocates for a bullish stance or a prudent sideline watch, especially amidst rumblings of overvaluation and potential corrections. The S&P 500’s bullish march is expected to continue, albeit fraught with possible volatility as investors ponder profit retention.

For now, adopting a neutrality stance in the short run appears judicious.

Here’s a snapshot:

- The S&P 500 poised for an extended consolidation amid the looming Fed report.

- Ongoing consolidation within an uptrend remains evident.

- Short-term outlook seemingly neutral from the perspective shared.