In an effort to strengthen its online sales and rival retail giants like Walmart WMT and Amazon AMZN, Target TGT unveiled a collaboration with Shopify SHOP on Monday, aimed at enhancing its e-commerce marketplace.

The partnership will enable merchants using Shopify’s renowned global commerce platform to showcase their products on Target Plus, an exclusive third-party marketplace.

Let’s now analyze whether it is an opportune moment to invest in Shopify or Target’s stock following this intriguing collaboration.

An Essential Partnership (Especially for Target)

While this alliance presents growth opportunities for Shopify post its 2015 IPO, it holds significant importance for Target in catching up with Walmart’s extensive e-commerce expansion. In the past year, Walmart reported e-commerce sales of $100 billion compared to Target’s $19.4 billion.

Target’s strategy seems focused on narrowing the gap with Walmart, as projections suggest a slight sales decline to $106.88 billion in fiscal 2025 followed by a 4% rise to $110.84 billion in fiscal 2026.

In comparison, Walmart is expected to witness a 4% growth in its current fiscal year 2025, along with a further 3% increase in fiscal 2026 to $700.05 billion.

Image Source: Zacks Investment Research

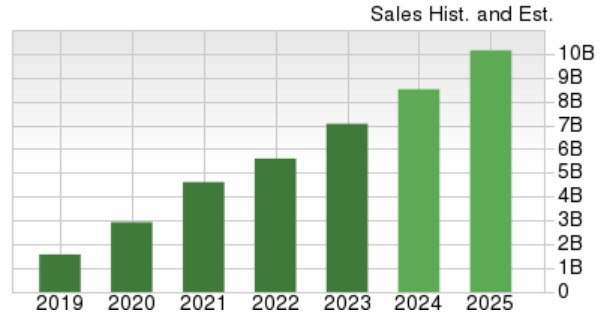

On the other hand, Shopify’s growth trajectory remains promising, with total sales estimated to surge by 20% to $8.51 billion in fiscal year 2024 compared to $7.06 billion in the prior year. Additionally, sales are projected to rise by 19% to $10.13 billion in fiscal year 2025.

Image Source: Zacks Investment Research

Earnings Perspective

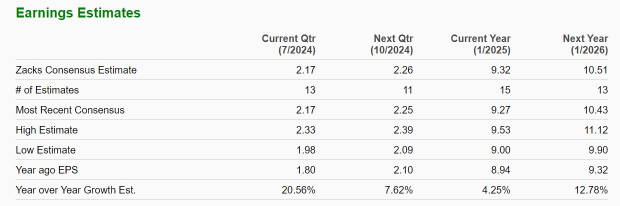

As per Zacks estimates, Target’s yearly earnings are predicted to rise by 4% in fiscal year 2025, with a further 13% jump anticipated in fiscal year 2026 to reach $10.51 per share. Notably, the projections for fiscal year 2026 indicate a 22% decrease from five years ago, where earnings were an impressive $13.56 per share in Target’s fiscal year 2022.

Image Source: Zacks Investment Research

Conversely, Shopify’s annual earnings are anticipated to skyrocket by 34% this year to $0.99 per share, up from $0.74 per share in 2023. Furthermore, an impressive 24% increase is expected in earnings per share in fiscal year 2025 to $1.23, signifying a remarkable 272% surge over the past five years from $0.33 per share in fiscal year 2021.

Image Source: Zacks Investment Research

Comparative Performance

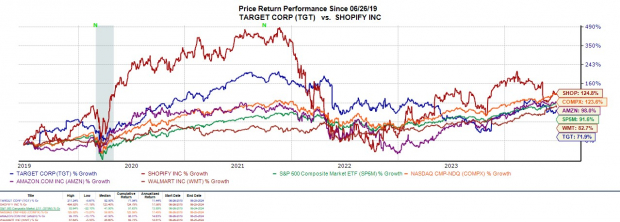

Year-to-date, Shopify’s stock has declined by -16%, whereas Target’s shares have shown a modest increase of +3%. However, both companies have lagged behind the S&P 500’s +14%, Nasdaq’s +17%, Amazon’s +23%, and Walmart’s +28%.

Notably, Shopify’s stock has surged by +125% over the past five years, outperforming broader indexes and peers like Amazon (+98%), Walmart (+83%), and Target (+72%).

Image Source: Zacks Investment Research

Key Takeaway

Despite the somewhat lackluster stock performance of Shopify and Target this year, both stocks hold a Zacks Rank #3 (Hold) rating. Long-term investors could potentially reap the benefits of this collaboration, bolstering the positive outlook for both companies.