The US stock market is flourishing, marked by a robust breakout. With a stable economy, robust employment rates, declining inflation, and soaring stock prices, the current bullish sentiment is undeniable. If you’re not optimistic now, it’s hard to fathom what could inspire confidence in you.

Image Source: TradingView

Stock Market Generals Showcase Remarkable Earnings Growth and Momentum

Navigating this market seems effortless, especially with some of the most prominent global companies offering enticing trading opportunities.

The ‘Magnificent 7’ are on a trajectory of remarkable earnings growth, showcasing impressive momentum. Projections for Q2 earnings indicate a staggering increase of +25.5% from the previous year, with +13.1% higher revenues. Stocks of these companies are riding the wave of record-breaking highs this year.

Among the ‘Magnificent 7,’ top picks currently include Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL). Honorable mention goes to Nvidia (NVDA), celebrated for its top Zacks Rank status.

The comparative strength of each of these stocks against the broader market is evident. Particularly noteworthy is Apple’s significant short-term momentum, boasting a 30% surge over the last three months.

Image Source: Zacks Investment Research

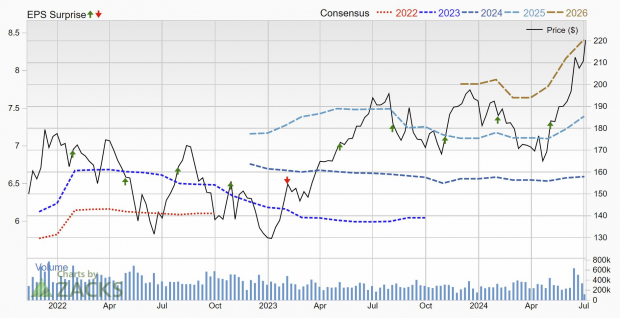

Surging Earnings Trend Propels Share Prices

Apple, known for its consistent success and robust stock performance, is closely monitored for its earnings trends. While past years saw flat earnings revisions, recent developments indicate a positive shift. Apple now proudly holds a Zacks Rank #2 (Buy) rating.

Amazon has also witnessed an upturn in its earnings revision trend, securing a Zacks Rank #2 (Buy) rating. With significant tailwinds from the AI boom, companies like Apple, Amazon, and Alphabet are poised for substantial growth.

Amazon’s utilization of AI in its various business segments, including web services and operations, positions it as a major beneficiary of evolving technologies. This strategic adoption is reflected in the upward trend of analyst earnings estimates.

Image Source: Zacks Investment Research

Appealing Valuations, Especially in Alphabet’s Case

Despite holding a Zacks Rank #3 (Hold) rating due to a stable earnings revision trend, Alphabet remains an attractive option, being the most affordable stock among the group.

With a forward earnings multiple of 24.4x, slightly above the market average, and a projected annual EPS growth rate of 17.5%, Alphabet is well-positioned for future growth. Its plans for significant share buybacks and a modest dividend yield further enhance its investment appeal.

Both Amazon and Apple offer compelling investment opportunities, trading at historical discounts. Amazon’s forward earnings at 43x are well below its median, with a projected impressive annual EPS growth rate. Apple, with a premium valuation for its quality, remains a solid investment choice.

Image Source: Zacks Investment Research

Final Thoughts

The current bullish trend in the market, supported by economic stability, declining inflation, and exceptional earnings growth from industry leaders, presents lucrative opportunities for investors. The ‘Magnificent 7’ highlight their remarkable growth trajectory, making them attractive entry points for investors eyeing top-performing stocks.

The increasing integration of AI across these tech giants, particularly in areas such as automation and cloud computing, positions them as frontrunners in the ever-evolving technological landscape.

Riding the Market Wave: A Look at the Current Rally

Market Rally Outlook

Despite market fluctuations and economic uncertainties, the current market rally remains steadfast in its trajectory, showing resilience in the face of challenges.

Stable Valuations and Fundamental Strength

The market rally continues to hold its ground with valuations staying at reasonable levels, providing a solid foundation for sustained growth.

Poised for Extension

With valuations remaining reasonable and fundamental strength unwavering, this market rally appears poised to extend its winning streak.

Historical Context

Reflecting on past market rallies and economic downturns, the current environment showcases a unique blend of fortitude and opportunity for investors.

Innovative Portfolio Services

Amidst the market rally, investors are encouraged to explore innovative portfolio services that offer insights and strategies to navigate the dynamic financial landscape.

Unveiling Investment Recommendations

Investors are presented with a range of compelling investment opportunities through curated recommendations from reputable sources, guiding them towards informed decision-making.