As Chewy Inc. (CHWY) prepares to release its second-quarter fiscal 2024 earnings on Aug 28, the investment community is abuzz with anticipation. The pet-centric e-commerce giant has been riding a wave of success, but with earnings looming, the crucial question arises – is Chewy’s stock still a smart bet?

Chewy has won over investors with its impressive growth trajectory, solid market positioning, and steadfast customer base. Analysts project revenues to hit $2.86 billion for the upcoming quarter, signaling a 2.8% uptick from the same period last year.

On the earnings side, the consensus estimate stands strong at 22 cents per share, reflecting a robust 46.7% year-over-year rise.

Chewy boasts a stellar track record, with an average earnings beat of 57.7% over the last four quarters. In the previous quarter, the company surpassed estimates by an impressive 47.6% margin.

Image Source: Zacks Investment Research

Insights on Chewy’s Potential

The analytical model suggests that Chewy is poised to exceed earnings expectations this time around. The favorable combination of a positive Earnings ESP and a Zacks Rank #1, #2, or #3 enhances the likelihood of an earnings beat – a scenario accurately forecasted in this case.

With an Earnings ESP of +4.55% and holding a Zacks Rank #2, Chewy appears to be in good stead. Investors can access valuable insights on stock market movements by leveraging our Earnings ESP Filter.

Driving Forces

Chewy’s strategic efforts to diversify its product range and elevate customer experiences are likely fueling revenue growth. The company’s consistent expansion of its inventory to include new and exclusive items caters to evolving preferences and requirements. This, combined with targeted marketing strategies and promotional activities, is forecasted to attract new clientele and boost spending among existing customers.

The success of the Autoship program is anticipated to significantly contribute to revenue generation. As this program gains traction, its convenience and value proposition are set to enhance customer retention and repeat purchases.

The introduction of the Chewy Plus membership program stands as another pivotal factor. With added benefits such as free shipping and exclusive discounts, this initiative is expected to boost purchase frequency and basket sizes.

Chewy’s expansions into new territories, particularly in Canada and other global markets, present fresh avenues for revenue growth. This geographic diversity opens doors to new customer acquisition opportunities. Moreover, Chewy’s foray into veterinary services via Chewy Health is likely to attract pet owners seeking holistic pet care solutions. This move is predicted to create cross-selling opportunities, elevate customer lifetime value, and further drive revenue growth.

Chewy Takes the Lead

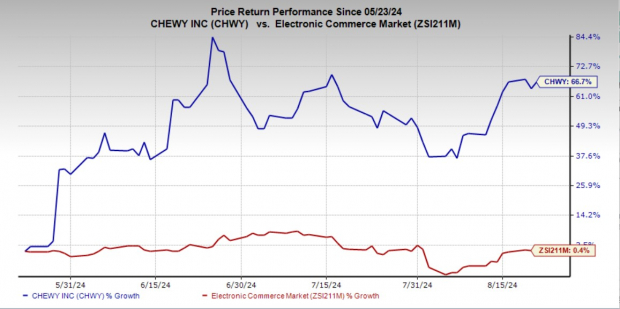

Chewy has witnessed a remarkable surge in its stock price over the last three months, with a staggering 66.7% climb, significantly surpassing the industry’s meager 0.4% uptick.

Image Source: Zacks Investment Research

CHWY has outperformed its competitors, including BARK, Inc. (BARK), Petco Health and Wellness Company, Inc. (WOOF), and Central Garden & Pet Company (CENT). While BARK shares have surged by 43.3% during the same period, WOOF and CENT have witnessed declines of 10.7% and 13.7%, respectively.

Is Chewy a Golden Opportunity for Value Investors?

From a valuation perspective, Chewy shares currently present an enticing proposition, trading at a discount compared to historical and industry standards. With a forward 12-month price-to-sales ratio of 0.98 – below the five-year median of 1.72 and the industry average of 1.73, Chewy’s stock offers compelling value to investors eyeing exposure in the sector.

Image Source: Zacks Investment Research

Evaluating the Investment Landscape

Chewy has consistently delivered strong performance, characterized by substantial stock price appreciation, robust financial metrics, and strategic maneuvers. Despite its recent upswing, Chewy’s stock continues to boast attractive valuation metrics alongside promising growth prospects. The company’s dedication to innovation, exemplified by initiatives like expanding the Autoship program and introducing services such as Chewy Health, not only reinforces customer loyalty but also unlocks new revenue streams. Complemented by its strategic global expansions and operational efficiencies, Chewy is in a prime position to leverage the burgeoning pet care industry.

Final Thoughts

Considering the robust growth trajectory of Chewy alongside its strategic focus on product diversification and enhanced customer engagement, investing in Chewy before the Q2 earnings report seems like a prudent move. The anticipated revenue surge, driven by initiatives such as the Autoship program and Chewy Plus membership, underscores the company’s knack for attracting and retaining customers.

Moreover, Chewy’s international market expansions and venture into veterinary services reinforce its long-term growth potential. With a strong history of surpassing earnings estimates and positive indicators for the upcoming quarter, Chewy emerges as an enticing investment opportunity in the market.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.