When it comes to companies exceeding market expectations, Toll Brothers (TOL) seems to have hit the nail on the head. Following its recent fiscal third-quarter results, the stock of Toll Brothers is on a triumphant trajectory, leaving its counterparts far behind. The thrill of seeing the stock up by more than 80% year-to-date is just the beginning.

The remarkable outperformance of Toll Brothers stock during this fiscal year is not only a phenomenal feat but is also reflective of the company’s exceptional fiscal discipline. In comparison, KB Home (KBH) and Lennar Corporation (LEN) witnessed impressive yet more modest growth at just over 50%.

Image Source: Zacks Investment Research

Toll Brothers Q3 Results and Financial Insights

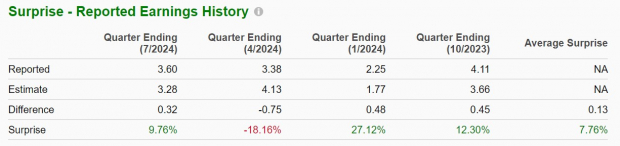

Surpassing market anticipations, Toll Brothers delivered a record-breaking performance in the third quarter. By clocking sales of $2.72 billion through the sale of 2,814 homes at an average price of $968,000, the company exceeded revenue estimates by an impressive 1%. Despite a dip in EPS from the previous year, the quarterly earnings of $3.60 per share outperformed expectations by a significant 10%.

In the span of its last four quarterly reports, Toll Brothers has continually outshone earnings forecasts, boasting an average EPS surprise of 7.76%. This consistent track record signifies a robust and reliable financial standing for the company.

Image Source: Zacks Investment Research

Revenue Projections and Future Growth Trajectory

Looking towards the future, Toll Brothers has forecasted a revenue range between $10.4 billion to $10.5 billion for the current fiscal year. This guidance, although slightly below Zacks estimates, indicates a potential 5% growth compared to its previous outlook.

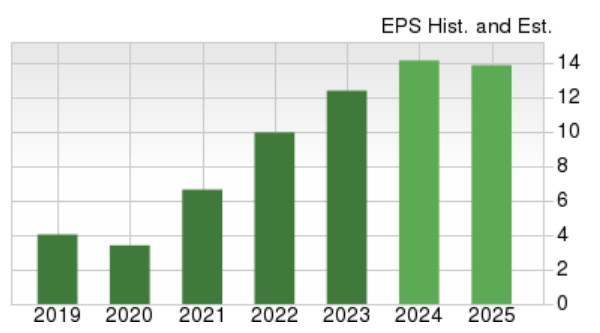

As per Zacks estimates, Toll Brothers is expected to witness a further 4% growth in revenue in fiscal year 2025, with a projected revenue of $10.98 billion. Simultaneously, annual earnings are predicted to surge by 14% in FY24, reaching $14.11 per share, laying a sturdy foundation for the coming years.

Despite a slight projected dip in EPS for fiscal year 2025, Toll Brothers remains on a trajectory of remarkable growth, showcasing a whopping 109% increase in earnings over the past five years.

Image Source: Zacks Investment Research

Comparative Valuation and Investor Appeal

The appeal of Toll Brothers does not stop at its financial prowess. Trading at a modest 10 times forward earnings, Toll Brothers’ stock valuation appears all the more alluring when juxtaposed against the S&P 500’s 23.7X. Furthermore, the stock stands at a significant discount compared to its industry counterparts, with KB Home at 9.8X and Lennar at 12.6X.

Image Source: Zacks Investment Research

Final Thoughts on Toll Brothers

Emerging victorious post their Q3 earnings unveiling, Toll Brothers stock stands at a Zacks Rank #2 (Buy). With expectations pointing towards an uptrend in earnings projections, investors can likely look forward to an extension of the stock’s impressive rally that has taken the market by storm.