Walmart’s stock may be on many investors’ minds as its three-to-one stock split is set to take effect on Monday, February, 26. As part of Walmart’s ongoing review of optimal trading and spread levels, WMT shares should open at around $59 next week with the current price at $177 a share.

With over 400,000 associates participating in Walmart’s stock purchase plan, the company has desired to make shares more affordable with other retail investors certainly enthused as well. With that being said, let’s check Walmart’s recent price performance and see if its stock will be a bargain after reporting Q4 results this week.

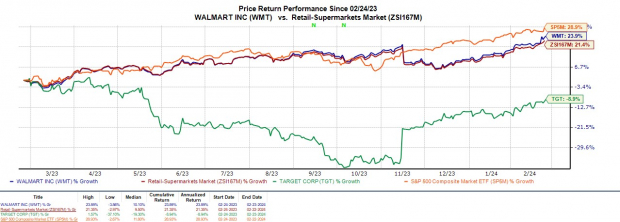

Assessing Recent Price Performance

Walmart’s stock is already up +12% year to date to top the S&P 500’s +6% and omnichannel peer Target’s TGT +7% while also edging the Zacks Retail-Supermarkets’ +10%. Over the last year, WMT shares have now risen +24% which has largely outperformed Target’s -9% and also topped its Zacks Subindustry’s +21% while slightly trailing the benchmark.

Image Source: Zacks Investment Research

Implications of Favorable Q4 Results Driven by E-commerce Sales

Reporting its Q4 results on Tuesday, Walmart’s report was favorable for the broader retail industry as Wall Street and many economists await Target’s earnings in early March. Coming off of the busy holiday shopping season, earnings of $1.80 per share beat the Zacks Consensus of $1.65 a share by 9%. Fourth quarter earnings rose 5% year over year with Q4 sales of $173.38 billion rising 5% as well and topping estimates of $170.63 billion by over 1%.

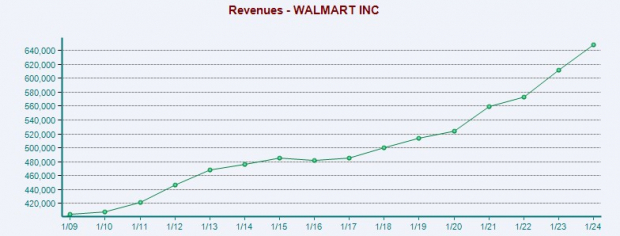

Image Source: Zacks Investment Research

Walmart’s strong quarter was attributed to its expanding e-commerce business which saw 23% sales growth during Q4 helping the company achieve over $100 billion in online sales for the year. Overall, Walmart’s total sales grew 6% in its fiscal 2024 to $648.1 billion. Annual earnings also increased 6% to $6.65 per share.

Image Source: Zacks Investment Research

A Look at EPS & Outlook Overview

Walmart’s EPS will naturally decrease or be diluted with the number of shares outstanding increasing after its stock split. However, in this situation, it is important to remember that the total earnings or net income of a company remains unchanged just as revenue or sales wouldn’t be affected.

Walmart is expected to post 3% growth on its top line in its current FY25 with FY26 sales projected to rise another 4% to $698.5 billion based on Zacks estimates. Annual earnings are forecasted to be up 5% in FY25 to $7.02 per share which would translate into $2.34 a share post-split. Plus, Walmart is projected to post 9% EPS growth in FY26.

Image Source: Zacks Investment Research

Key Takeaway for Investors

At the moment Walmart’s stock currently lands a Zacks Rank #3 (Hold) following a sizzling start to the year. Part of Walmart’s YTD rally has been attributed to investors piling into its stock with the notion it would move higher before the split. Although Walmart’s expanding e-commerce business and long-term prospects remain attractive there could be better buying opportunities even after its stock split as this does not always translate to shares of a company moving higher immediately afterward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report