Alibaba Group BABA is positioning itself as a formidable player in the artificial intelligence (AI) landscape, demonstrating remarkable technological innovation and financial resilience in its latest quarterly results. The company’s strategic moves, particularly in AI development and semiconductor technologies, suggest a compelling investment opportunity for 2025.

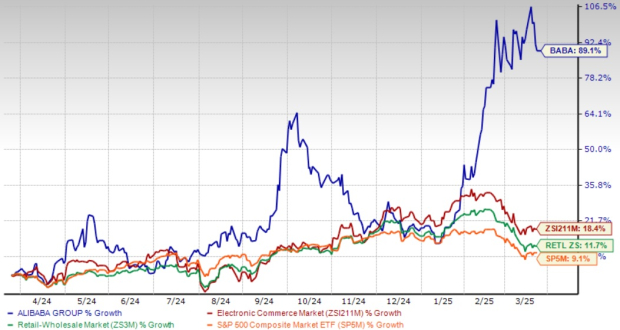

The stock has gained 89.1% in the past year, outperforming the Zacks Internet-Commerce industry, the Zacks Retail-Wholesale sector and the S&P 500’s return of 18.4%, 11.7% and 9.1%, respectively.

1-Year Performance

Image Source: Zacks Investment Research

Breakthrough in AI Model Development

Alibaba’s affiliate, Ant Group, has made significant strides in AI model development, showcasing an innovative approach to reducing AI training costs. By strategically combining Chinese and U.S.-made semiconductors, Ant Group has reduced the time and computational expenses associated with training AI models. The company reported a 20% reduction in computing costs through its unique approach, which limits reliance on a single-chip supplier like NVIDIA Corporation NVDA.

This technological breakthrough is particularly noteworthy in the context of U.S. restrictions on advanced semiconductor exports to China. Ant Group’s ability to effectively train AI models using a mix of domestic and international chips demonstrates its technological adaptability and innovation potential.

Robust Financial Performance

The company’s December quarter financial results underscore its strong market position. Alibaba reported consolidated revenues of RMB280,154 million (US$38,381 million), representing an 8% year-over-year increase. More impressively, the company’s income from operations surged 83% from the same quarter in the previous year, reaching RMB41,205 million.

Cloud Intelligence Group, a critical segment for Alibaba, showed particular strength. The segment’s revenues grew 13% year over year, with AI-related product revenues maintaining triple-digit growth for the sixth consecutive quarter. This consistent performance in the AI and cloud computing domains signals the company’s robust technological ecosystem and market potential.

Strategic AI and Open-Source Initiatives

Alibaba is not just developing AI technologies but also actively promoting open-source innovation. In January 2025, the company open-sourced Qwen2.5-VL, a next-generation multi-modal model, and launched its flagship Mixture of Experts (MoE)-based model, Qwen2.5-Max. These models have demonstrated globally leading results across recognized benchmarks.

The company’s commitment to open-source development is evident in the widespread adoption of its Qwen family of models. As of Jan. 31, 2025, more than 90,000 derivative models had been developed on Hugging Face based on the Qwen family, making it one of the largest AI model families worldwide.

Diversified Business Growth

Beyond AI, Alibaba continues to show strength across multiple business segments. The Taobao and Tmall Group saw a 5% revenue increase, with customer management revenues growing 9%. The Alibaba International Digital Commerce Group experienced a remarkable 32% year-over-year revenue growth, driven by strong cross-border business performance.

The company’s strategic investments and operational efficiency are also noteworthy. Alibaba has been actively optimizing its balance sheet through strategic divestments, share buybacks and debt management. During the quarter, the company repurchased 119 million ordinary shares for a total of US$1.3 billion, demonstrating confidence in its intrinsic value.

However, Alibaba’s dominant e-commerce position in China remains threatened by global bigwigs like Amazon AMZN and eBay EBAY. Also, BABA’s growth in the global cloud market has been significantly hindered due to rising competition from the leading cloud players, namely Amazon, Microsoft and Google.

Investment Outlook for 2025

For investors looking at 2025, Alibaba presents a compelling case. The company’s multifaceted approach to technological innovation, particularly in AI and cloud computing, combined with its diverse revenue streams and disciplined financial management, positions it strongly in the market.

The consistent growth in AI-related products, the successful development of advanced language models and the strategic approach to semiconductor challenges indicate that Alibaba is not just adapting to the technological landscape but actively shaping it.

The stock’s potential is further bolstered by the company’s solid financial fundamentals. With an 8% revenue increase, 83% growth in income from operations and continued investment in cutting-edge technologies, Alibaba appears well-positioned for sustained growth.

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $138.29 billion, indicating 5.97% year-over-year growth. With the Zacks Consensus Estimate for fiscal 2025 earnings indicating an upward revision of 0.9% over the past 30 days to $8.80 per share, the market appears to be optimistic about Alibaba’s growth trajectory.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Alibaba is currently trading at a discount with a forward 12-month Price/Earnings of 12.52X, lower than the industry’s 21.4X and the median of 14.21X. This valuation metric indicates that BABA’s stock is significantly undervalued compared to its industry peers, trading at less than half the industry average P/E ratio. The lower-than-median forward P/E suggests an attractive entry point for investors, as the stock appears to be trading below its fair market value despite strong fundamentals.

BABA’s P/E F12M Ratio Depicts Discounted Valuation

Image Source: Zacks Investment Research

Conclusion

Investors should consider Alibaba as a strategic long-term investment, particularly those who are interested in companies at the forefront of AI and digital transformation. The company’s innovative spirit, financial strength and commitment to technological advancement make it an attractive prospect for the 2025 investment landscape. BABA stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).