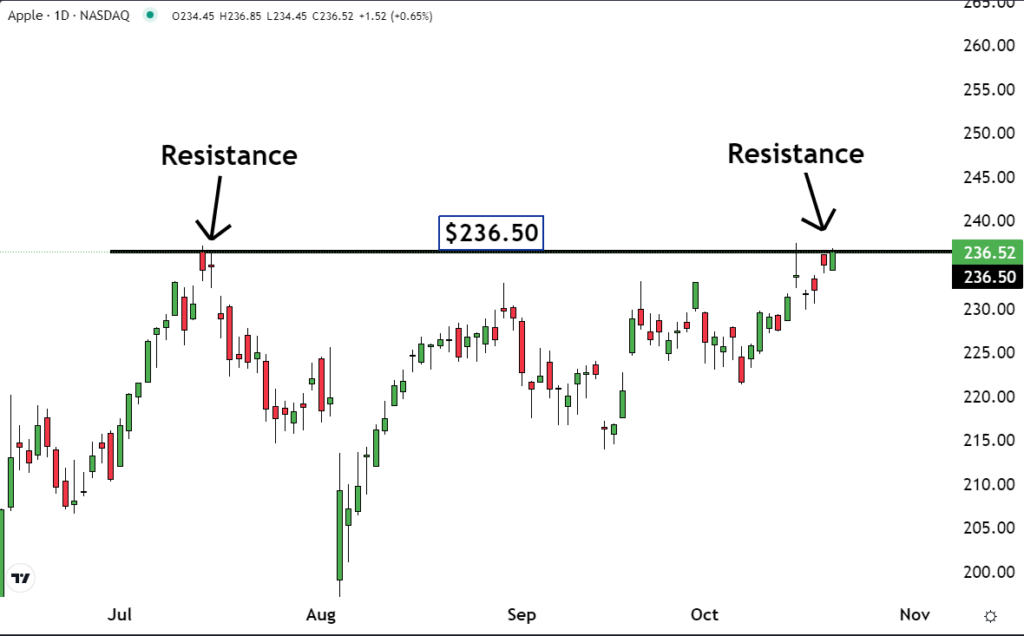

The Crossroads of Apple’s Fate

Apple Inc.AAPL has encountered a familiar foe as its shares confront resistance at a significant price level that once stood as the zenith. The likelihood of Apple lingering at this juncture is slim, presenting binary outcomes of either a breakthrough leading to upward momentum or a reversal paving the way for a downward trajectory.

Embarking on endeavors to decipher these pivotal moments, our cadre of trading savants has rigorously identified Apple as our Stock of the Day.

Financial markets undulate under the caprices of supply, demand, and human sentiment. Embedded in these undulations lies the psyche of investors and traders, orchestrating the price gyrations that materialize into intricate patterns on charted terrains.

Delving deeper, consider a scenario where a stock catapults to a price echelon erstwhile designated as a pinnacle or a barricade. At such junctures, a proclivity ensues for the stock to encounter resistance anew. Gazing at the chart, this very scenario unfolds with Apple’s shares as the $236.50 level, previously a bastion in July, recommences its role as a steadfast barrier.

Peruse Further: Goldman Sachs Predicts Bleak Long-Term S&P 500 Returns As Market Concentration Hits ‘Highest Level In 100 Years’

A conglomeration of these rueful buyers pledges to relinquish their positions, meticulous not to incur losses. Hence, they adopt a stance to vend their shares if prices rally back to their procurement threshold, ensuring a breakeven scenario.

As Apple retraces to its encampment around $236.50, a plethora of vend orders is erected. This congregation of sell imperatives has spawned an impasse at the very price point that previously manifested as a barricade.

A decisive conquest of this barrier by Apple would symbolize the egress of erstwhile sellers, absolved from the market. Their missions are consummated, or their directives rescinded. Consequently, prospective acquirers must acquiesce to escalating prices to secure shares, heralding an upward trajectory.

However, if the stock falters in breaching this barrier, a descent seems probable.

Fearful sellers anticipating the urge to divest might resort to underpricing tactics, recognizing that buyers gravitate towards the most affordable vend offers, eschewing a prospective deal. Observing this trend, other apprehensive vendors follow suit, sparking a cascading effect poised to drive prices southward.

When a stock gravitates towards a pivotal juncture, akin to Apple’s current position, the odds favor against prolonged stasis. The probabilities weigh heavier towards an imminent breakthrough or a reversal and subsequent descent.

Delve Deeper:

• Tesla Q3 Earnings Preview: Analyst Says 1.8 Million Unit Estimate ‘Hittable’ For 2024, ‘2 Million+ Number The Focus For 2025’

Photo Credit: Shutterstock

Market News and Data brought to you by Benzinga APIs