Tech giant Apple Inc. AAPL began the week with another decline on Monday, as concerns grow that U.S. President Donald Trump’s tariffs on several of its global manufacturing hubs could hit the Cupertino-based company hard.

What Happened: On Monday, Apple ended nearly 4% lower, and was among a few mega-cap tech stocks to have declined during the day. This also marks the company’s third consecutive day in the red, during which the stock has lost 20%, wiping out nearly $640 billion in market capitalization.

This comes amid growing concerns that the tariffs could hurt Apple’s sales, supply chain, and operations more than the other Mag 7 stocks. Despite the company’s efforts in diversifying away from China, its new manufacturing hubs in India, Malaysia, and Indonesia also face sweeping new tariffs being imposed by the U.S. Government.

See More: ‘Dr. Doom’ Roubini Warns Markets ‘Delusional’ About Fed Rescue As Trump, Xi Jinping, Jerome Powell Locked In High-Stakes Standoff

According to a study by UBS Group AG, Apple’s top-end iPhone model, which is currently priced at $1,199, could see prices rise 30%, or by $350, if the tariffs remain in their current form. The company could either reduce prices and hurt its margins, or keep prices intact and lose sales, it stands to lose either way.

Barclays PLC analyst Tim Long believes that if the company decides not to cut prices, its earnings per share could take at least a 15% haircut immediately. Long further adds that the company could rearrange its supply chain, such that its imports to the U.S. are routed through other countries where the tariffs are lower.

The most prominent bearish take on the stock comes from Daniel Ives of Wedbush Securities, who calls the ‘tariff economic armageddon’ unleashed by Donald Trump and an ‘absolute disaster’ for Apple, considering its massive exposure to China, both for production, as well as a market.

‘No U.S. company is more negatively impacted by tariffs than Apple, ‘ Ives adds while cutting the stock’s target from $325 a share to $250.

Why It Matters: Besides being a major production hub for the company, China is also Apple’s second biggest market after the United States. This means that it also stands to be hit by the retaliatory tariffs now being imposed by China on U.S. imports.

Analysts also believe that the company is unlikely to offer any guidance during its second-quarter results, in line with most other tech giants until the dust settles on the tariff front, and there is more clarity.

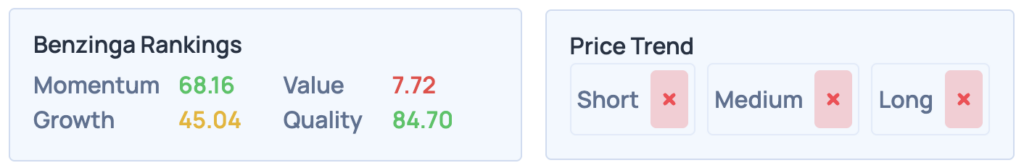

According to Benzinga Edge Rankings, Apple is unfavorable in the short, medium, and long term, but how does it compare with other tech stocks? Check out Benzinga Edge Stock rankings today to learn more.

Read More:

Photo courtesy: Shutterstock

Momentum68.16

Growth45.04

Quality84.70

Value7.72

Market News and Data brought to you by Benzinga APIs