While the electric vertical takeoff and landing (eVTOL) industry may represent the future of mobility, as an investment, the narrative presents a cloudier picture. Case in point is sector heavyweight Archer Aviation Inc ACHR. Although ACHR stock has witnessed powerful ebbs and flows, the net performance since its public market debut has been lackluster overall.

As a result, caution should be the theme when approaching Archer. For example, ACHR stock lost 22.67% of value last week (defined as the difference between Monday’s open and Friday’s close). Given the rarity of such declines — the worst such loss occurring in June 2022 for a drop of 29.68% — it wasn’t unusual to see the opinion cycle label ACHR as a discounted buying opportunity.

To be fair, some factors support the optimism. Earlier this week, Benzinga’s options scanner uncovered unusual activity for ACHR stock derivatives, with all aberrant transactions featuring bullish sentiment. However, the bulk of the dollar volume targeted calls expiring this Friday and that appears to be the point.

Analysts generally don’t disagree that over the long run, eVTOL players offer tremendous potential for advanced mobility. However, fundamental concerns such as certification hurdles against sky-high valuations warrant caution. Indeed, the statistical evidence suggests that the bears still have the upper hand.

ACHR Stock Really Comes Down To Numbers Game

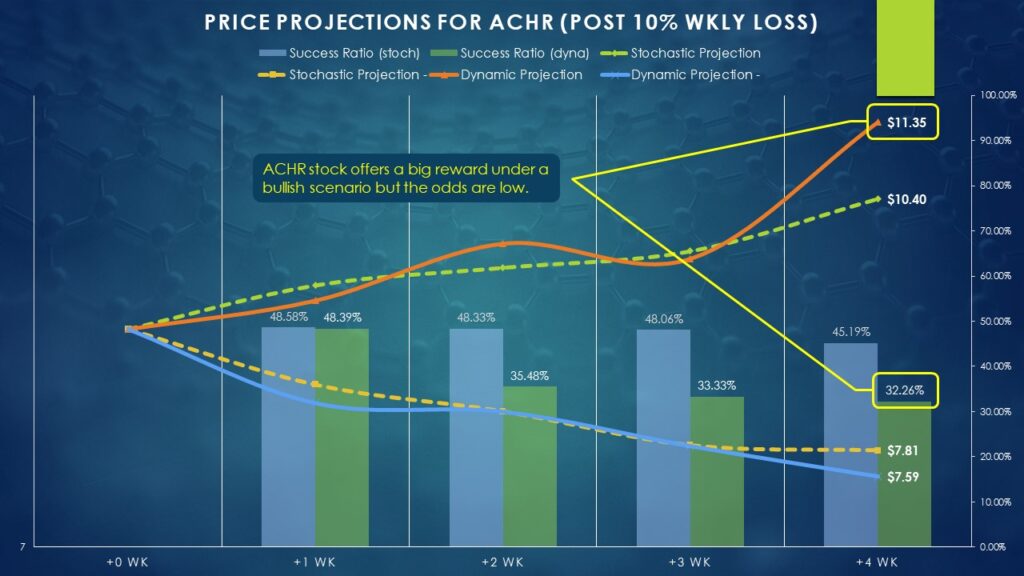

Before engaging in any trade, it’s important to understand the lay of the land. Barring any other context, on any given week, there’s a 45.19% chance that by the end of the fourth subsequent week, a position held in ACHR stock will rise in value. Out of 208 qualifying weeks, 94 were positive, 114 were negative and one ended up completely flat.

However, the context of the moment isn’t about whether ACHR stock will rise based on a random entry point. Instead, the assertion in the opinion cycle is that because ACHR suffered an extreme-fear event last week, Archer Aviation represents a deep-value play. However, the evidence does not support this claim.

Since Archer’s public market debut, there have been 31 weeks where ACHR stock suffered a 10% weekly loss or worse. Out of this tally, there have only been 10 weeks (or 32.26%) where by the end of the fourth subsequent week, ACHR posted a positive return. In other words, not only do the bulls not buy the dip, the bears tend to further puncture the wound.

Chart created by the author.

To be fair, the median positive return under a dynamic statistical model — that is, looking at the median return of ACHR stock when it moves higher following an extreme-fear event — clocks in at 26.5% at the end of week four. That’s much higher than the median positive return of 15.95% when viewed stochastically, meaning any four-week window irrespective of context.

Stated simply, if ACHR stock manages to beat the odds, the rewards can be intense. It’s just that historically, the numbers don’t favor the bullish thesis.

Also Read: Stock Of The Day: Time To Buy Edison International?

Two Different Approaches For Archer Aviation

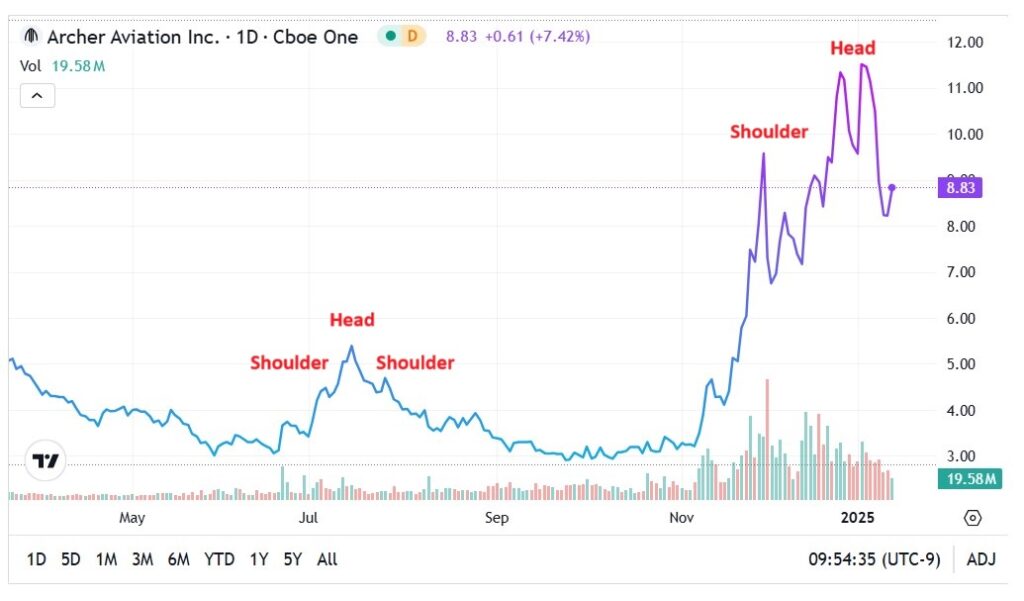

Another worrisome factor potentially impacting ACHR stock is that it currently appears to be charting a pattern similar to a bearish head and shoulders. A similar-looking formation materialized last year between July and August, resulting in early optimism succumbing to significant disappointment. Naturally, there’s risk that the same scenario can emerge at a greater scale.

Chart: Tradingview

Those traders who believe in the numbers game may consider a bear put spread. This multi-leg options strategy involves buying a put option and simultaneously selling a put at a lower strike price. Traders aim for the underlying security to fall to the short strike price, with the idea that they will use the credit received from the short put to offset the debit paid for the long put.

Whether calculated stochastically or dynamically, the statistical downside target for ACHR stock one month following an extreme-fear event is quite similar: $7.81 and $7.59, respectively. Put another way, investors may anticipate an average loss of 14.17% from last Friday’s close of $8.97.

With a timeline corresponding with the options chain expiring Feb. 7, aggressive traders can target the 9.00/7.50 bear put spread. At the time of writing, the breakeven threshold for this transaction stands well above $8, providing greater odds of success but also with a very robust maximum payout.

Finally, those who believe that “this time could be different” for ACHR stock may consider a directionally neutral long iron condor. This trade combines a bear put spread with a bull call spread, establishing top-and-bottom profitability targets.

Under a dynamic pricing model, ACHR stock may rise to $11.35 under the positive scenario. Therefore, a 7.50 | 8.00P || 10.50C | 11.00C long iron condor — or a 7.50/8.00 bear put spread combined with a 10.50/11.00 bull call spread — could be the ticket to trading success.

Read Next:

Image created using artificial intelligence via Midjourney.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.