Alphabet’s Resilience Amidst a Financial Storm

Alphabet (GOOGL) sparked a frenzy in Friday’s trading session as it obliterated first-quarter earnings forecasts, injecting a dose of adrenaline into the markets. Shooting up by over +10%, Alphabet’s stocks basked in glory following the announcement of its inaugural dividend payout and a staggering $70 billion buyback program.

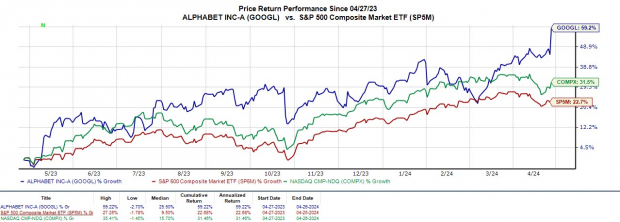

Delving into Alphabet’s enthralling Q1 report unveils a tantalizing narrative. With GOOGL already boasting a remarkable +20% year-to-date surge, investors are now pondering whether it’s the opportune moment to jump on the bandwagon and ride the tidal wave of Alphabet’s success.

Image Source: Zacks Investment Research

Unlocking the Treasures of Alphabet’s Q1 Performance

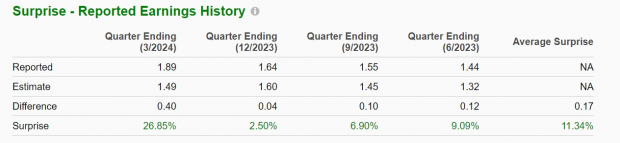

Alphabet’s earnings for Q1 surged by a stunning 61% to $1.89 per share, overshadowing the $1.17 EPS in the corresponding period. The top line painted a similar tale of triumph, with Q1 sales scaling to $67.59 billion, a 16% leap from $58.06 billion a year ago, and surpassing estimates by 2%.

Behind this stellar performance lies the prowess of Google Search, Cloud services, and a robust uptick in YouTube’s advertising growth. Alphabet’s foray into the domain of artificial intelligence through Gemini, a generative AI platform spanning audio, video, and text code, is poised to spearhead the next AI revolution.

Google Cloud emerged as a standout performer with a revenue surge of 28% YoY, reaching $9.57 billion. While Alphabet still lags behind Amazon’s AWS and Microsoft’s Azure in the domestic cloud computing realm, its meteoric rise is a force to be reckoned with.

Image Source: Zacks Investment Research

The Pinnacles of Market Capitalization and Earnings Lucrativeness

Alphabet’s decisive move to introduce a quarterly dividend of $0.20 per share, scheduled to kick off on June 17 for shareholders of record on June 10, kindled the flames of market enthusiasm. Fueled by this jubilant announcement, Alphabet briefly eclipsed a $2 trillion market cap, a feat last achieved in 2021, placing it in the echelons alongside tech behemoths like Apple and Microsoft.

Image Source: Zacks Investment Research

Prospects on the Horizon and Investment Implications

Alphabet’s Q1 triumph presents a compelling case for sustained double-digit growth in both top and bottom lines throughout fiscal 2024. Currently sitting at a Zacks Rank #3 (Hold), GOOGL might soon find itself in the spotlight as earnings forecasts undergo favorable revisions in the forthcoming weeks.