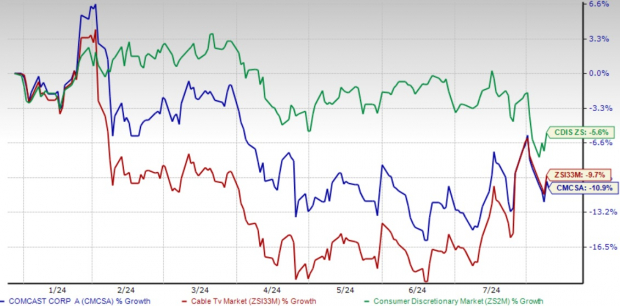

Comcast Corporation CMCSA, a formidable force in media and technology, has witnessed a somber 10.9% decline in its stock price since the beginning of the year, a stark contrast to the 5.3% dip observed in the wider Zacks Consumer Discretionary sector. This downturn has stirred a hornet’s nest among investors, triggering a soul-searching quest to either stand firm or cash out. The tumultuous descent unfurls against a backdrop of market gyrations and specific hurdles besieging the telecom and media domains.

Deliberation looms large as investors grapple with Comcast’s growth prospects amid attendant adversities. The perpetual metamorphosis in media consumption dynamics, plausible regulatory roadblocks, and the hefty capital outlays imperative to sustain competitiveness on both the content and infrastructure fronts are pivotal variables demanding meticulous consideration.

Under the Lens: Comcast’s Performance Year-to-Date

Image Source: Zacks Investment Research

Xfinity to Universal: Peering into Comcast’s Investment Viability

Nestled within the Connectivity & Platforms echelon, Comcast’s Xfinity brand emanates as a stalwart in broadband Internet services. Markedly, the upsurge in domestic broadband average revenue per user by 3.6% orchestrated a 3% ascent in domestic broadband revenue to a princely sum of $6.6 billion during the second quarter, encapsulating the quintessence of monetary buoyancy.

The telecommuting leitmotif and digital umbilical cord tethering continue to exert their unfaded essence, offering a linear revenue rivulet. Comcast’s persistent investments in its broadband edifice — notably the fiber-optic network’s expansion — intricately position it on an evolutionary cusp for future proliferation. In the recent quarter, Comcast Business unfurled a bouquet of economically tailored mobile concoctions targeting small commercial wardrobes to enhance value and performance. Further titillating the zeitgeist, the advent of a 5-Year Price Lock Guarantee promotion aims to bedrock long-term pricing tranquility for qualifying parvenus.

The dalliance into the wireless milieu via Xfinity Mobile has unfurled latent promises, knitting an additional stratum to its connectivity bouquet. Noteworthy is the exhilarating 20% annual uptick in domestic wireless customer lines to 7.2 million, featuring 322K net additions during the recent quarter.

The narrative pirouettes to the Content & Experiences arena, housing NBCUniversal and Sky, where riveting growth pastures unfurl. The recent launch of NOW TV Latino by Comcast at a $10 per month price point sans contractual ballastage serves the Spanish-speaking cohort. Picture this amidst NBCUniversal’s Peacock streaming platform’s ascendant trajectory that, despite grueling industry impedance, unfurls its unique blend harmonizing live sports, news, and native content amid the seas of streaming behemoths.

Galloping on this pursuit, Peacock burgeons its paid subscriber flock by close to 38% year over year to 33 million, meriting its nomenclature as a revenue arbitror. In synergy with this, Peacock’s fiscal arcs witness a 28% northward dash to $1 billion, egged on by the launch of Xfinity StreamSaver, a streaming amalgam bundling Peacock, Netflix, and Apple TV+ for the nascent and extant Xfinity Internet and TV apostles.

The universal theme parks boa, fostered within the Content & Experiences precinct, voraciously wait on tenterhooks for the global tourism’s resentence as it rebounds post-pandemic shackles. Noteworthy is the sought-after universal tomb at Beijing Resort and its ilk, reiterating Comcast’s avid watchdogship over this high-margin terrain.

Delving deeper into the artistic mores, Comcast’s celluloid and television studios prance in relevance, twirling popular content strains that besides oiling the box office machineries, feed into the streaming and conventional broadcast arteries. This vertical symbiosis not only maximizes the intellectual property’s elixir value across assorted portals but also emboldens Comcast’s eclectic perorations.

Further accentuating the corporate underpinnings, the fusion of Comcast’s cardinal segments fabricates a competitive mettle. Leveraging its connectivity apparati to parley its content spools, and vice versa, transmutes into a coherent, irresistible medley for patrons.

The Zacks Consensus Estimation for CMCSA’s 2024 revenues pegs at $123.02 billion, etching a 1.2% growth from the correlative quarter’s reported number. The chorus of consensus vocalists anticipates 2024 earnings to ascend to $4.23 per share post a 0.5% spring in the past month, heralding a 6.28% cumbrous climb from yore.

Image Source: Zacks Investment Research

Parity rings as another cardinal measure for prospective virtuosos. CMCSA’s saunter at 1.23X forward 12 months sales steers below its historical median alongside the broader Cable Television industry’s forward earnings multiple that clock at 1.34X, murmuring echoes of potential underestimation grounded on revenue inklings.

Inching Closer: Pondering Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

Cord-Cutting and Streaming Pressures: Weighing on Comcast Shares

The ineluctable drift of cord-cutting continues its nibbling spree on Comcast’s erstwhile stolid cable subscriber bedrock, menacing a once-viable revenue thoroughfare. Cascading towards streaming sanctuaries like Netflix, Amazon Prime Video, and Disney-owned Disney+, consumers spiral away from Comcast’s cable TV realm, casting a churlish cloud.

Comcast’s foray into streaming’s verdant pastures via Peacock, while cogent, unfurls with unmastered costs stemming from content origination and infrastructural sustenance. These investments, shadowed by an instense streaming contest, heap pressure on profitability terrains, exacerbating whispers about investment payoffs.

Further adding to the investor palpitatons, the flagging traction in broadband subscriptions, an engine fuelling Comcast’s recent jubilation, sets a carnival of sirens blaring. This slackening sinusoid, twinned with the elephantine keep-up costs entailed in network infrastructure finesse, sows seeds of skepticism about Comcast’s escapde into the growth yonder.

These constituents share quarters as a potpourri fomenting investor vacillations despite Comcast’s nimble acclimatizations to the chameleon hues of the media abode.

Wrapping Up: A Conclusive Potpourri of Considerations

Comcast’s divisive 10.9% dip year-to-date presents an intricate investment tapestry. The company’s sturdy market bastion, tapestry-like business model, and seductive valuation metrics whisper potential vistas. However, the media’s turbulent terrain exhales a cautionary wind that investors would be wise to hearken to. The long haul beckons a judicious reckoning of these strands against one’s risk belly and investment chronicle before tilting the chalice hemispheres. While bidding adieu to the stocking might premise premature for existing apostles, new acolytes are better positioned stalling their enthusiastic stampede forth, awaiting impending resolves and signals…

Exploring Investment Opportunities in the Semiconductor Industry

Recent Findings by Zacks

Upon deliberating Comcast’s current status, it shows a Zacks Rank #3, categorizing it as a “Hold.” Investors looking for a more opportune entry point may find this assessment crucial.

Emerging Semiconductor Stock Takes Center Stage

Despite being a mere fraction of NVIDIA’s size, a semiconductor stock singled out by Zacks has the stage set for remarkable growth. While NVIDIA has basked in an over 800% surge following a previous recommendation, this new contender in the chip sector is projected to soar higher.

Boasting substantial earnings growth coupled with a broadening customer base, this semiconductor stock is strategically positioned to cater to the escalating demand for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor market’s anticipated surge from $452 billion in 2021 to a staggering $803 billion by 2028 underscores the vast potential this sector holds.

Insights into Stock Analysis

A parting thought gleaned from Zacks’ Investment Research is the offer of free stock analysis for select companies. Amazon.com, Inc. (AMZN), Comcast Corporation (CMCSA), Netflix, Inc. (NFLX), and The Walt Disney Company (DIS) are among those under the spotlight for eager investors seeking informed decisions.

Click here to get a Free Stock Analysis Report

Final Considerations

In light of the changing landscape, the suggestion of whether investors should “hold or fold” on Comcast Corporation (CMCSA) poses a significant question. Insights provided by companies such as Zacks aid investors in navigating the complex financial market.