CrowdStrike Holdings, Inc. CRWD is set to unveil its second-quarter fiscal 2025 outcomes on Jun 4.

Anticipating revenues between $958.3 million and $961.2 million for the quarter, CrowdStrike forecasts substantial growth. With a Zacks Consensus Estimate of $958.7 million, representing a 31% rise from the year-prior quarter.

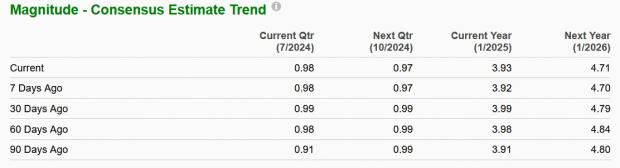

Projected non-GAAP earnings of 98 to 99 cents per share align with analyst expectations. The revised consensus of 98 cents per share signals 32.4% year-over-year growth.

Image Source: Zacks Investment Research

Reveling in consistent financial prowess, CrowdStrike boasts advancements fueled by its subscription-oriented revenue structure. Surpassing Zacks Consensus Estimates in each of the past four quarters with a remarkable average surprise of 15.8%.

Dive into Price Performance & Valuation

Year to date, CrowdStrike shares have risen 4.8%, undershooting the Zacks Internet – Software industry’s 14.6% growth. The CRWD stock also lags behind peers such as Palo Alto Networks PANW and Fortinet FTNT, registering 18.5% and 27.2% upticks, respectively.

Year-to-Date Price Returns

Image Source: Zacks Investment Research

Delving into CrowdStrike’s present value proposition, CRWD stock trades at a premium with a forward 12-month P/S of 14.47X compared to the industry’s 2.57X. This indicates an extended valuation.

Image Source: Zacks Investment Research

Assessment of Investment Viability

Despite robust post-IPO growth, recent quarters indicate a deceleration for CrowdStrike. While revenue growth remains strong, it has tapered compared to previous years. Fiscal 2023 recorded over 50% year-over-year revenue growth, a figure that moderated to 36% in fiscal 2024. Forecasts for fiscal 2025 and 2026 project further deceleration to 30% and 24%, respectively.

This deceleration results, in part, from the law of large numbers, making it harder to sustain high growth percentages as companies expand. Rising competition in the cybersecurity realm also poses challenges to CrowdStrike’s growth trajectory.

The company’s short-term prospects may be dimmed by softening IT expenditure due to macroeconomic uncertainties. The global IT outage incident in July 2024 underscored operational weaknesses within CrowdStrike, impacting client trust following system malfunctions across various sectors post a faulty Falcon platform update.

Epilogue

Amidst challenges faced, it may be time for investors to reassess their CrowdStrike position. With waning sales growth and operational lapses impacting its reputation, CRWD stock appears a risky stake. The combination of these factors with the company’s elevated valuations signal caution for potential investors.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.