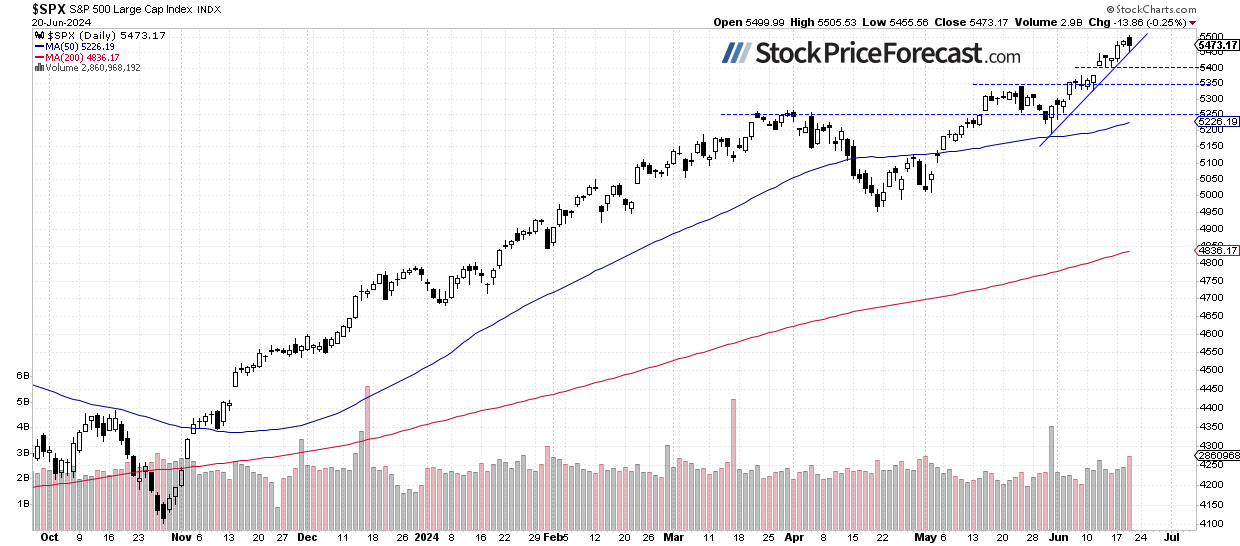

Yesterday’s trading session witnessed the stock market’s continued tumult, as the S&P 500 surged to a new record high of 5,505.53 before ultimately closing 0.25% lower. Today, futures contracts suggest an opening 0.2% lower, setting the stage for another day of uncertainty. Investors eagerly await the release of crucial U.S. PMI data at 9:45 a.m., but the true highlight of the day lies in the ‘quadruple witching’ phenomenon – a quarterly occurrence involving derivatives contract expirations that typically ushers in heightened market turbulence.

In a prescient forecast for June, I pondered:

“For the last three months, the S&P 500 index has been traversing record highs, firmly above the 5,000 mark breached back in February. It appears to be a consolidation within a prolonged uptrend, yet there looms the possibility of a significant correction. What path will it take? Guided by the age-old adage, ‘the trend is your friend,’ the likeliest scenario points toward further advancements in the days ahead.

Nevertheless, a red flag would emerge with a slip below 5,000. Such a development would raise concerns of a deeper correction and a reversal of fortunes. I’d assess the odds of a bullish upturn at 60/40 – while not ruling out a downward trend. The market eagerly awaits cues from the Fed regarding potential interest rate adjustments, with the looming earnings season towards month-end poised to steer market sentiment.”

Despite prevailing uncertainties, investor sentiment appears relatively steady, as demonstrated by the AAII Investor Sentiment Survey, which indicates that 44.4% of individual investors exhibit bullish tendencies, with a mere 22.5% leaning bearish (a drop from the previous week’s 25.7%). The AAII sentiment serves as a contrarian indicator, implying that heightened bullish sentiments might signify unwarranted complacency and a degree of market apathy. Conversely, a surge in bearish sentiments often paves the way for market upswings.

Notably, the S&P 500 index maintains its position above the upward trend line, evident from the daily chart.

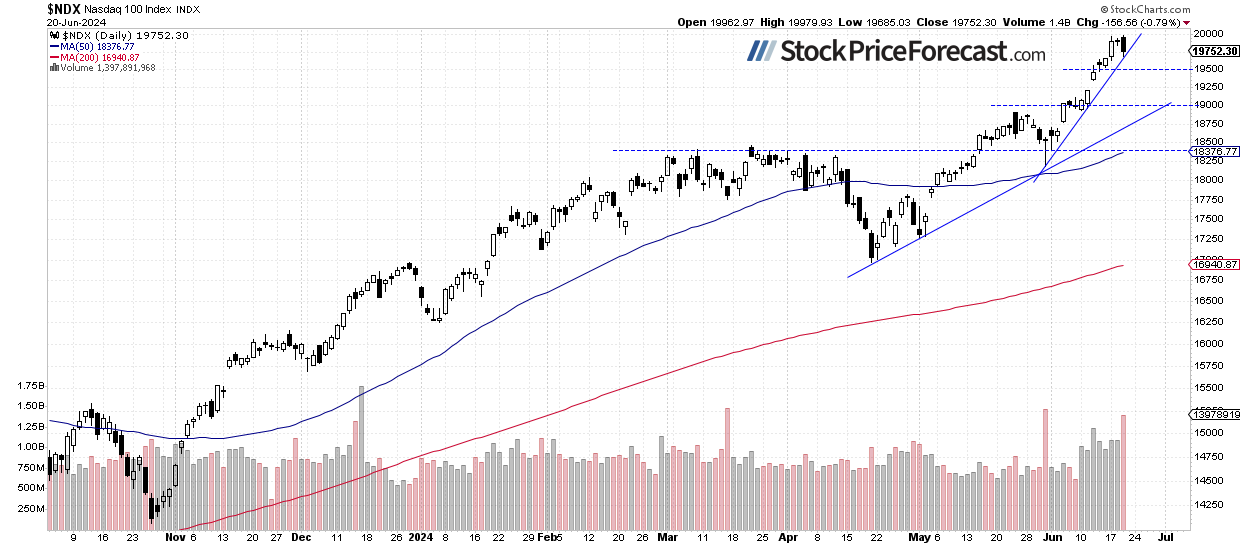

The Nasdaq 100: Navigating Volatility Above 20,000

The technology-centric Nasdaq 100 registered another record high of 19,979.93 yesterday before retracing most of its gains and concluding 0.79% lower. At present, it appears to be undergoing a correction phase; however, a breach beneath 19,500 could potentially spur heightened selling pressure. The Nasdaq 100 is anticipated to open 0.3% lower today.

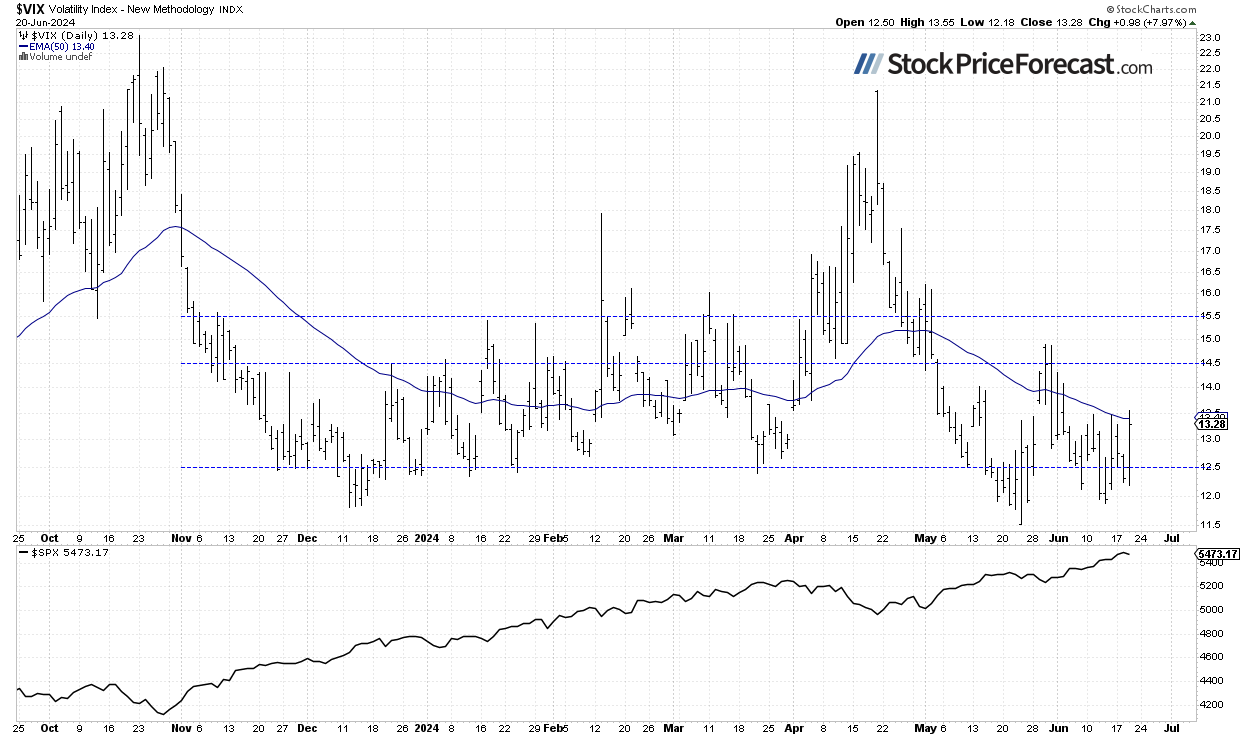

Amidst Rising Fear: VIX Touches Above 13 Again

The VIX, commonly referred to as the fear gauge, derives from option prices. In late May, it plumbed a medium-term low of 11.52 before rebounding to approximately 15 on concerns over corrections. Recent movements have seen the VIX navigate back towards 12, closing above 13 for the first time since early June – indicating a surge in market apprehension.

Traditionally, a declining VIX denotes dwindling market fears, while an ascending VIX coincides with market downturns. Paradoxically, a lower VIX heightens the likelihood of an impending market reversal.

Delving Into Futures Contracts: Below 5,550

An examination of the contract’s hourly chart reveals a retreat following recent advances subsequent to attaining an overnight record high around 5,588 on Thursday. Market dynamics saw a dip to a local low of 5,525 yesterday, with today’s trading hovering in proximity to that support level. The support base aligns around 5,500, characterized by recent local highs.

Concluding Thoughts

The S&P 500 index anticipates a modestly lower opening today, potentially extending the previous day’s downtrend. The trajectory hinges significantly on the forthcoming PMI data and the derivatives expirations later in the day. Envisioned within the day is a probable scenario of volatile consolidation. Is the recent upward trend reversing its course? As of now, it seems akin to a transient downward correction, yet the market may probe lower realms before reemerging.

My current short-term standpoint remains neutral.

Here’s a condensed gist:

- The S&P 500 exhibited a reversal from yesterday’s record high, presently undergoing a corrective phase.

- Recent market upswings persisted amidst mixed signals and escalating uncertainties.

In my assessment, the short-term outlook maintains a neutral stance.