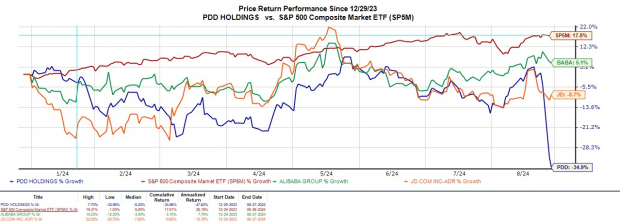

PDD Holdings PDD held a shining torch in the stock market in recent years before its recent plunge of 30% post its Q2 earnings release. The multinational e-commerce giant wrenchingly admitted that an impending profitability downturn looms darkly on the horizon, with the clouds set to gather come Q3.

Despite offering cut-price goods that enabled it to snatch market portions from e-commerce juggernauts like Alibaba BABA and JD.com JD, PDD now stands at a crossroads of stiffer competition and broader economic anxieties reigning over China.

Image Source: Zacks Investment Research

PDD’s Q2 Performance

Q2 witnessed PDD amassing $13.35 billion in revenue, marginally below estimates by 2%; nevertheless, the figures soared by a colossal 85% from the $7.2 billion recorded in the corresponding quarter. Profits, on the other hand, saw an upward surge, with Q2 EPS clocking in at $3.20, a 10% beat over expectations and an astounding leap of 122% from the $1.44 per share in the prior year.

PDD’s remarkable streak of surpassing Zacks EPS Consensus for 14 consecutive quarters showcases an average earnings surprise of 41.14% in its last four quarterly displays.

Image Source: Zacks Investment Research

PDD’s Growth Trajectory

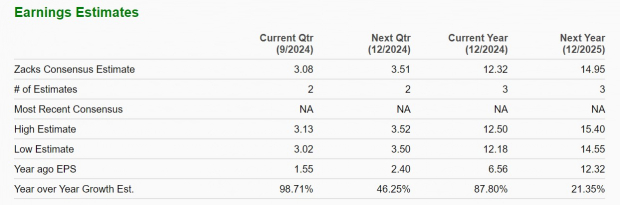

As per Zacks projections, PDD’s total sales are expected to ascend by 62% in fiscal 2024, aiming for $56.27 billion compared to the previous year’s $34.64 billion. Further, in the FY25 forecast, a 27% rise is anticipated, reaching $71.59 billion.

Brimming with potential, annual earnings are set to rocket by 87% this year, soaring to $12.32 per share from $6.56 in 2023. The trajectory is poised to continue upwards with a further 21% jump in FY25. However, caution is advised as the predicted decline in earnings estimates for FY24 and FY25 following the ominous profitability warning cannot be overlooked.

Image Source: Zacks Investment Research

Valuation Comparison

Priced at $95 per share, PDD sits at an 8.1X forward earnings multiple, marking a substantial discount to the S&P 500’s 23.7X valuation. Despite the recent nosedive, PDD now hovers near Alibaba’s 9.4X but above JD.com’s 6.5X multiples.

Image Source: Zacks Investment Research

In Conclusion

Following the Q2 disclosures, PDD Holdings stock secures a Zacks Rank #3 (Hold) label. While the temptation to pounce on the plummeting PDD shares post-earnings is palpable, the sobering reality emerges that PDD now treads the same path as numerous Chinese e-commerce entities—ostensibly undervalued yet submerged in the tempest of market volatility fueled by broader economic jitters.

PDD indeed presents an attractive proposition for long-haul investors given its expansive growth projections, but discerning buyers would do well to stay vigilant for potentially more lucrative openings ahead.