In a recent update, it was determined that the NASDAQ 100 was expected to experience a correction, based on the Elliott Wave Principle.

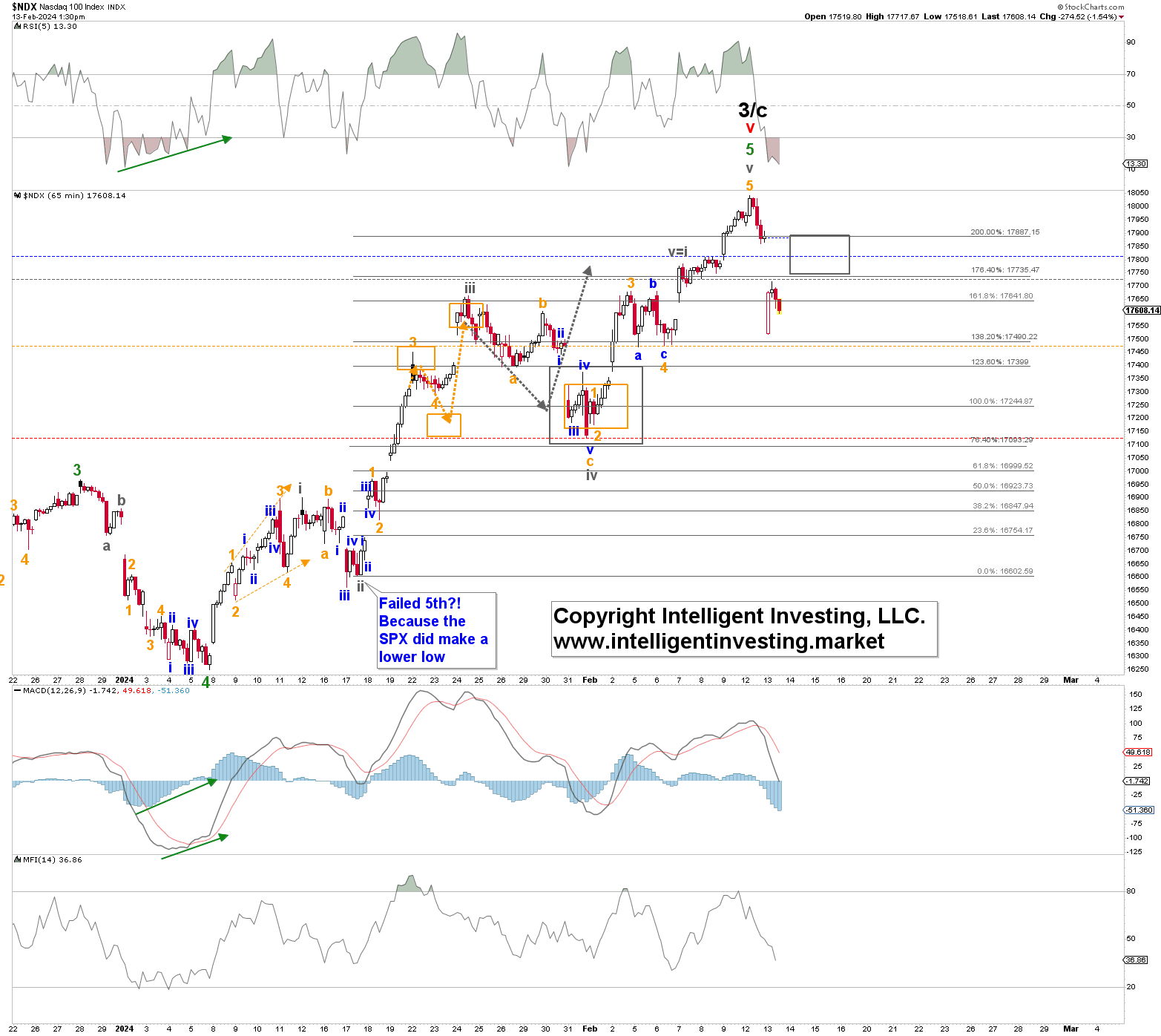

“An impulse consists of five waves; so far, there have been only three waves since the January 5th low. Hence, we must expect another grey W-v to ideally $17738-890 once the current minor correction since last week’s high has run its course while staying above critical price levels. Note that the grey W-iv typically reaches the 100% Fib-extension level but can also bottom at 123.60% (shallow) or 76.40% (deep).”

Subsequently, the index reached a low at the 76.40% level and then rallied, only to experience a sharp decline. It is crucial to note that this forecast is based on potentials rather than certainties, and specific price levels play a significant role in verifying the market’s trajectory.

Figure 1. NDX hourly chart with detailed EWP count and technical indicators

Today, the index broke below two of the four colored warning levels, indicating an increased caution for market participants. A further decline would strongly suggest that the recent rally has concluded.

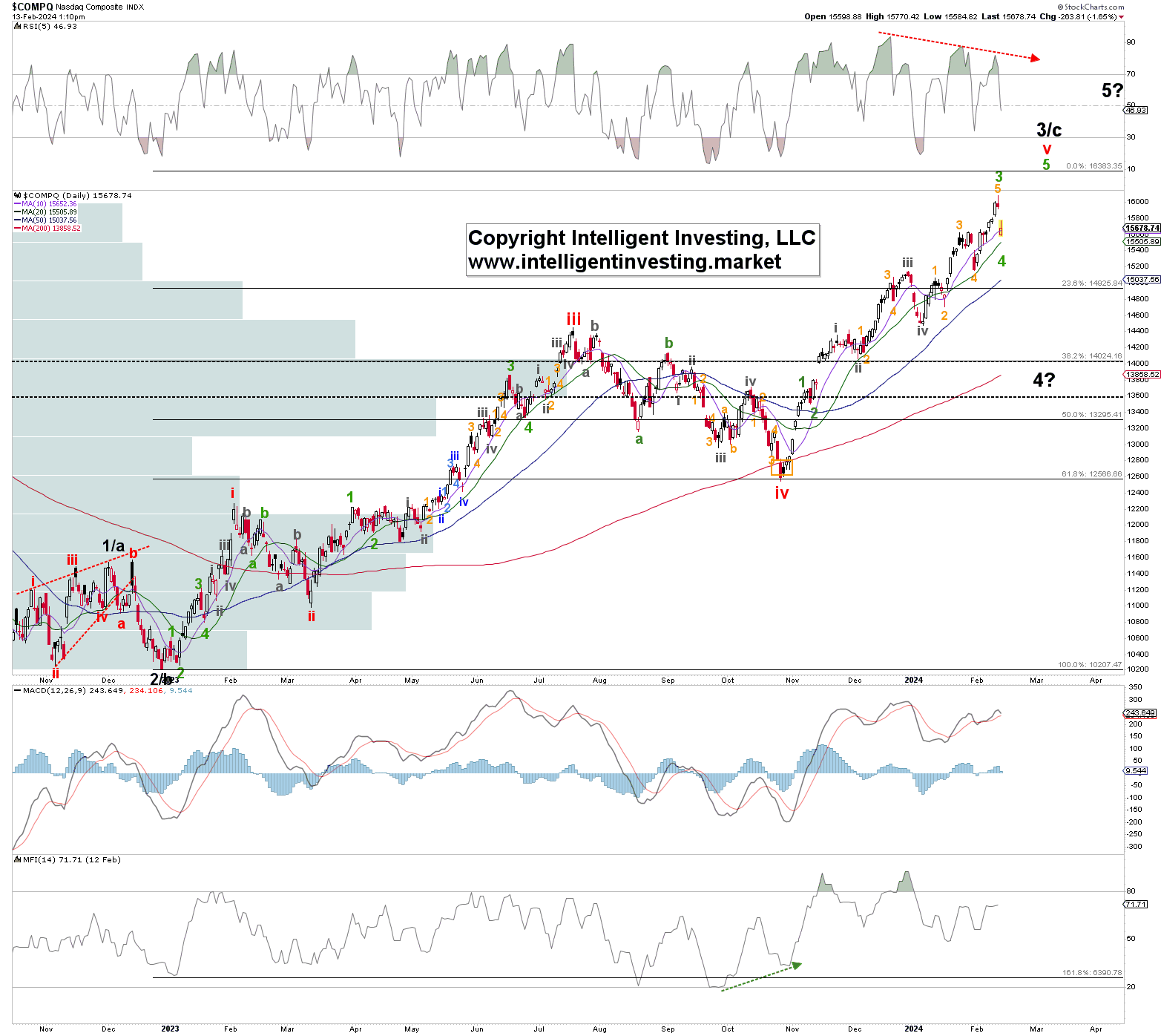

However, the alternative scenario using the regular NASDAQ paints a slightly different picture, as displayed in Figure 2 below.

Figure 2. Daily NAS chart with detailed EWP count and technical indicators

Given the recent price action, interpreting the market from an EWP perspective is complex. A pullback in the near term could be expected, with a break below certain levels signaling a potential downturn. Moreover, a break below a specific low may suggest a broader market shift.