- Alibaba and PayPal have failed to stage a rally despite broader market recoveries.

- Both stocks have been hit hard, still down 70-80% from their all-time highs following the 2022 bear market.

- The key question is whether these stocks can recover or if their best days are behind them.

Once market darlings, Alibaba and PayPal have remained grounded despite broader market recoveries. These two stocks, heavily impacted by the 2022 bear market that followed the meme stock frenzy of 2021, are still down a staggering 70-80% from their all-time highs. The question on every investor’s mind: will these fallen giants ever recover, or is their story over?

Let’s take a look at each stock individually to determine if any of the stocks are worth a bet at current levels.

Alibaba: Undervalued but Overshadowed?

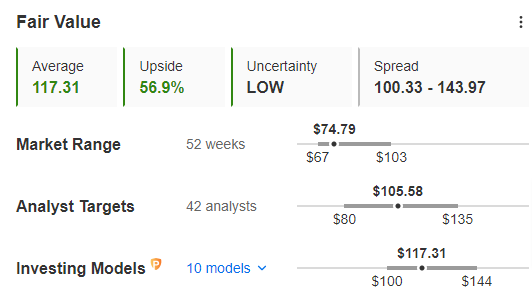

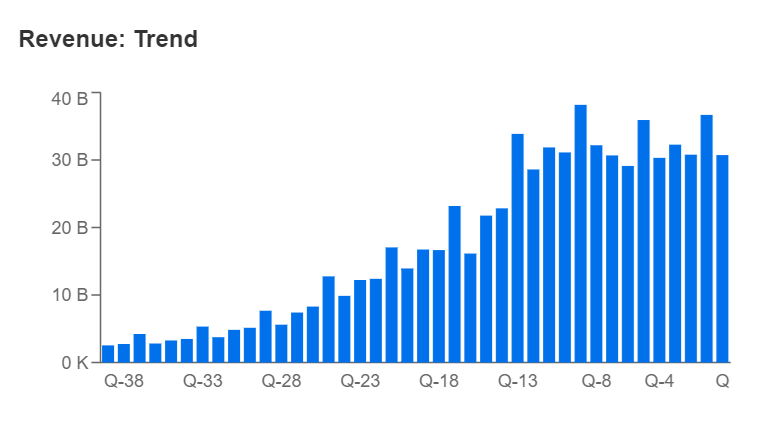

Alibaba’s stock price currently sits at a significant discount (56.9%) to its intrinsic value, as estimated by ten different mathematical models. However, the company has faced recent challenges, including a slowdown in revenue and profit growth.

Source: InvestingPro

Additionally, political uncertainties surrounding the Chinese government’s control over businesses pose a difficult-to-quantify risk. Despite these concerns, Alibaba boasts a strong balance sheet. The company’s liquid assets and short-term investments can comfortably cover its current debt, and its current assets outweigh current liabilities.

Source: InvestingPro

While the stock appears undervalued, the political risk factor remains a major concern for me. Given this uncertainty, I wouldn’t personally include Alibaba in my portfolio, even though it has potential for recovery at its current valuation.

PayPal: Discount Potential Despite Short-Term Headwinds

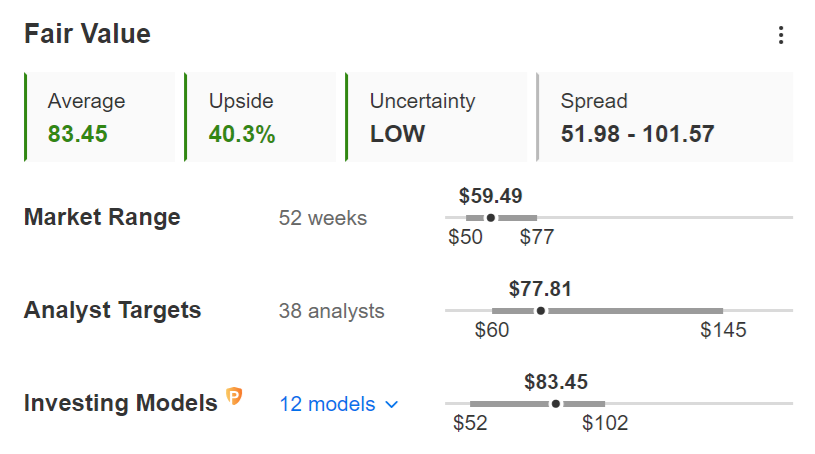

PayPal’s stock seems significantly undervalued, affected by two main factors: competition and margin reduction. These bearish elements have weighed heavily on the stock, but the new management appears to be steering the company in the right direction.

Source: InvestingPro

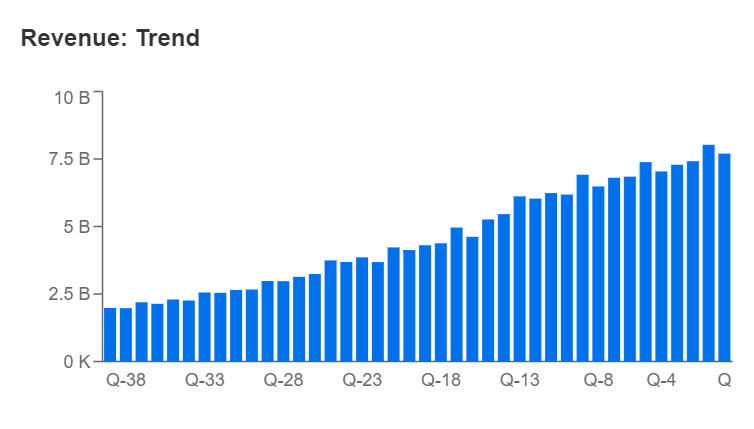

Competition, particularly from Apple Pay, poses a significant risk. Additionally, margin compression, primarily due to the lower conversion rates of unbranded checkouts (Braintree) compared to branded checkouts, has also impacted the stock. However, it is important to focus on PayPal’s core business: payment transaction fees. The key metric here is Total Payment Volume (TPV), which continues to grow steadily.

Source: InvestingPro

Despite the current challenges, several factors indicate a brighter future for PayPal. Innovations such as Fastlane and ADV are not yet reflected in the stock’s current valuation. Additionally, the market seems to be pricing the stock as if future cash flow growth will be nearly stagnant, which may not be the case.

Source: InvestingPro

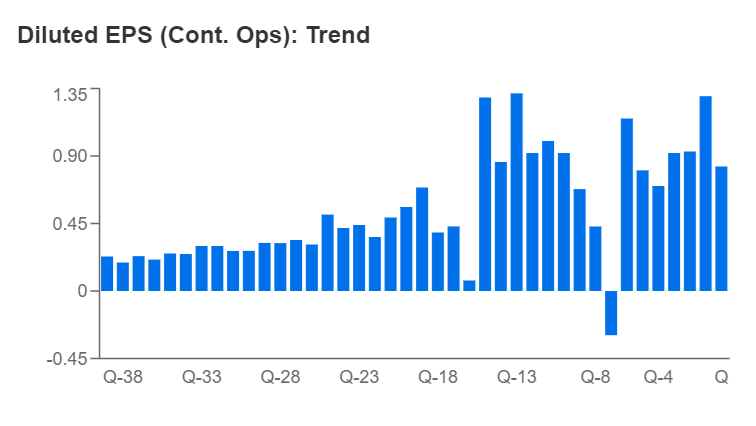

Recent data shows that revenues and EPS are beginning to recover from the 2022 decline. The stock’s free cash flow (FCF) return now exceeds 10%, an attractive figure supported by an ambitious buyback plan averaging $5 billion per year. This buyback strategy suggests that, theoretically, PayPal could repurchase the entire company in 13 years at this pace.

Investors should keep an eye on the upcoming quarterly report. While it’s unrealistic to expect a quick recovery, patience and a long-term perspective (at least 2-3 years) are essential. Buying above $300 was ill-advised, but at current levels, the stock presents a different, more promising story—provided investors exercise caution and proper money management.

Exclusive Summer Discounts: Seize the Opportunity!

Tired of watching the big players rake in profits while you’re left on the sidelines? InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips! Don’t miss this limited-time offer. Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, and as such, it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and the associated risk remain with the investor.