US Inks Tariff Deals with EU, Japan: Sell the News?

If history is any teacher, markets are the master manipulator and Wall Street is ‘bent on fooling the masses.’ 2025 is a perfect example of how market psychology works. Following President Donald Trump’s ‘Liberation Day’ blanket reciprocal tariffs on April 1st, US stocks plunged into a bear market. As trade negotiations looked bleak, investors and some of Wall Street’s top minds began to predict the worst. For instance, Ray Dalio, manager of Bridgewater Associates (the world’s largest hedge fund) predicted a recession. CNBC’s Jim Cramer boldly predicted another ‘Black Monday’ (when the S&P 500 Index crashed 20% in a single session).

As is usually the case, the market sniffed out the future better than the crowd. Just as fear hit a fever pitch, US stocks began rallying and climbing the proverbial ‘Wall of Worry.’ Fast forward to today, the major US equity indexes are each at new highs, and the US has inked trade deals with its biggest trading partners, including China, Japan, and the European Union.

Image Source: TradingView

It’s tough to argue with the Trump administration’s trade wins. For example, Trump critic and left-leaning political commentator and comedian Bill Maher has admitted he was wrong about Trump’s tariff policy. Nevertheless, savvy investors understand that August may be a time when the ‘sell the news’ phenomenon takes hold. Often, when a highly anticipated event or news announcement occurs, investors take profits, realizing that the news’ impact has already been factored into stock prices. With the major indices essentially flat after the EU deal, a sell-the-news event may be underway.

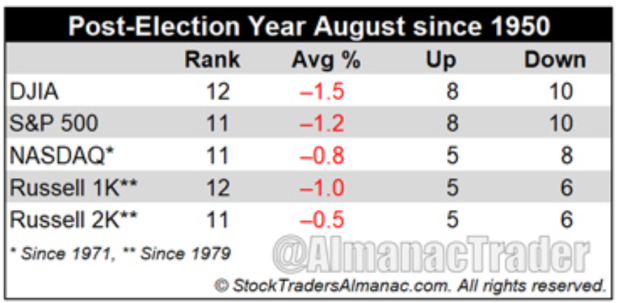

August Post-Election Seasonality is Poor

Jeffrey Hirsch, author of “The Stock Trader’s Almanac,” does the best work on seasonal patterns on Wall Street. According Hirsch, “August is the worst month in post-election years for the DJIA and Russell 1000, 2nd worst for the S&P 500, Nasdaq, and Russell 2000. Average declines in post-election year Augusts range from -0.5% to -1.5%. Each index has seen more declining post-election year Augusts than positive.”

Image Source: (stocktradersalmanac.com)

In addition to troubling seasonality patterns, many of Wall Street’s top institutional investors take off on vacation, leading to illiquid and tricky markets during ‘the summer doldrums.’

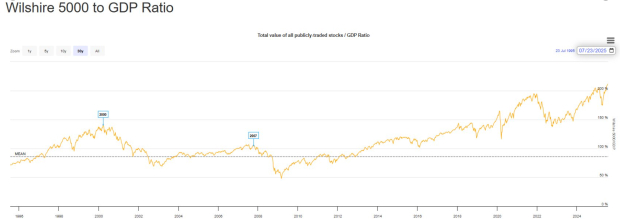

‘The Warren Buffett Indicator’ Flashes a Warning Sign

‘The Warren Buffett Indicator’ looks at the stock market’s valuation versus gross domestic product (GDP). The indicator is calculated by comparing the Wilshire 5000 Total Market Index to GDP. At a current ratio of 212% publicly traded stock valuations to GDP, the indicator is flashing its most ‘expensive levels in history.’

Image Source: Zacks Investment Research

Though such a reading should raise a yellow flag, there are two critical caveats investors must understand:

1. Valuations are a Poor Timing Device: While valuations can warn investors of a frothy market environment, they are a poor timing device. For instance, Buffett himself did not take advantage of historic gains during the Internet bubble due to his valuation metrics. Although stocks ultimately declined, the gains on the way up were monumental.

2. Denominator Can Increase: A bloated valuation does not necessarily mean that a market top is imminent. For example, suppose stocks correct or move sideways and the denominator (GDP) increases significantly (which is a distinct possibility with the current AI boom). In that case, the lopsided valuation can return to equilibrium.

Earnings Reports will Dictate the Short-term Market Action

Despite the short-term caution signals, earnings will likely dictate the short-term market action as Wall Street investors brace for the busiest part of earnings season. Big tech earnings from Meta Platforms (META), Microsoft (MSFT), Apple (AAPL), Arm Holdings (ARM), and Amazon (AMZN) are looming. Investors will focus on these tech juggernauts and will listen closely to gauge whether AI growth and CAPEX spending can continue to drive the market higher.

Bottom Line

While stocks continue to print fresh all-time highs, the ‘sell the news’ phenomenon, August post-election seasonality, and ‘The Warren Buffett Indicator,’ suggest that August may be a good time for active investors to take the foot off the gas pedal.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).