Autoscope Technologies Corporation AATC has been upgraded to “Outperform” on the back of robust dividend returns, strong end-market support, accelerating product momentum and highly attractive valuation.

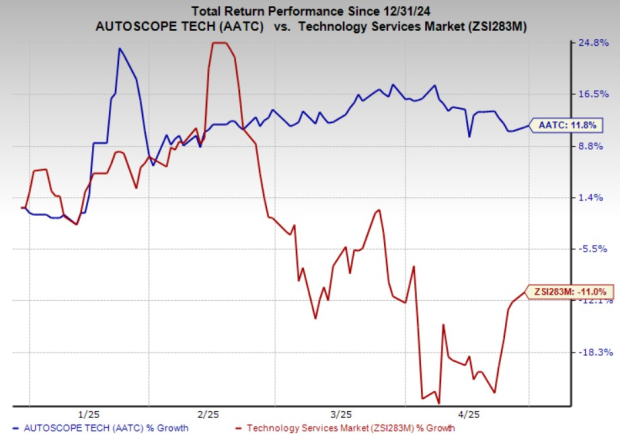

Price Performance

AATC shares have outperformed the industry year to date. The stock has gained 11.8% against the industry’s 11% decline in the said period.

Image Source: Zacks Investment Research

The following factors support the investment thesis.

Attractive 7% Dividend Yield Signals Stability

Autoscope offers a compelling dividend yield of approximately 7%, factoring in its quarterly dividend of 15 cents per share (increased in the fourth quarter of 2024) and a recent trading price of $8.60. This follows a one-time special dividend of $1.32 per share paid out in February 2024. Backed by $4.4 million in cash and more than $5 million in annual operating cash flow, the dividend program is financially secure. This income stream provides downside protection and is likely to attract yield-focused investors, especially in a volatile rate environment.

Federal Infrastructure Funding Supports Long-Term Demand

The U.S. DOT’s Safe Streets and Roads for All (SS4A) program, which provides $5 billion in funding through 2026, directly supports Autoscope’s intelligent traffic solutions. This federal initiative, aimed at achieving “Vision Zero,” prioritizes traffic safety infrastructure — a core application for AATC’s products.

As agencies deploy funds, demand for above-ground detection platforms like Autoscope Vision, IntelliSight and Analytics is expected to scale, positioning the company for multi-year revenue visibility and order growth.

North America Rollout of Proven Product in 2025

Autoscope plans to introduce its high-performance IntelliSight platform, which has already been launched in the EMEA markets, to North America in 2025 under the new brand “Autoscope OptiVu.” The AI-powered solution provides multi-modal detection (vehicles, pedestrians and bicycles) and integrates seamlessly with smart city infrastructure. Its prior market validation in Europe enhances confidence in commercial success. The 2025 North America launch is expected to open a large incremental revenue stream while reinforcing the company’s competitive edge.

High-Margin Product Line Gains Share Rapidly

Product sales more than doubled in 2024 to $429,000, accounting for more than 3% of total revenues versus just 1.3% in 2023. Importantly, fourth-quarter 2024 product revenues surged to $292,000, representing almost 9% of the quarter’s sales, driven by demand for Wrong Way detection, Autoscope Analytics and IntelliSight. These products achieve gross margins of up to 40% for the fourth quarter of 2024, significantly higher than the full-year 2024 margin of 24.5% and a notable improvement from the negative margins recorded in 2023. This shift signals a meaningful and profitable diversification beyond legacy royalties.

EBITDA to Free Cash Flow Conversion Strong

Autoscope’s operating model exhibits excellent capital efficiency. In 2024, the company generated $6.2 million in income from operations and converted $5.2 million into cash from operating activities, reflecting an 84% EBITDA-to-FCF conversion rate. This strong correlation between earnings and cash underscores disciplined expense control and capital allocation. The high conversion ratio enhances Autoscope’s ability to self-fund dividends, invest in R&D, and weather macroeconomic uncertainty without external financing needs.

Undervalued at 6X Trailing EBITDA

Based on $6.7 million in 2024 EBITDA and an enterprise value of around $40 million, Autoscope trades at just 6X TTM EBITDA, well below the 10-15X typical for infrastructure-tech peers. As product revenues scale and investor confidence in the latest launches builds, the stock’s multiple can rerate meaningfully. The current discount offers a margin of safety for value investors with medium-term horizons.

Strong Balance Sheet, With $7M in Liquidity

As of the end of 2024, Autoscope held $4.4 million in cash and $2.8 million in short-term investment securities, totaling $7.2 million in liquid assets. With minimal debt (total $1.6 million), strong cash flow and no pending large capital obligations, the company maintains financial flexibility. This liquidity buffer supports the dividend policy, cushions execution risk in product rollouts and provides optionality for opportunistic investment. Autoscope’s healthy balance sheet remains a key strategic asset.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Autoscope Technologies Corporation (AATC) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).