SUMMARY

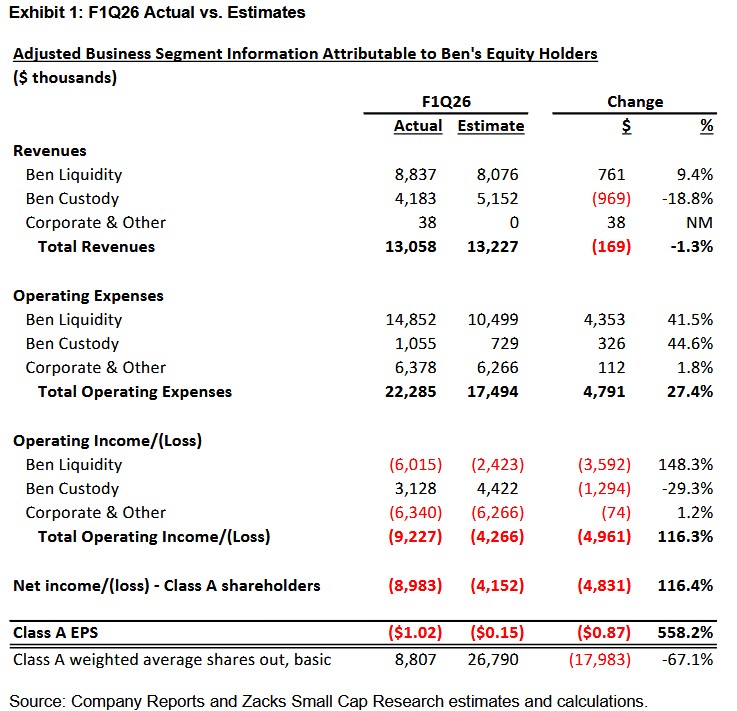

On an adjusted basis, BENF reported a net loss of ($1.02) per Class A share based on our calculations vs. our ($0.15) estimate. The miss primarily reflected higher-than-expected operating expenses and lower weighted-average shares outstanding for the quarter. Lowering our F2026 (Mar) and F2027 adjusted EPS estimates from ($0.44)/($0.24) to ($1.61)/($0.50). No change to our $2.00 price target.

- Unique business model, with sustainable competitive advantages

- Growth – shifting into gear

- Exposure to optimized alternative asset portfolio

OUTLOOK

While we still see considerable upside potential for the stock over time, we recognize a meaningful upward revaluation likely necessitates sustained growth in loan origination volumes driving an inflection in profitability

HISTORICAL STOCK PRICE

Beneficient Price

Beneficient price | Beneficient Quote

Actual vs Estimate

Image Source: SCR

F1Q26 EARNINGS: ADJUSTED OPERATING INCOME SHORTFAL

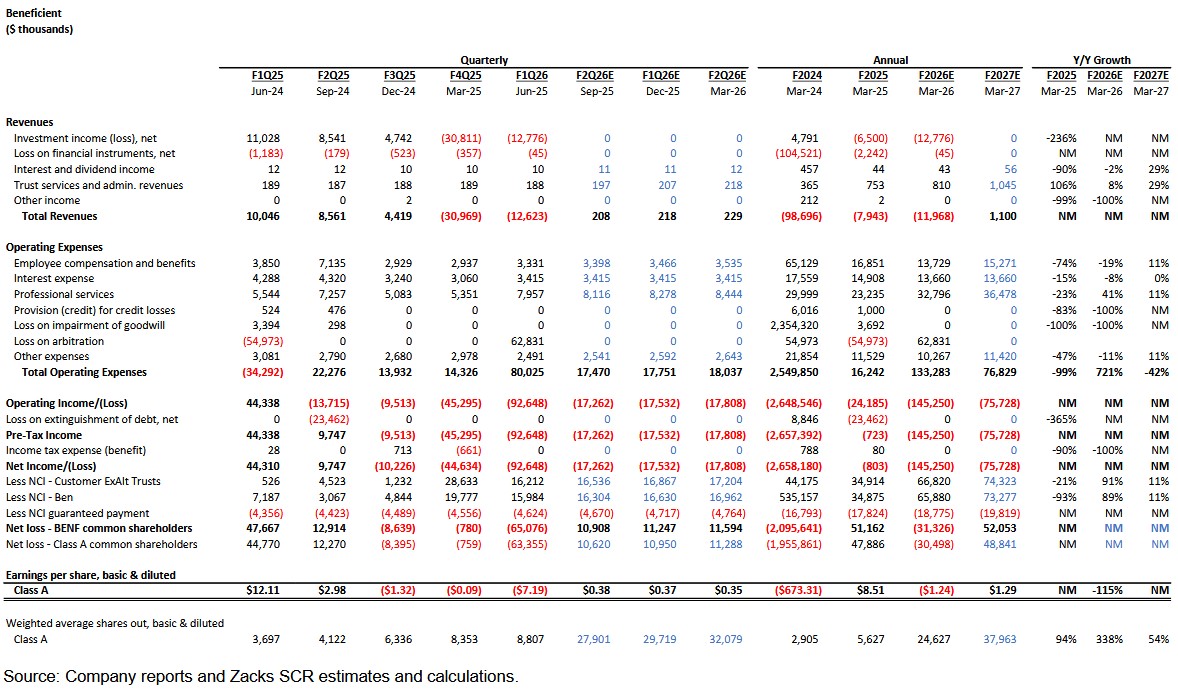

Post-market close on 10/20/25, Beneficient reported F1Q26 (June) earnings results and filed the company’s Quarterly Report of Form 10-Q. On a GAAP basis, BENF reported a net loss of $7.19 per Class A diluted share for F1Q26 versus net income of $12.11 per share for F1Q25. The year-over-year variance primarily related to less favorable GAAP revenue trends as well as a $62.8 million arbitration loss charge in F1Q26 compared to a $55.0 million release of a loss contingency accrual in the year-ago quarter.

BENF reported ($12.6) million of GAAP revenues in F1Q26 compared to $10.0 million in the prior-year period. The year-over-year decline primarily reflected investment losses driven by changes in the NAV of investments in alternative assets held by certain of the Customer ExAlt Trusts.

GAAP operating expenses totaled $80.0 million in F1Q26 compared to ($34.3) million for the prior-year period. The year-over-year variance largely reflected a $62.8 million arbitration loss charge in F1Q26 compared to a $55.0 million release of a loss contingency accrual in the year-ago quarter. Excluding non-recurring items, operating expenses totaled $17.2 million for the most recent quarter, or essentially flat relative to the same period of fiscal 2025.

Adjusted segment revenues attributable to BENF equity holders comprising Ben Liquidity interest income, Ben Custody fees, and Corporate & Other totaled $13.1 million for F1Q26, down 8% from the prior quarter’s level. While Ben Liquidity interest income increased by 4% on a sequential basis, Ben Custody fees were down 22% on a sequential-quarter basis – consistent with lower NAVs of custodied assets given dispositions, distributions, and unrealized losses partially offset by new originations.

BENF reported an adjusted segment operating loss attributable to BENF equity holders of $9.9 million for F1Q26 compared to a loss of $13.9 million in F4Q25. The favorable Q/Q trend was largely a function of a lower operating loss for the Ben Liquidity segment partially offset by a step down in Ben Custody revenue/operating income. On an adjusted basis, Beneficient reported a net loss of $1.02 per Class A share versus our $0.15 estimate. Relative to our model, the miss was primarily a function of higher-than-expected operating expenses and lower shares (Exhibit1).

Turning to Beneficient’s balance sheet, the fair value of Customer ExAlt Trust investments totaled $264 million as of June 30, 2025, down from $291 million as of March 31, 2025. Investments on the balance sheet serve as collateral for Ben Liquidity’s loan portfolio. Net of allowances for credit losses, Ben Liquidity’s loan balances totaled $231 million as of June 30, 2025 compared to $244 million as of March 31, 2025. Distributions from alternative/custodied assets totaled $3.7 million for F1Q26 compared to $7.2 million in F1Q25. Finally, as of June 30, 2025, the company maintained $7.6 million of cash and cash equivalents and $108.4 million of total debt.

LOWERING EPS ESTIMATES

After updating our model for F1Q26 actuals, we are taking down our F2026 and F2027 adjusted EPS estimates. On an adjusted business segment attributable to BENF equity holders basis, we forecast net losses per Class A share of $1.61 in F2026 followed by $0.50 in F2027 – down from our prior $0.44 and $0.24 net loss per share estimates, respectively, primarily reflecting a flatter revenue trajectory and inflated expense assumptions. Looking ahead, the key revenue driver for Beneficient remains loan origination volumes, with the company generating interest income and related fees based on the level and growth of financing transactions, as well as the trajectory of underlying collateral over time.

Turning to valuation, no change to our $2.00 price target. The recent CEO turnover adds near-term uncertainty to the company’s strategic direction and ownership profile, particularly given the seemingly contentious nature of theprior CEO’s departure, as well as his holdings of Class B and preferred shares. That said, we still see considerable upside potential for the stock over time, though we recognize a meaningful upward revaluation likely necessitates sustained growth in loan origination volumes driving an inflection in profitability.

LOWERING EPS ESTIMATES

LOWERING EPS ESTIMATES

INVESTMENT THESIS

Beneficient leverages a proprietary FinTech platform and an innovative/fiduciary trust structure branded as the ExAlt Plan to provide early exit liquidity solutions and custody/data analytics services to holders of alternative assets including medium-to-high net worth (MHNW) individuals and small-to-midsized institutions (STMIs). In addition, the company delivers primary capital solutions to fundraising General Partners (GPs).

Our investment thesis revolves around:

- Unique business model, with sustainable competitive advantages: Beneficient’s differentiated trust structure and comprehensive FinTech platform delivers liquidity solutions to Medium-to-High Net Worth investors and Small-to-Medium Sized Institutions in a timely and cost-effective manner with price certainty. From a structural standpoint, Beneficient’s trust company originates loans to specialized trusts called the Customer ExAlt Trusts, with loan proceeds allocated to acquiring alternative assets from its customers that are Limited Partners (LPs) in funds. In turn, underlying alternative assets acquired by the Customer ExAlt Trusts serve as collateral for the loans, with the trusts drawing on distributions/proceeds from investments to fund loan payments, pay transaction, trust, and custody fees, and make distributions to the beneficiaries of the Customer ExAlt Trusts. In exchange for alternative asset holdings (and unfunded commitments), Beneficient offers customers cash, BENF common/preferred stock, or a combination thereof. Ben AltAccess®, the company’s proprietary end-to-end technology-enabled engine, provides liquidity solutions and related trust, custody, data analytics, transfer agency, and broker-dealer services to holders of alternative assets within an online portal built to facilitate timely and cost-effective transactions. Separately, Beneficient’s state-chartered trust company subsidiary provides financing, trust, and custody services to alternative asset trusts, and is subject to regulatory oversight by the Kansas Office of the State Bank Commissioner, thereby adding credibility to the process and instilling confidence in customers.

- Growth – shifting into gear: We expect origination volumes to start to reaccelerate reflecting a number of powerful industry and company-specific factors. First, ongoing growth in alternative AUM generates rising demand for liquidity, particularly as distribution activity remains muted more broadly reflecting lackluster exit markets and extended holding periods. While GPs can access the secondary markets for larger, more complex liquidity transactions, Beneficient focuses on underserved MHNW investors and STMIs that value certainty of price, cost, and time when seeking early liquidity options. Of the $16+ trillion of global alternative AUM, recent studies estimate MHNW individuals and STMI investors in the U.S. hold a growing $2+ trillion of related assets, with annual demand for liquidity reaching $100+ billion over the next five years. On top of that, the company’s GP Solutions and Primary Commitment Program businesses target private funds with identifiable liquidity and fundraising needs. In aggregate, related funds represent north of $400 billion of potential new business. As such, even a fractional win rate likely translates into meaningful transaction volumes and TBV/earnings accretion for BENF.

Second, Beneficient maintains a comprehensive go-to-market strategy spanning multiple clients, distribution channels, and approaches. GP Solutions targets funds facing identifiable liquidity needs including absolute/relative performance issues, limited carry potential, first-time managers, and those nearing winddown. The company’s Preferred Liquidity Program (PLP) offering leverages Beneficient’s AltAccess platform to deliver turnkey liquidity, primary capital, custody, and reporting services to platform customers. Furthermore, the recently launched Primary Capital Program (PCP) supports GP fundraising initiatives, with Beneficient financing commitments to new alternative asset funds.

- Exposure to optimized alternative asset portfolio: Beneficient has organically constructed a value- added balance sheet mostly comprised of loans collateralized by alternative asset fund holdings and direct investments. The underlying collateral remains well diversified across asset classes (private equity, real estate, natural resources, debt, and venture capital), sectors, and geographies, with holdings in approximately 200 private market funds and ~590 investments. Stepping back, management has deliberately built the loan portfolio by leveraging the endowment model of investing. More specifically, Beneficient’s approach incorporates longer-term time horizons, higher allocations to illiquid alternative assets, and broad diversification to lower correlations, minimize risk, and ultimately optimize returns. Continued growth of Beneficient’s alternative asset portfolio drives accelerating interest income on loans to the Customer ExAlt Trusts, with the potential to earn additional interest based on various factors. Furthermore, balance sheet growth promotes stepped up deal flow for Ben Liquidity, thereby driving higher revenues and operating income.

INVESTMENT RISKS

- Management in transition: While we applaud the Board’s decision to separate the Chairman and Chief Executive Officer roles, Mr. Heppner’s recent resignation adds uncertainty to the story, in our minds. More specifically, we look forward to learning more about incoming-CEO Mr. Silk’s vision for the strategic direction of the company along with his plans to accelerate growth and reach profitability on a sustainable basis. Furthermore, we await clarity on Beneficient’s ownership profile, particularly as it relates to Mr. Heppner’s holdings of Class B and preferred shares.

- GAAP reporting clouds underlying financial performance and economic interests: BENF’s GAAP income statement consolidates investment income and gains/losses on financial instruments held by Customer ExAlt Trusts, or the customized trust vehicles that acilitate the exchange of alternative assets for cash and/or equity or debt securities. Related income/losses represent NAV markups/markdowns on underlying fund holdings and fair value changes of equity/debt/derivative securities. Importantly, the Customer ExAlt Trusts are not legally owned by the company, and do not directly impact the economic interests of BENF equity holders. Furthermore, interest and fee income related to transactions between the company’s operating subsidiaries – Ben Liquidity and Ben Custody – and Customer ExAlt Trusts are eliminated from consolidated financial statements despite related allocations to BENF equity holders. From our perspective, GAAP reporting misrepresents the underlying financial performance of the company, particularly as it relates to the economic interests of BENF equity holders. As such, we focus exclusively on adjusted segment reporting for our analysis and valuation work.

- Model partially reliant on issuing BENF (preferred) stock to finance liquidity transactions: One of the primary reasons behind management’s decision to go public was the ability to offer BENF common/preferred stock in connection with Ben Liquidity’s delivery of early liquidity solutions for its customers’ alternative assets. Equity-linked transactions remain dependent on the relative attractiveness of BENF stock (versus other liquidity options and retaining illiquid assets). Factors influencing that analysis include projected stock price performance, volatility, and liquidity. To be sure, BENF has meaningfully underperformed since the de-SPAC in June 2023 reflecting various headwinds including the complexity of Beneficient’s structure and business model, continued net losses on a GAAP basis, and ongoing legal issues. As such, we suspect accelerating Ben Liquidity transaction volumes will be partially dependent on a sustained period of stock price stability and building trading volumes. Moreover, further equity issuances to fund alternative asset exchanges likely dilute existing shareholders and drive stepped up volatility of investment income on the GAAP P&L.

- Capital to fund growth: As Beneficient increasingly taps into the liquidity needs of MHNW individuals and STMI investors, LiquidTrust (cash considerations in exchange for alternative assets) acceptance and adoption will likely ramp up in concert. As such, the company seemingly needs broader access to capital to fund accelerating cash considerations, particularly as cash flow from operations likely remains insufficient to fund growth in the near term. One option is for management to tap the equity markets via a shelf registration.

PROJECTED GAAP INCOME STATEMENT

Image Source: SCR

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

This article originally published on Zacks Investment Research (zacks.com).