Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Read Also: EXCLUSIVE: March’s 20 Most-Searched Tickers On Benzinga Pro — Where Do Tesla, Nvidia, Apple, Applovin Stock Rank?

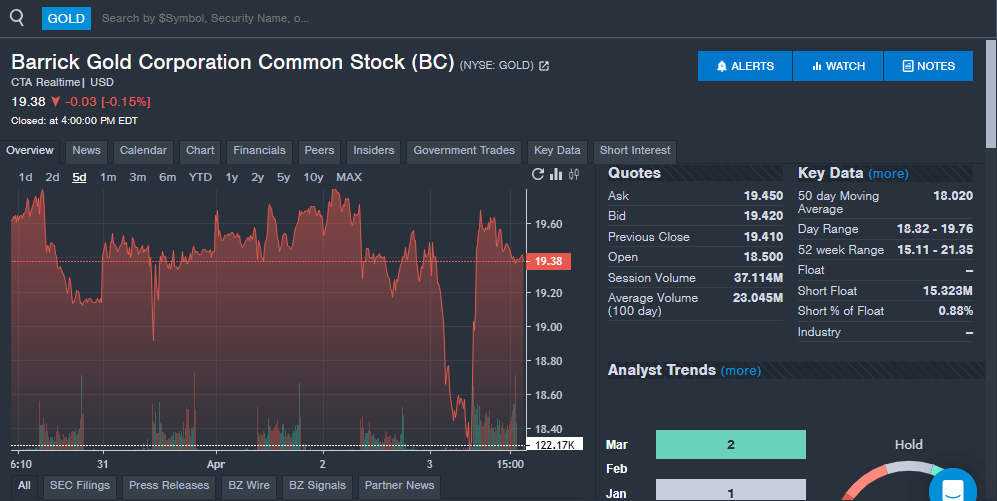

Barrick Gold Corporation GOLD: For the second-straight week, a gold stock makes its way on the Stock Whisper Index. Readers are paying increased attention to gold stocks with the price of gold at record highs.

Barrick Gold is expected to report first-quarter financial results later this month. Analysts expect the company to post earnings per share and revenue growth from the year-over-year period. Barrick has beaten analyst estimates for earnings per share in two of the last three quarters, but only four of the past 10 quarters overall. The company has missed revenue estimates in seven of the past 10 quarters, including two straight quarters. With improving prices for gold, investors will be waiting to see if Barrick’s financials improved and what the company is saying about the future.

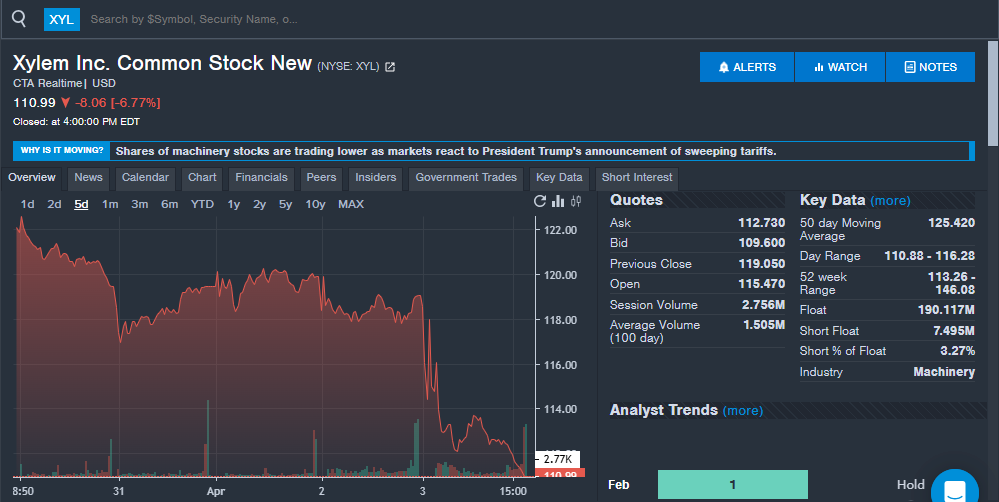

The Benzinga Pro chart below shows shares dropping slightly on the week in the midst of tariffs from President Donald Trump.

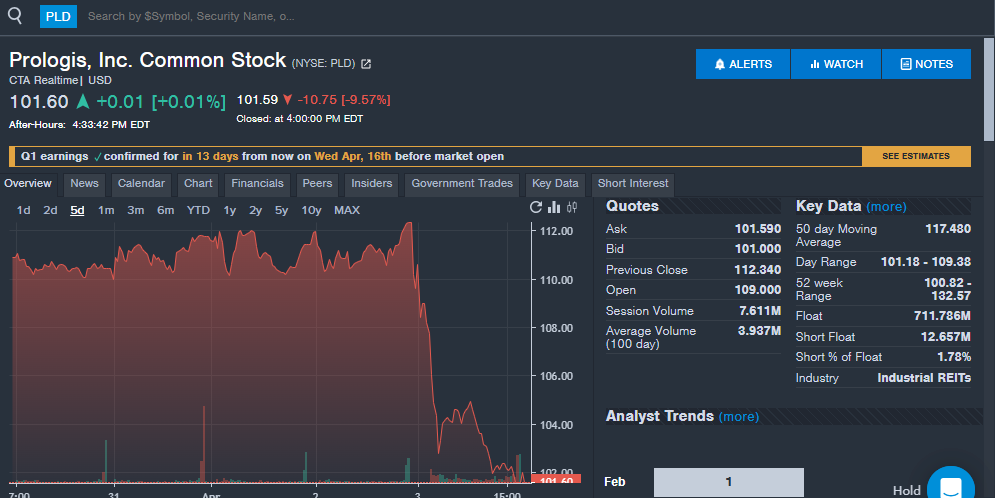

Prologis Inc PLD: The industrial and logistics real estate company saw increased interest from readers during the week.

The company is set to report first-quarter financials on April 16. Analysts expect the company to report earnings per share of $1.38, up from $1.28 per share in last year’s first quarter. Prologis has beaten earnings estimates in three straight quarters.

Analysts expect the company to report first-quarter revenue of $2.04 billion, up from $1.83 billion in last year’s first quarter. The company has missed analyst estimates for revenue in five straight quarters and seven of the past 10 quarters overall. Prologis will also host its annual shareholder meeting on May 8, which could provide back-to-back months of company news and catalysts.

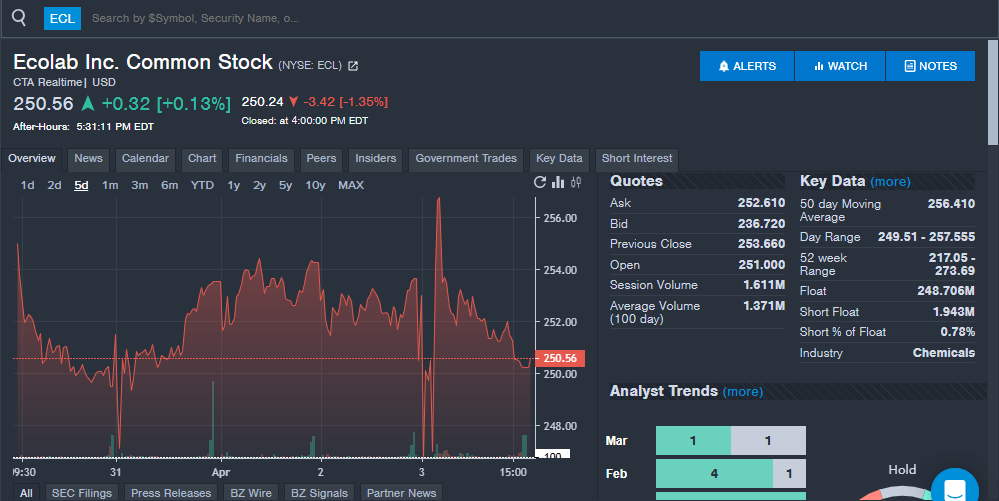

Ecolab Inc ECL: The cleaning and sanitation company saw strong interest from readers during the week, which comes with Baird maintaining a Neutral rating and lowering the price target from $288 to $277.

The company is expected to report first-quarter financial results later this month. Analysts expect the company to report earnings per share of $1.50, up from $1.34 in last year’s first quarter; it has beaten analyst estimates for earnings per share in nine straight quarters. Analysts expect the company to report revenue of $3.70 billion, down from $3.75 billion in last year’s first quarter. Ecolab beat analyst estimates for revenue in the fourth quarter and has beaten the estimate in five of the last 10 quarters.

“We enter 2025 confident in our ability to deliver continued strong performance in a dynamic environment. Growth in the United States, our largest and most profitable region, continues to be very strong,” Ecolab CEO Christophe Beck said after fourth-quarter financial results.

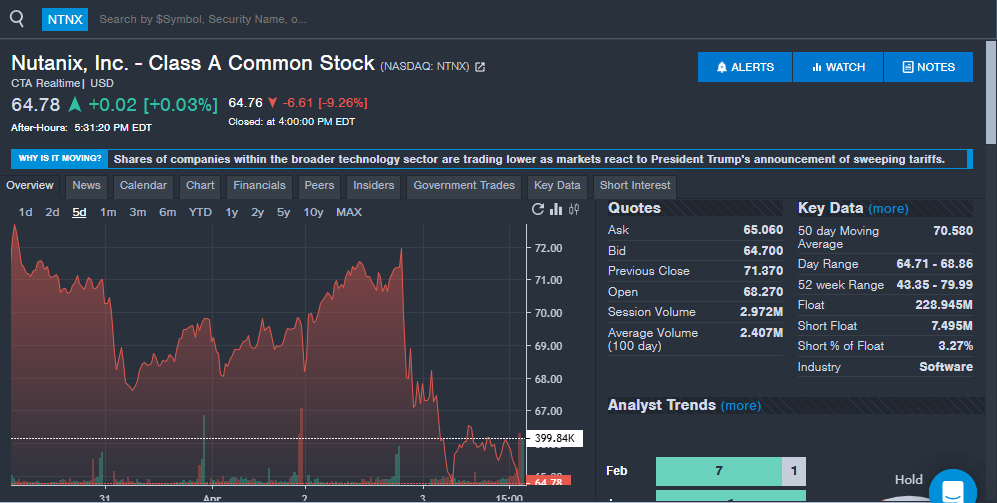

Nutanix Inc NTNX: The cloud software company saw increased interest from readers during the week.

In February, Nutanix reported second-quarter results that included revenue up 16% year-over-year and earnings per share of 56 cents. Both figures beat analyst estimates and led to several analysts raising their price targets on the stock. Nutanix also raised its full-year revenue, operating margin and free cash flow estimates. The company will host the NEXT 2025 event covering sectors like AI and the cloud from May 7 to May 9.

Xylem Inc XYL: The water technology company saw increased interest from investors during the week. The company will report first-quarter financial results on April 29.

Analysts expect earnings per share and revenue to increase from last year’s first quarter. Xylem beat analyst estimates for earnings per share in the fourth quarter and has beaten estimates in eight of the past 10 quarters overall. The company has beaten analyst revenue estimates in eight of the past 10 quarters.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Momentum78.49

Growth58.32

Quality63.71

Value16.92

Market News and Data brought to you by Benzinga APIs